BlackRock and Monochrome Asset Management have announced significant expansions in the United States and Australia, respectively. This move could potentially make Bitcoin exchange-traded funds (ETFs) more accessible to a wider base of investors and create significant momentum for investment opportunities. In fact, these initiatives reflect the ongoing growth of cryptocurrency investment and highlight the sector’s potential for continuous expansion and integration into broader financial markets.

What’s Happening in the ETF Space?

BlackRock, the world’s largest asset manager, continues to make strides with its spot Bitcoin exchange-traded fund (ETF) IBIT in the United States. The firm has added five new Authorized Participants (APs) to enhance the fund’s accessibility and liquidity for investors. These include ABN AMRO Clearing USA LLC, Citadel Securities LLC, Citigroup Global Markets, Inc., Goldman Sachs & Co. LLC, and UBS Securities LLC.

These institutions play a crucial role in the functioning of the ETF, facilitating the creation and redemption of shares. With a total of nine APs, IBIT has been operational since January 11, 2024, and stands as a sign of increasing confidence and demand for Bitcoin as a legitimate asset class.

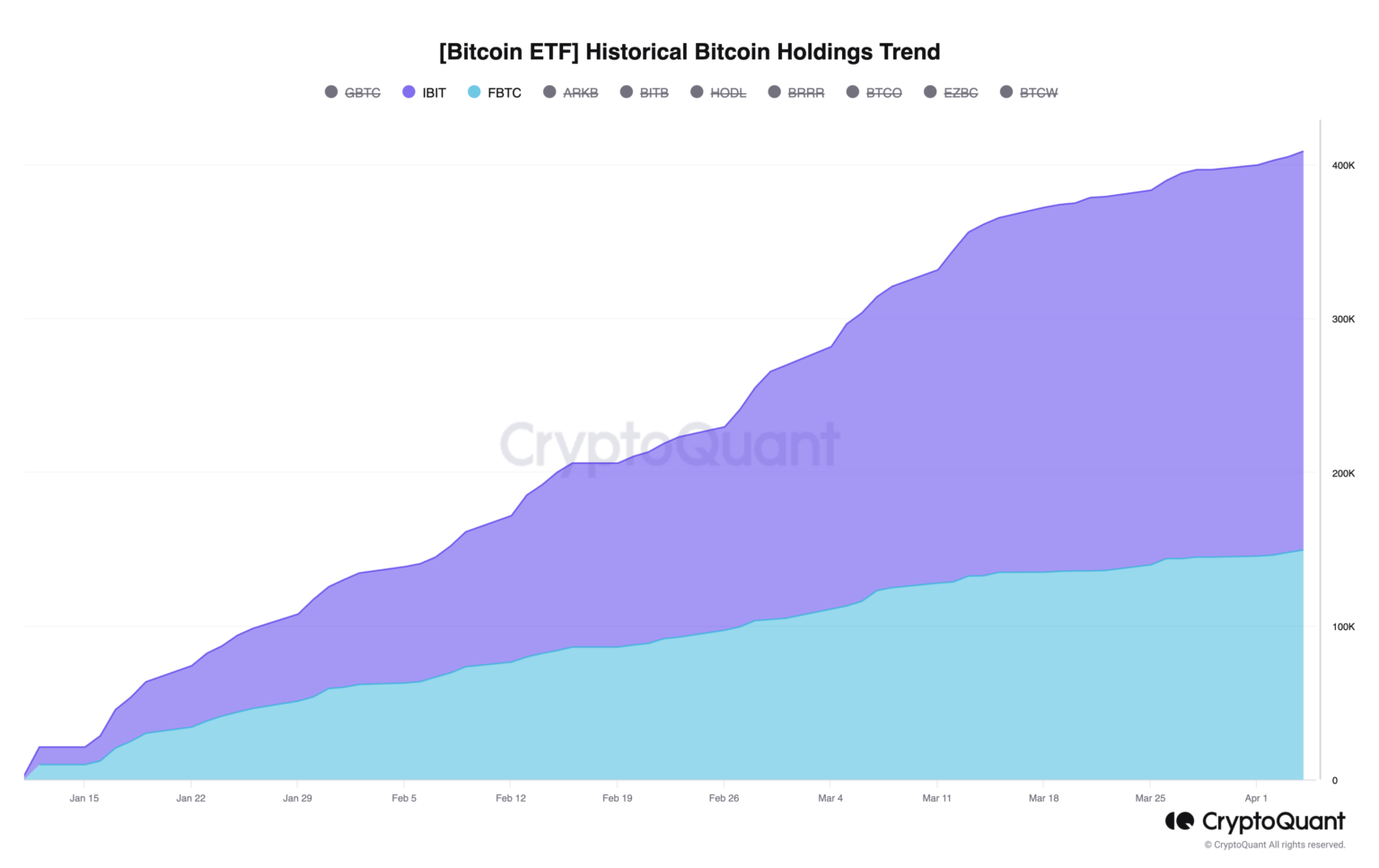

Indeed, this process may be part of the broader acceptance of Bitcoin in the mainstream financial market, highlighted by significant investor interest in similar funds like Fidelity’s Wise Origin Bitcoin Fund (FBTC). Both IBIT and FBTC have followed an impressive trajectory, having amassed investments worth 259,381.19 Bitcoin and 149,339.22 Bitcoin to date, respectively.

ETF Developments in Australia

Meanwhile, in Australia, Monochrome Asset Management has made a strategic move by shifting its flagship Monochrome Bitcoin ETF application to Cboe Australia. Monochrome aims to capitalize on Asia’s investment climate by aligning with Cboe, known for its extensive history in financial markets. This decision underscores Monochrome’s process of offering investors a new way to diversify their portfolios with crypto assets. The company was quick to comment on the matter:

“We are proud to work with Cboe Australia to launch Monochrome’s new Bitcoin ETF fund and to expand the investment universe for Australian investors. Cboe Australia’s established history as a global leader in crypto assets and its commitment to innovation and secure market accessibility align with Monochrome’s strategic goals.”

The addition of heavyweight financial institutions as APs for BlackRock’s IBIT and Monochrome’s strategic decision to list its Bitcoin ETF fund on Cboe Australia demonstrate the increasing mainstream acceptance of Bitcoin.

Türkçe

Türkçe Español

Español