After a week of rising, Bitcoin‘s (BTC) price movement has slowed down with a marginal decrease in the last 24 hours. This comes at a time when one of the key measurements has recorded a sharp increase, which could indicate further price drops in the coming days.

Expert Views on BTC

The leading cryptocurrency started the new year on a hopeful note with its price increasing by more than 6% over the last seven days. However, the frenzy of gains ended with a marginal drop in its price recently. According to CoinMarketCap, BTC has experienced a 0.11% decrease in the last 24 hours. At the time of writing, BTC is trading at $45,161.20 with a market value of over 884 billion dollars.

While this was happening, a significant BTC metric recorded consistent increases. A popular crypto analyst, Ali, recently highlighted in a tweet how Bitcoin’s open positions have increased. Although the rise in open positions points to more BTC trading activity, it could also be a sign of increased market fluctuation. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Analysis Reports on Bitcoin

Some analysts have reported that the number of BTC investors in loss was higher than those in profit, which had already triggered alarms. According to CryptoQuant‘s data, as exchange reserves increased, so did the selling pressure on BTC. The cryptocurrency’s SOPR was on a decline, which could mean that more investors were selling their assets at a profit. In the midst of a bull market, this situation could often indicate that the market has reached its peak.

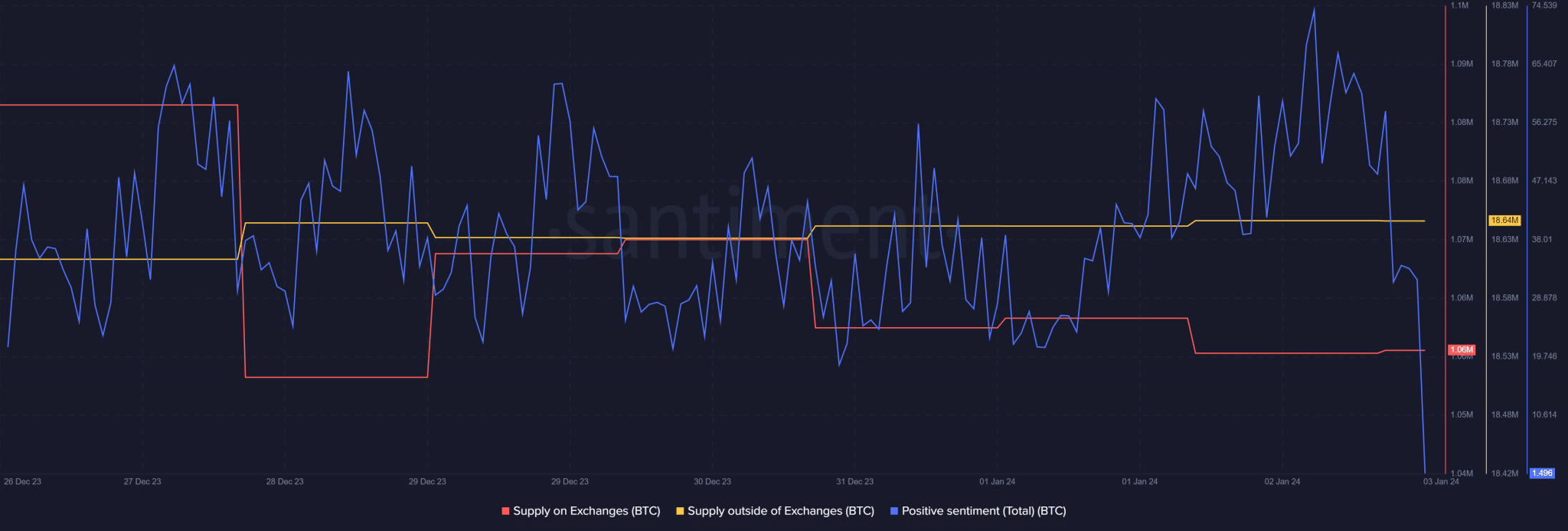

Additionally, Bitcoin’s Net Unrealized Profit and Loss (NULP) indicated that investors were in a “belief” phase with high unrealized profits. However, a look at Santiment data told a different story. While the supply of BTC on exchanges continued to decrease, the supply outside of exchanges increased. This situation indicated high buying pressure on the cryptocurrency. The positive sentiment towards BTC was also high, reflecting investors’ confidence in the king of cryptos.

Türkçe

Türkçe Español

Español