Bitcoin has been experiencing sideways price movement for almost two weeks, indicating that the market is still in a state of uncertainty. This can be interpreted as the market waiting for a clear indication of the next market movement.

Decline in Bitcoin Trading Volume

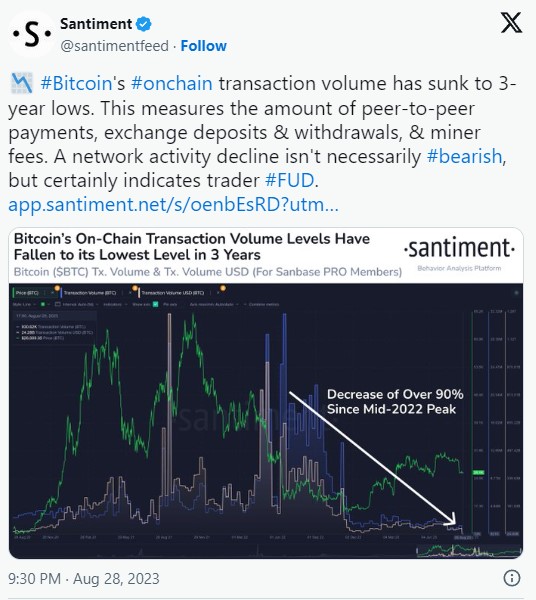

The extent of this outcome in the market is clearly visible in Bitcoin’s measurements. Network activity has significantly slowed down in the past few days, particularly evident in the trading volume. According to the latest Santiment analysis, the trading volume is at its lowest level in the past three years.

Low volume means less buying and selling/trading activity, resulting in reduced miner fees. While some may see this as a cause for concern, periods where BTC trading activity levels drop and lead to sideways price movement are quite common. However, this is usually followed by an increase in volume and a directional price movement.

Bitcoin Holders Accumulating

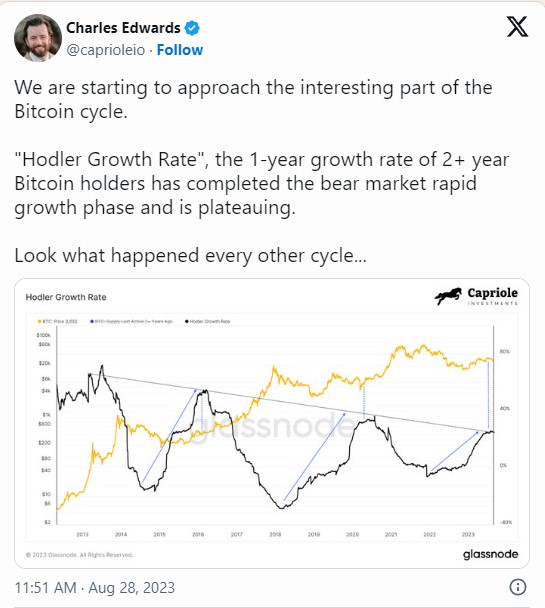

While the market remains uncertain at the time of writing, there was a specific metric that could provide insights into the next market movement. Holder growth rate has historically been a reliable measure of Bitcoin cycles. The same conservative measure recently retested the declining trend line, indicating a slowdown in accumulation at the time of writing.

Speaking of accumulation, Bitcoin’s average cryptocurrency age has been steadily increasing and was at its highest level in six months at the time of publication. This confirms the continuation of long-term hodling. Additionally, the number of active addresses in the past 24 hours has seen a sharp decline since mid-August, parallel to the decrease in trading activity mentioned above.

The Future of Bitcoin

Bitcoin’s sideways price movements are often followed by a resurgence in volatility. We can see this particularly at the beginning of August. However, the direction of this volatility remains mysterious.

Nevertheless, at the time of writing, Bitcoin experienced a rise due to news from the Grayscale case and was trading at $27,500. This indicated the possibility of investors buying in anticipation of a recovery. On the other hand, the market still did not appear to have emerged from uncertainty, especially after the recent announcement that the US may raise interest rates. This perfectly summarized the conundrum of the leading cryptocurrency.