Bitcoin price is recovering, turning altcoins green and several altcoins are seeing double-digit increases. Each period has its prominent altcoins, and at the peak of a bull market, these can achieve massive gains. In 2024, we witnessed many such altcoins.

Pendle Finance (PENDLE)

Ethereum-based DeFi protocol Pendle Finance allows for yield farming by dividing assets into Principal Tokens and Yield Tokens. This enables investors to earn up to 47% annual returns while trading tokens based on the underlying asset. Compared to its launch period in 2021, Pendle and its competitors are more popular today.

Increased Ethereum liquidity buyback activities and airdrops from DeFi protocols like EtherFi are driving activity. Instead of staked locked tokens, tokens like eETH can be acquired, offering earning opportunities and making DeFi increasingly resemble traditional finance.

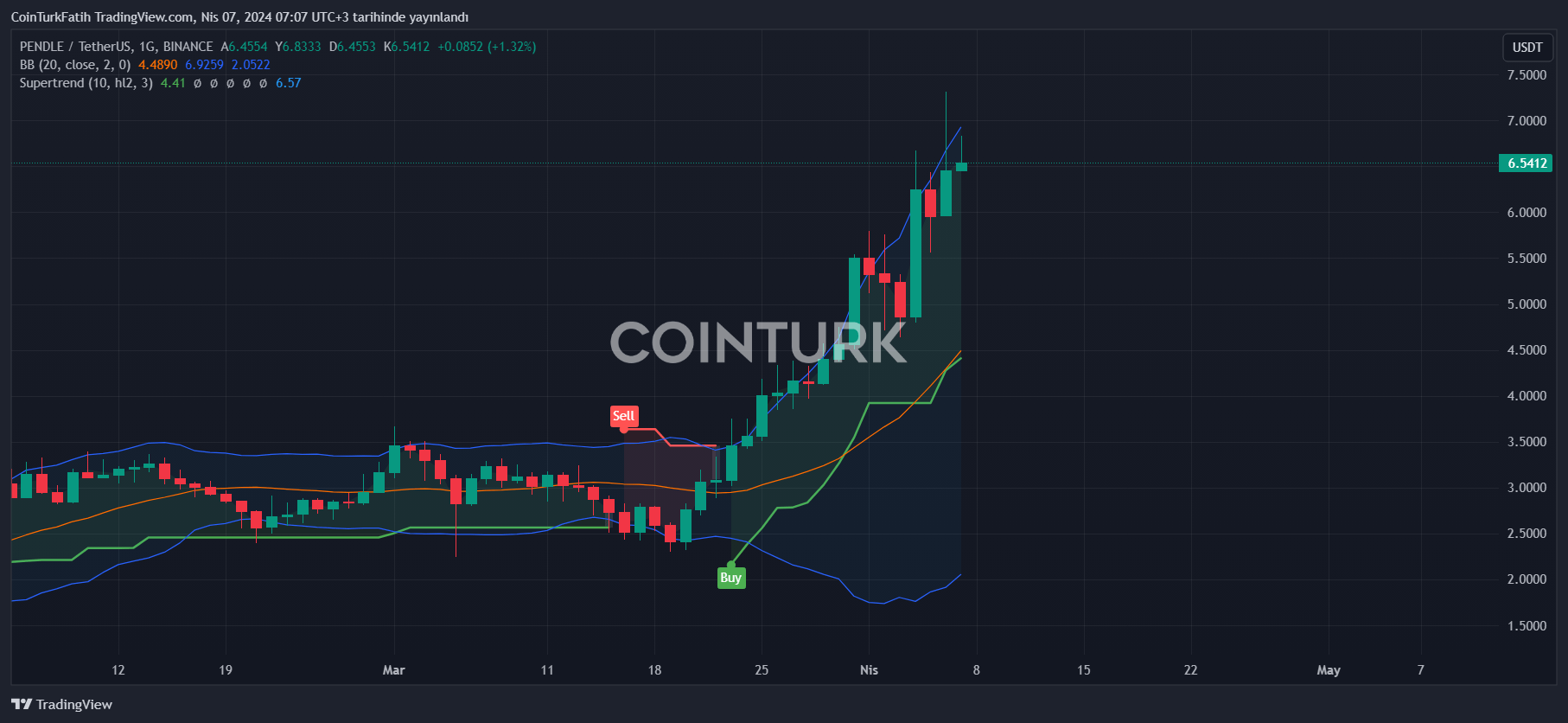

We mentioned that the token price has increased fivefold this year, with the rise in activity correlating with the anticipated airdrop from EigenLayer. Investors deposited Ether restaking token eETH on the Pendle Finance platform for the upcoming airdrop. Ethena’s increase of the USDe pool cap to 400 million also supported the price increase.

PENDLE Price Predictions

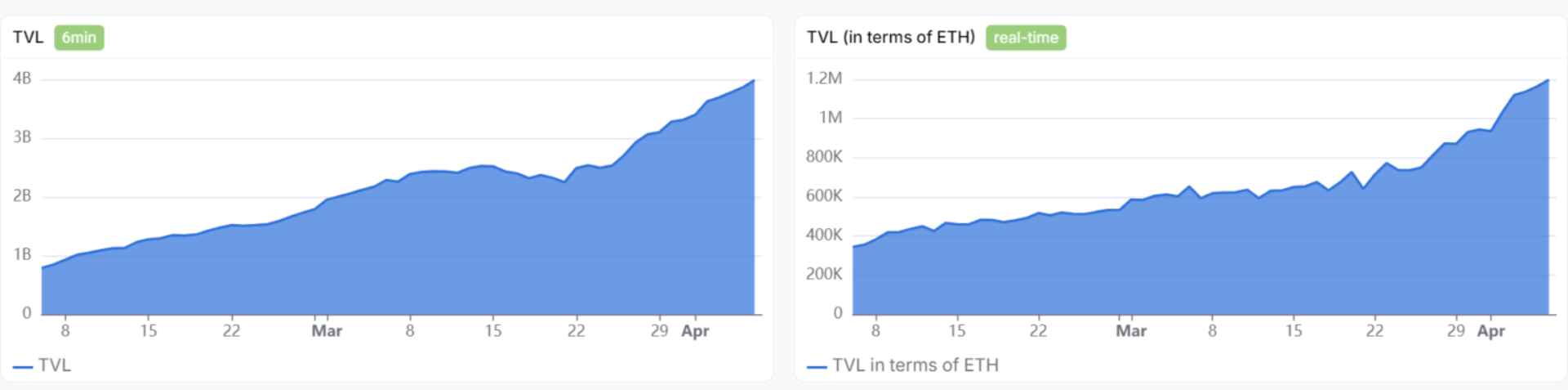

As the number of network participants grows, the token price is likely to continue rising. The protocol’s total value locked (TVL) has already reached 4 billion dollars. Considering Pendle’s TVL started the year at 233 million dollars, a 1500% increase in TVL with a fivefold token price rise indicates the potential is still vast.

The platform’s total trading volume has risen to 10.5 billion dollars, with significant interest in the protocol on Layer-2 networks such as Arbitrum and Mantle. The restaking narrative is expected to gain more attention in this bull market, and Pendle is igniting a new era in DeFi.

BitMEX co-founder Arthur Hayes has declared this protocol as “the future of DeFi.” We had announced on August 23, 2023, that Binance invested in PENDLE, and since then, the price has increased by 1243% in 227 days, now just below the peak of 7.3 dollars. If the price can sustain above 6.5 dollars, it may move towards even higher peaks in the short term. Long-term double-digit price targets also seem within reach.

Türkçe

Türkçe Español

Español