The crypto market is in a state of high anticipation for the upcoming halving event of Bitcoin, with significant expectations for its future price movements. Last week saw a notable increase in Bitcoin‘s value. The Bitcoin halving event starts after 210,000 blocks are produced during Bitcoin mining. This occurs roughly every four years and cuts the mining reward for Bitcoin in half. Here are three important things crypto investors should pay attention to before the Bitcoin halving event.

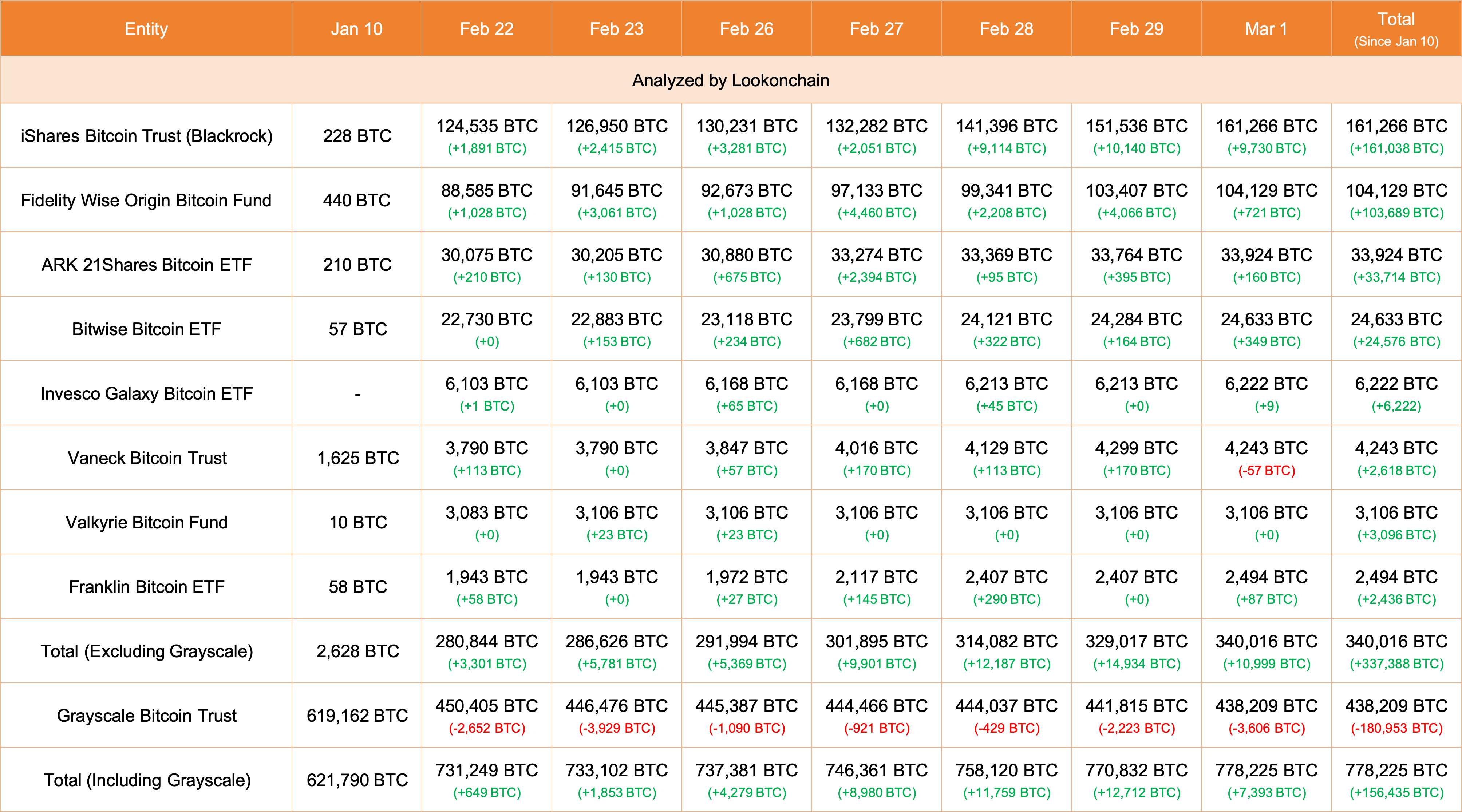

Bitcoin ETF Funds

Bitcoin‘s price increase is primarily due to the demand for Bitcoin ETF funds. However, a supply shock has also contributed to the price increases. Currently, there is a supply shortage and an excess demand for Bitcoin. The upcoming halving event will change the supply and demand dynamics for Bitcoin. After the event, the block mining reward will be halved. In such a scenario, it is likely that Bitcoin’s supply will continue to be lower than the demand. If the trend continues, the price should sharply increase following the halving event.

Bitcoin’s price has previously risen above $63,000 and is currently just below the peak of $68,700 reached 27 months ago. This increase indicates that investors are becoming increasingly eager to turn to Bitcoin.

The Fed’s March Meeting

The Fed’s March meeting will be extremely important in assessing the trajectory of future interest rate cuts. Initially, Fed Chairman Jerome Powell predicted three rate cuts in 2024, and Fed officials were expected to act cautiously following CPI data. Considering current expectations and economic data, a rate cut seems unlikely at the March meeting. However, the Fed’s commentary and tone regarding the outlook it will announce in March will be very important in assessing the macroeconomic background. The market is currently predicting that interest rate cuts will begin in September.

If Bitcoin’s price rises after the halving, it will put pressure on purchasing power. However, any sign of delay in the Fed’s decision to cut interest rates will further reduce risk appetite. This development could lead to lower demand for Bitcoin after the halving.

Bitcoin and Return on Investment

Return on Investment (ROI) is an important parameter used by many investors to measure their financial assets. Currently, the ROI in Bitcoin continues to be resilient. Ethereum and Bitcoin are attracting Wall Street investors to Bitcoin ETF funds because they provide better returns than other assets, including gold, oil, stock markets, and more.

If this trend continues into the next month, it will likely maintain investor interest in Bitcoin. A higher ROI will also help investors maintain a stable risk appetite, which will in turn reflect on the Bitcoin price.

Türkçe

Türkçe Español

Español