Bitcoin‘s price recovered on January 16th as developments unfolded, and analysts suggest that the cryptocurrency could be supported by the possibility of the United States Federal Reserve pausing interest rates at their next meeting at the end of January. At the time of writing, Bitcoin had risen by 0.91% in the last 24 hours, trading at the level of $42,911. Let’s examine what is expected for Bitcoin.

Eyes Turn to the US

The Federal Reserve will hold a meeting in 15 days to decide on the direction of the central bank’s monetary policy. According to the CME FedWatch tool, there is a 97.4% chance that the Fed funds rate will remain within the current target range of 5.25% to 5.50%. Bitfinex analysts have explained that a potential interest rate pause in January could lead to a surge for Bitcoin, while providing relief for a tense banking sector and traditional financial circles.

Analysts also referred to the Summary of Economic Projections, which forecasts the central bank to cut the policy rate by approximately 75 basis points throughout 2024, sharing the following statements:

“This potential reduction is seen as a move to support the economy, especially if inflation continues to align with the Fed’s stability target. However, the timing and scale of these interest rate cuts are critically important. Early or excessive cuts could reignite inflation, while delays or minimal cuts could hinder economic growth.”

What’s Happening on the Bitcoin Front?

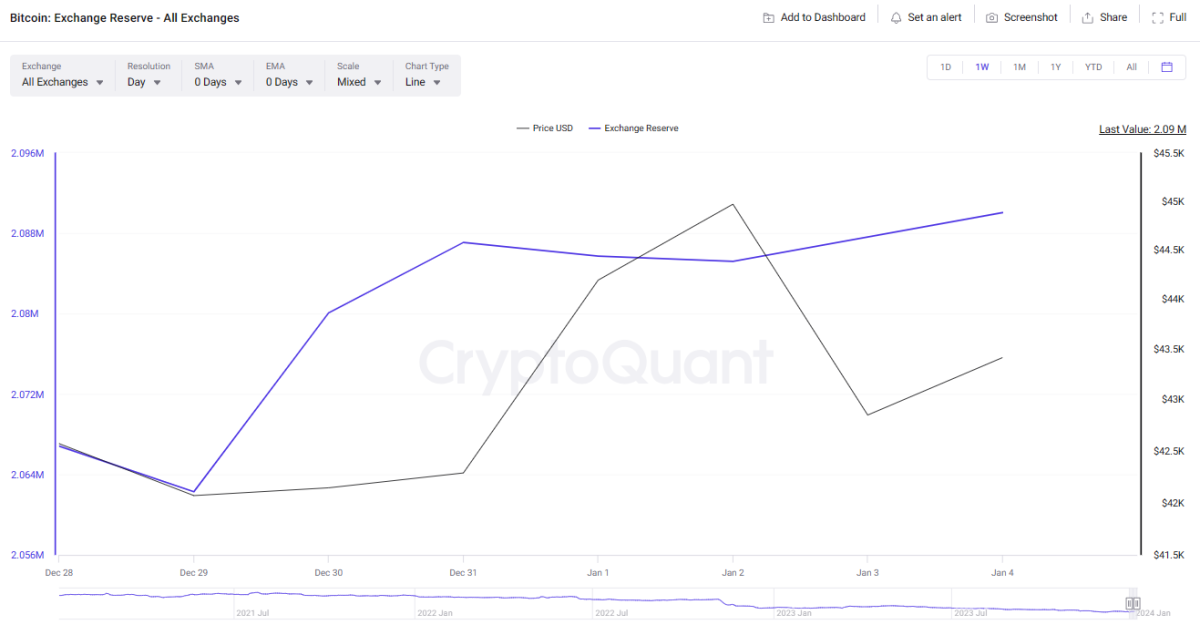

In light of these developments, on-chain data indicates that the selling pressure on the cryptocurrency continues to increase due to a steady rise in Bitcoin exchange reserves since the end of December. According to data obtained by blockchain data analysis platform CryptoQuant, the liquid Bitcoin supply on centralized exchanges increased by over 2% last month, from 2,060,000 to approximately 2,101,400.

Recently, the excitement over spot Bitcoin ETFs has particularly led investors to adopt an optimistic stance on Bitcoin’s price, but the expected rise since the launch of ETF products has not materialized, leading to disappointment among many investors. The process has been manipulated several times, and the increase in the number of false news stories caused this hype to end before it began.

Türkçe

Türkçe Español

Español