As the cryptocurrency market starts a new week, things are not looking particularly bright for Bitcoin (BTC). Yet, several formations have emerged that signal not just a recovery for the flagship of decentralized finance (DeFi) but also a potential rally that could continue over the next 18 months.

Bitcoin’s 18-Month Bull Run with a 220k Target

According to cryptocurrency expert Trader Tardigrade’s observation, the monthly chart of Bitcoin has found a second support from the 50-period Relative Moving Average (RMA), in addition to the parabolic SAR indicator. The anonymous analyst suggests that this could signal the start of a long 18-month bull run beginning this month, which may culminate in a strong price rally peaking at $220,000 by May 2025.

Specifically, the parabolic SAR indicator consists of a series of dots placed above or below the price bars, depending on the asset’s momentum. A dot below the price indicates an upward trend, while a dot above signifies a downward trend, with a shift in the position of these dots indicating a potential trend reversal.

Other Prominent Bullish Signals for BTC

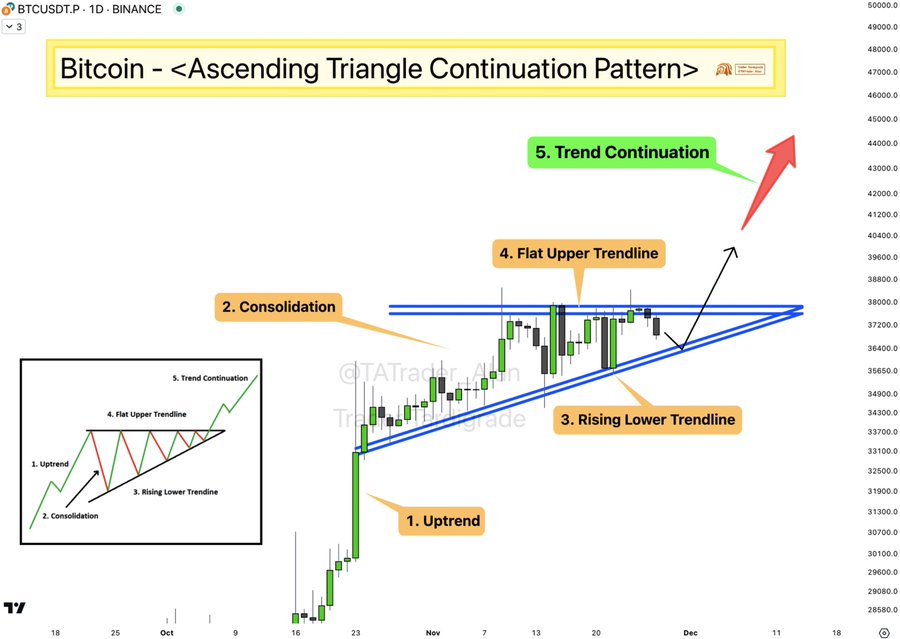

Prominent cryptocurrency expert PlanB has pointed out the formation of an ascending triangle continuation pattern on Bitcoin’s daily chart. This is another bullish chart formation that signals an uptrend, consisting of a rising lower trendline and a flat upper trendline, allowing the price to consolidate and rise.

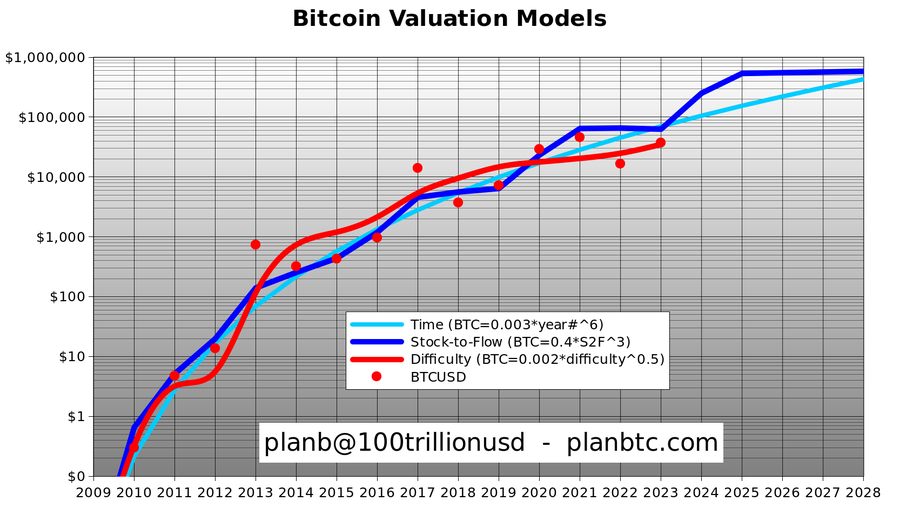

PlanB also noted that Bitcoin’s value based on mining difficulty (hash rate) rose to $35,000 on November 26th and emphasized that the price would never fall below this level, underlining it as a critical threshold.

Current data shows that the BTC price has seen an increase of 1.39% in the last 24 hours, trading at $37,416. It is also worth mentioning that the trading volume of the largest cryptocurrency has decreased by 7.59% to $16.73 billion in the same time frame.

- Bitcoin eyes an 18-month rally to $220k.

- Key indicators signal potential growth.

- Current trading volume shows a slight dip.