According to a news article published by Bloomberg, the oldest cryptocurrency exchange, Bitstamp, has denied the claims of being put up for sale and instead stated that the exchange has been working on creating new resources since June. It is reported that the created resources are planned to be used for various strategic purposes, such as launching cryptocurrency derivative trading in Europe in 2024 and expanding into the Asian market.

Denial of Bitstamp Being Put Up for Sale

It is reported that Bitstamp, led by CEO Jean-Baptiste Graftieaux, is actively seeking funds. According to a spokesperson for the cryptocurrency exchange cited by Bloomberg, the Luxembourg-based exchange started raising new funds in June. It is stated that Galaxy Digital Holdings, which provided consultancy services to Pantera during the fundraising process when Bitstamp sold its minority stake to Ripple, is now serving as a consultant in the fundraising process.

Responding to the allegations of Bitstamp being put up for sale, Graftieaux said, “Bitstamp is not for sale, and we are not actively considering selling the company. Our current and most important priority is to raise new resources through strategic investors to accelerate Bitstamp’s growth by offering new products and services to individual and institutional crypto customers.”

Created Resources for Various Strategic Moves

Bitstamp is in the process of creating resources for various strategic purposes. According to the plan, the created resources will be used to launch derivative trading, which many cryptocurrency exchanges in Europe aspire to offer, to expand further into the Asian market, and to finance operations in the UK.

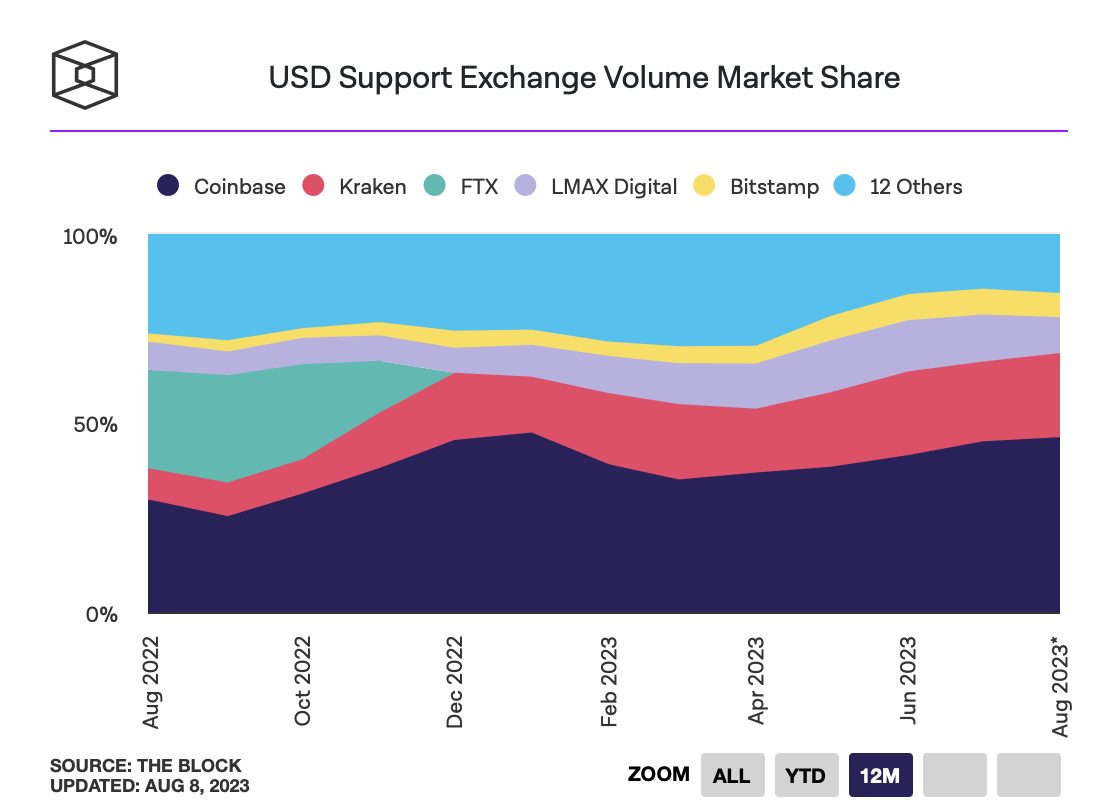

Founded in 2011, Bitstamp is the oldest cryptocurrency exchange that has managed to remain operational for the longest period of time. According to data provided by The Block’s Data Dashboard, it ranks fourth by holding less than 7% of the overall market share among cryptocurrency exchanges offering services supported by the US dollar.

Among cryptocurrency exchanges offering services supported by the US dollar, Coinbase holds the largest market share with 46.26%, followed by Kraken with 22.25% and LMAX Digital with 9.49%.

Btc trader