Bitcoin, regained its pricing momentum before the March 13 Wall Street opening as bulls overcame the sell-side liquidity. Data from TradingView shows Bitcoin reaching its all-time high of $73,679. The previous day, Bitcoin’s price strength took a breather, consolidating around $72,000, and even experienced a $4,000 drop before its sudden rise.

Why Is Bitcoin Rising?

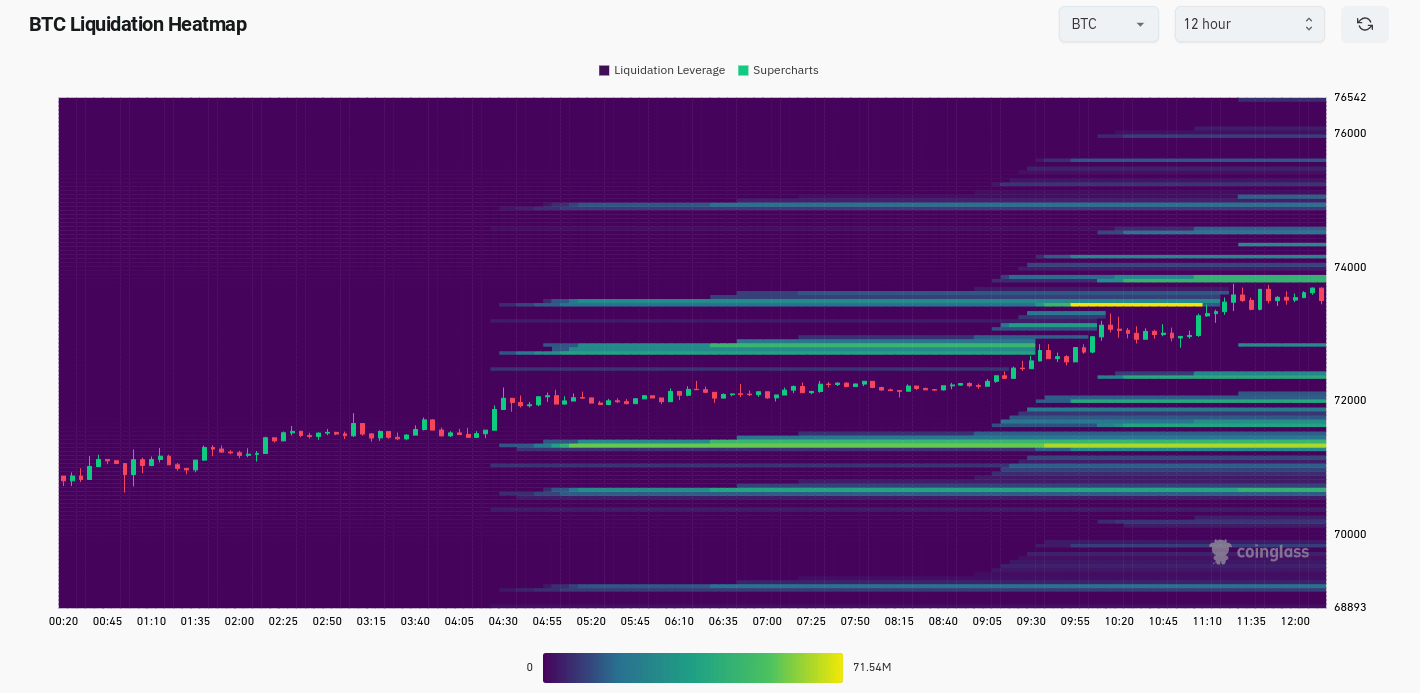

Throughout this period, the market has shown repeated performance since the beginning of the week, where resistance managed upward movements for a while. According to data from the monitoring platform CoinGlass, that day the resistance was at $73,800.

Moreover, as indicated by the lack of liquidation levels, there are very few steps left before price discovery towards the $80,000 level. Popular investor Jelle commented on the matter via X, adding that the outlook now looks good for continued upward movement, stating:

“Bitcoin wiped out excessive futures long positions, retested the highest level of the 2021 cycle, and then returned to the $72,000 level.”

Bitcoin and the ETF Process

Financial commentator Tedtalksmacro, pointed out the increase in institutional money inflows. These overshadowed everything seen before, even when considering the new spot Bitcoin exchange-traded funds in the United States, and he commented:

“We are seeing fund inflows like never before. This makes 2020 look small and prices will continue to rise in the coming months. We are steadily moving towards $100,000. Historically, there are 2-3 months to exit the market when these flows peak.”

According to the latest data, ETF funds achieved a record net inflow of $1 billion on March 12, with BlackRock’s iShares Bitcoin Trust taking the lion’s share. BitMEX Research, shared the figures via X, noting a record inflow of 14,706 Bitcoins on March 12, 2024.

This amount alone represents a significant portion of the new supply issued in 2024, amounting to approximately 65,500 Bitcoins. As of March 13, the two largest ETF funds from BlackRock and Fidelity Investments held over 330,000 Bitcoins.

Türkçe

Türkçe Español

Español