As this article was prepared, BTC climbed to $67,700 and the BlackRock ETF reached a volume of $900 million in just 3 hours. In March, the volumes of spot Bitcoin ETFs significantly increased, setting a new record of over $10 billion. The rapid increase in demand has enabled Bitcoin‘s price to embark on a journey to all-time highs.

Why Is Bitcoin Rising?

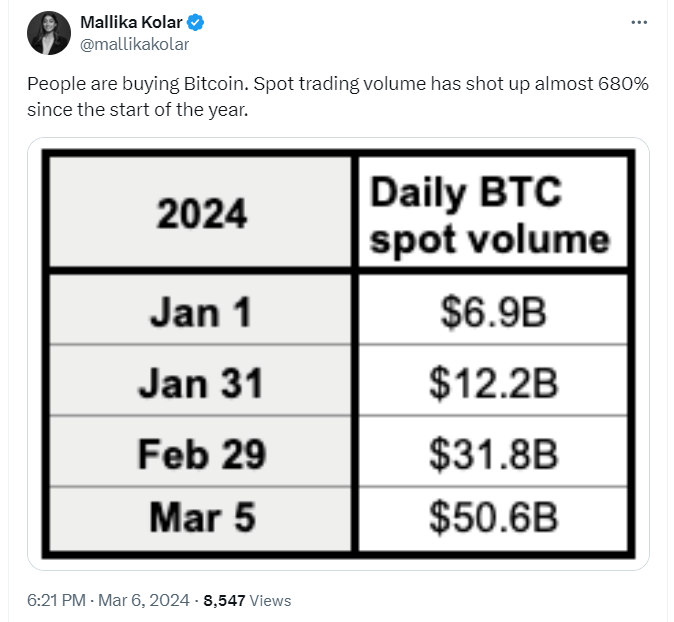

The cumulative spot Bitcoin trading volume on centralized cryptocurrency exchanges reached $46.26 billion on March 5th, marking the highest level in the last year. Moreover, this data confirms that the influx of individual investors, typical of bull markets, may have started. Bitwise analyst Mallika Kollar wrote on her social media account;

“People are buying Bitcoin, and spot trading volume has increased by almost 680% since the beginning of the year.”

The record trading volume since the beginning of the year follows massive inflows seen through ETF channels. The volume exceeding $10 billion reflects the excitement of investors familiar with traditional finance towards cryptocurrencies.

The Future of Cryptocurrencies

Bloomberg ETF analyst Eric Balchunas highlighted the strong rise concurrent with the increase in volume. Moreover, with growing interest from Asian markets and the United States joining the game through ETF channels, it signals the start of the strongest phase of the global rise. As you may recall, excessive demand had been coming from Asia for a long time and was the trigger for last year’s surges.

Today, demand in Asia remains strong. How do we know this? Of course, from the Korean Premium Index, which has been rising significantly since the beginning of February, indicating that demand from South Korean investors is above the global average.

