Bloomberg’s Senior Commodity Strategist Mike McGlone recently analyzed Bitcoin‘s approximately 40% pullback, assessing its potential impacts for the year 2024. He also examines the dynamics between Bitcoin’s development and gold’s resilience, and the potential outcomes of US ETFs.

Bitcoin’s Pullback and Gold’s Record Levels: A Key Intersection Point

The contrast between Bitcoin’s significant pullback from its peak and gold’s record levels is a noteworthy situation. McGlone points out that this scenario opens the door for a deeper understanding of the interaction between the crypto world and traditional safe-haven assets like gold, indicating potential outcomes for the coming year.

McGlone proposes the concept of US Exchange Traded Funds (ETFs) as a potential milestone in Bitcoin’s maturation process. As cryptocurrencies are relatively new players among rapidly rising risk assets, the impact of US ETFs could signal a transformative change, he notes.

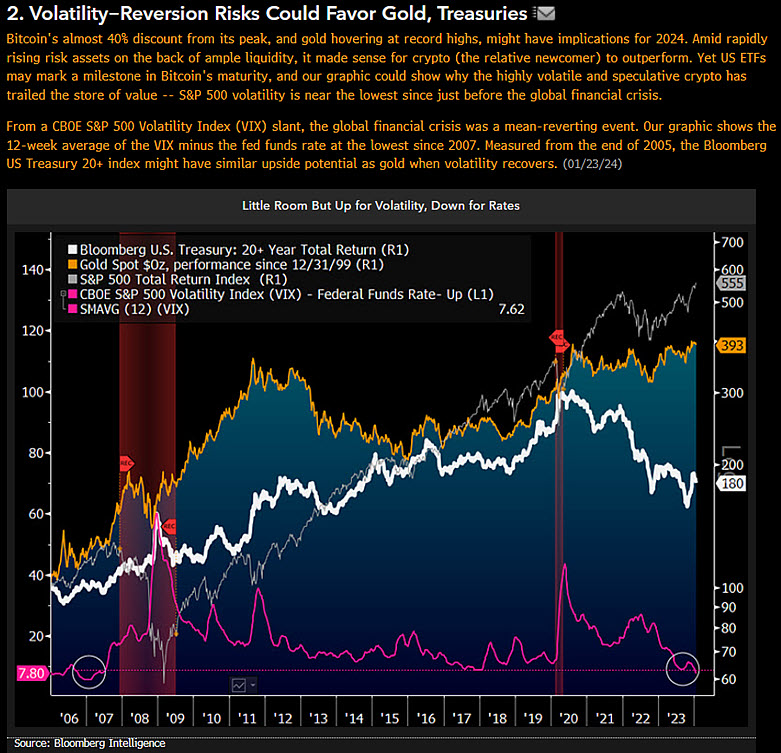

McGlone’s chart aims to show how the highly volatile and speculative nature of crypto could follow the relatively stable volatility of the S&P 500. This prompts reflection on Bitcoin’s role in the broader financial environment.

CBOE S&P 500 Volatility Index (VIX) Perspective

Shifting focus to the CBOE S&P 500 Volatility Index (VIX), McGlone draws parallels with the global financial crisis and frames it as an average event. The presented chart shows that the CBOE S&P 500 Volatility Index and the 12-week average of the FED funds rate have reached levels not seen since 2007.

This situation leads to consideration of historical patterns and the potential effects on the Bloomberg 20+ US Treasury Bonds index. McGlone suggests that if volatility recovers, this index could share the upward potential of assets like gold.

Steering Potential Upsurge: Analysis from Bloomberg US 20+ Bond Index

Comparing data since the end of 2005, McGlone suggests that the Bloomberg US Treasury Bonds 20+ index could follow a trajectory similar to gold during periods of volatility recovery. The analysis focuses on the interaction between market dynamics, historical trends, and the potential for assets like the US Treasury Bonds 20+ index to rise with increasing volatility.

In conclusion, Mike McGlone’s perspective presented in Bloomberg offers a comprehensive view on Bitcoin’s current state, its relationship with gold, and the potential impact of US ETFs. The chart provides visual information on market dynamics, volatility trends, and Bitcoin’s evolution in the broader financial landscape, becoming a valuable analytical tool for investors.

Türkçe

Türkçe Español

Español