Bitcoin (BTC) has attracted $20 million in institutional funds over the past week, increasing the total inflow since the beginning of the year to $1.7 billion. Moreover, according to the report, investors have been transferring a significant portion of their capital into Bitcoin in recent weeks.

The leading cryptocurrency recorded gains amidst the excitement over the potential approval of a dozen spot exchange-traded funds (ETFs). Investors are hopeful that such approvals would pave the way for mainstreaming the cryptocurrency and provide a suitable entry point for TradFi participants into the crypto markets.

Bitcoin has seen a 60% increase since the start of its rally in mid-October, leading the ongoing bull run. It has reclaimed critical levels last visited before the bear market began in May 2022. However, it’s important to note that at the time of writing, BTC’s price had fallen below $42,000 on the charts.

Liquidations in Bitcoin

While the cryptocurrency has been gaining value, not all investors in Bitcoin were betting on its rise. Short-Bitcoin positions saw an inflow of $8.6 million last week, suggesting that some investors see potential for a downward movement. According to data from Coinglass, the open interest (OI) in BTC futures on the global derivatives exchange CME reached its highest level in two years at $5.28 billion. OI has more than doubled since the start of the rally.

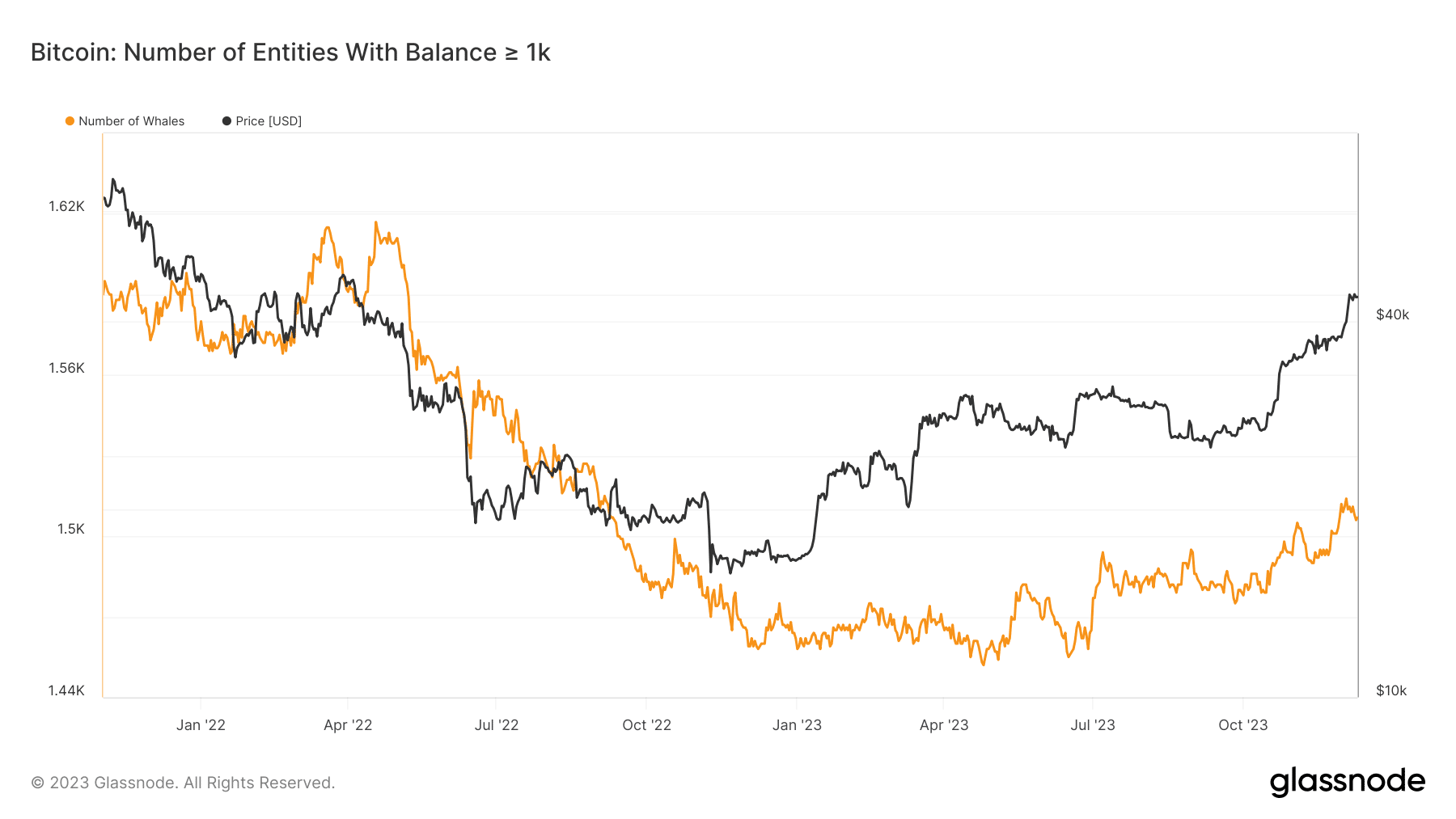

CME’s standard futures contract is valued at five BTC and is seen as a barometer of institutional interest in cryptocurrencies. It’s indicated that whale investors, who act on behalf of large cryptocurrency holders, are increasing their exposure to Bitcoin. According to an analysis of Santiment data, the number of entities holding at least 1,000 coins has been on the rise in the second half of 2022. This suggests net institutional buying of Bitcoin, providing additional evidence of Bitcoin’s institutional support. Overall, the cryptocurrency market recorded an inflow of $43 million for the 11th consecutive week. The optimistic sentiment linked to spot ETFs has also reflected on Ethereum (ETH) and the broader altcoin market.

Türkçe

Türkçe Español

Español