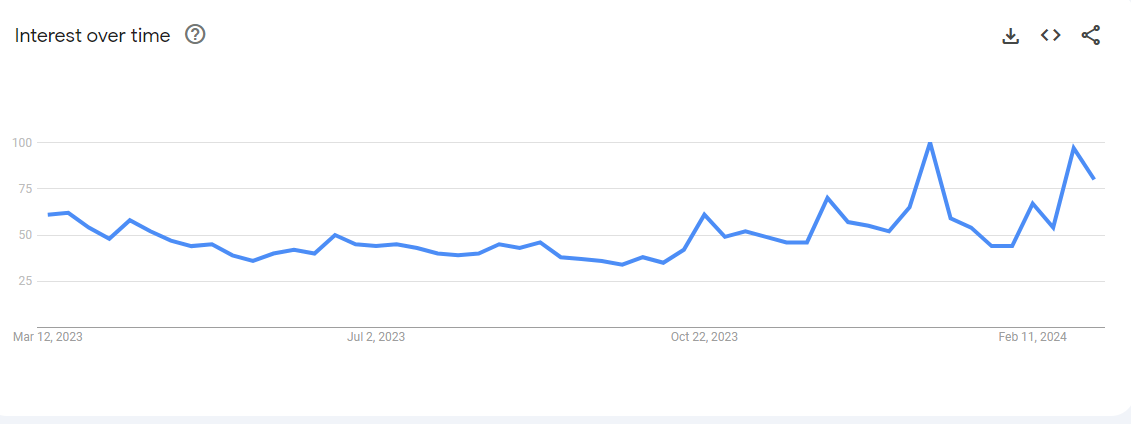

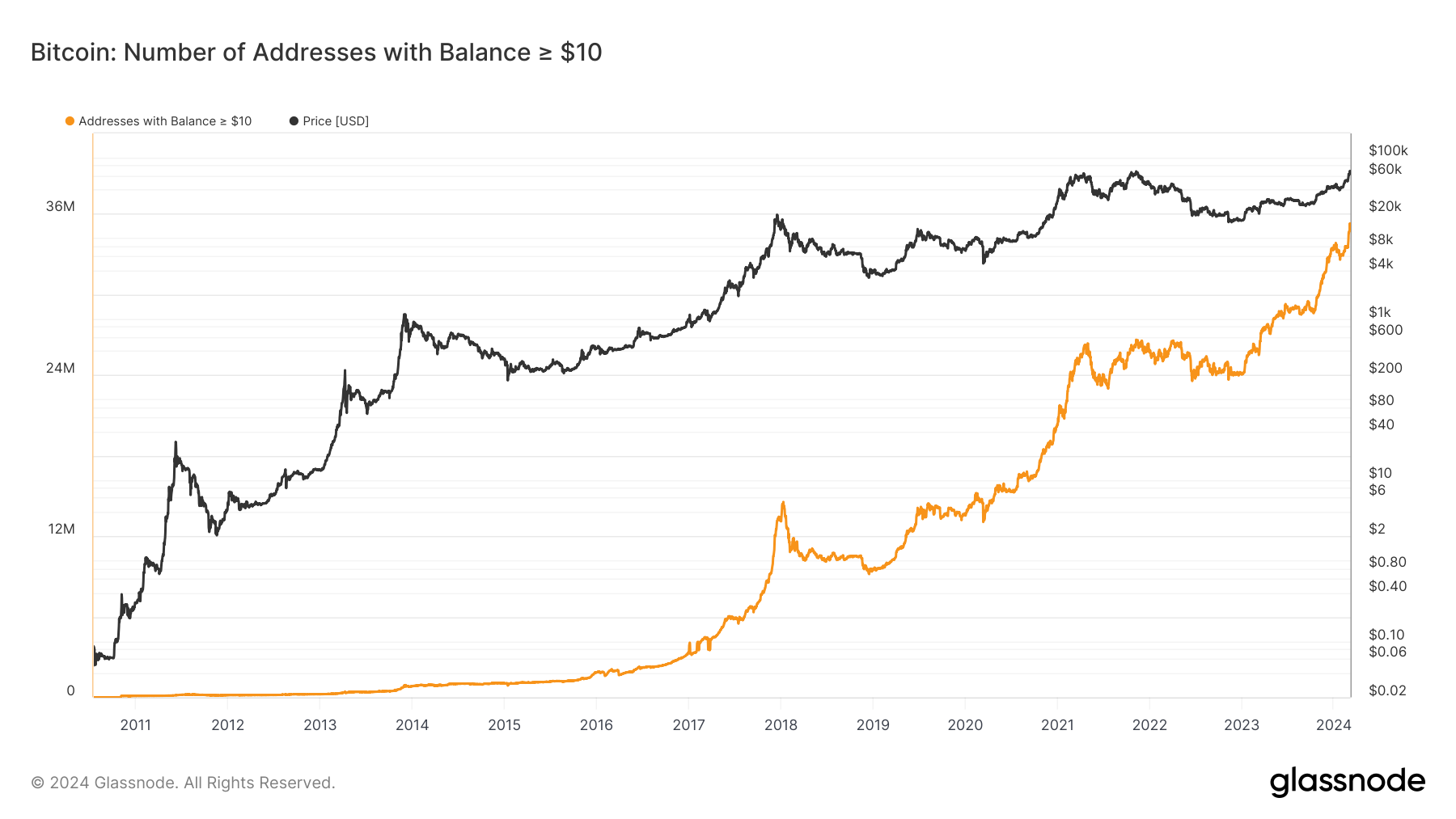

According to Coinglass data, the number of addresses holding at least $10 worth of Bitcoin exceeded 35 million on March 6th, further confirming the increase in individual investor interest. Google trend data also rose above 80, confirming a 31% increase in interest compared to a year ago.

The current outlook suggests that the strong interest in cryptocurrencies could trigger larger BTC peaks similar to previous bull markets. However, even during bull seasons, BTC corrections of up to 30% are not surprising. Currently, such a correction could trigger massive sell-offs in altcoins, so investors should carefully set their stop regions.