Data provider Glassnode has explained that Bitcoin (BTC) made a significant move on March 26, reaching $71,375 towards an all-time high, but the upward surge was not sufficient to reach a new peak, detailing the reasons behind it.

Profit-Taking Activities Increase Significantly

As known, Bitcoin reached an all-time high of $73,750 on March 14. This rise in the largest cryptocurrency was met with increased profit-taking, reminiscent of pullbacks seen before the block reward halving, resulting in a 16% correction.

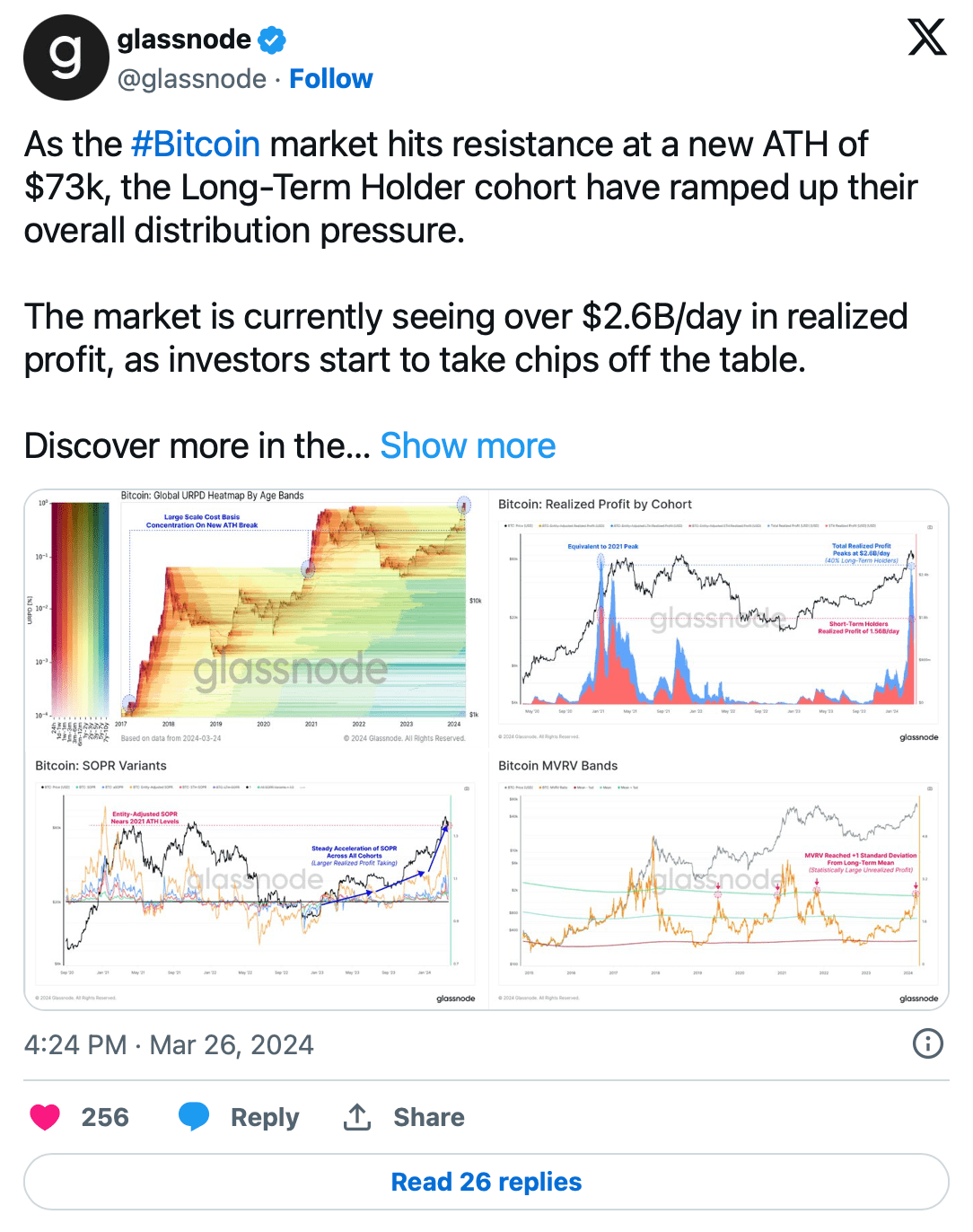

In its weekly update, Glassnode noted a significant increase in profit-taking activity when the market reached its peak, with over $2.6 billion in realized profits taken. Interestingly, most of the BTC that shifted from ‘profit’ to ‘loss’ during the pullback currently have a cost basis above $61.2k, and the majority of these BTC have changed hands recently.

Long-term investors accounted for approximately 40% of the profit-taking, while investors exiting from the Grayscale Bitcoin Trust (GBTC) significantly contributed to this trend. Grayscale’s GBTC has seen significant outflows since its conversion to a spot ETF in mid-January, with a notable $212 million outflow recorded on March 26 alone. However, these outflows and more were absorbed with the support of nine new ETFs that were approved and began trading in the US.

Currently, short-term investors are holding onto the remaining $1.66 billion in realized profits, benefiting from liquidity inflows and market momentum. Glassnode pointed out that this profit-taking level is closely aligned with market patterns observed during the previous all-time high breaking cycle, indicating typical market behavior.

Current State of Bitcoin and Altcoins

Despite the wave of profit-taking, Bitcoin has been trading mostly sideways for a while and is currently trading around $70,000 at the time of writing. The current price levels represent only a 4.6% decrease from the all-time high of $73,750 recorded on March 14, 2024.

On the other hand, the total market value of the cryptocurrency market is at $2.79 trillion, 9.4% below its peak in November 2021, with most altcoins showing a downward trend. While altcoins like BNB, XRP, AVAX, and TON have experienced slight declines during the day, significant increases are seen in altcoins like DOGE, SHIB, and ICP.

Türkçe

Türkçe Español

Español