BlackRock, the world’s largest asset manager with over $10 trillion in assets, has shown keen interest in cryptocurrencies since mid-last year. The firm has even issued its own tokenized bond and believes in the potential of blockchain-based finance, taking steps in this direction.

Ethena Chooses BlackRock

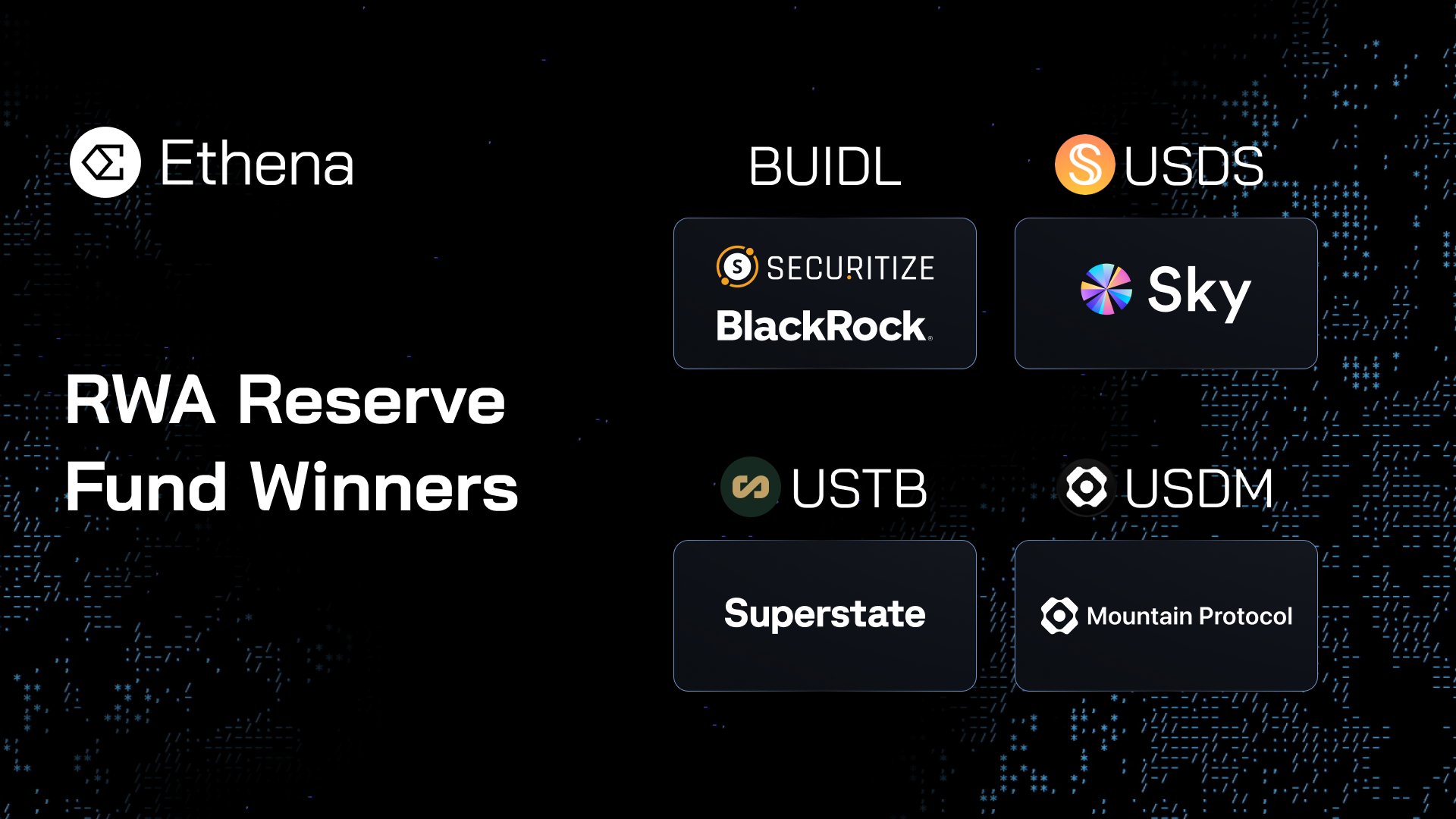

The DeFi platform Ethena recently announced its decision regarding a $46 million reserve fund. This fund will be converted into BlackRock and Securitize’s tokenized fund BUIDL, Mountain’s USDM token, Superstate’s USTB, and the former Maker known as Sky’s USDS token. BUIDL will take the lion’s share, receiving $18 million, while the distribution for others is as follows:

- USDS: $13 Million

- USDM: $8 Million

- USTB: $7 Million

The company behind USDe issues derivative-backed stablecoins by holding BTC and ETH. They aim to generate returns by converting surplus balances into RWA tokens, utilizing them as an insurance fund.

Tokenized Bonds

One key lesson from Tether‘s FUD is the necessity of backing reserves with easily liquid assets. If stablecoin issuers invest the reserves that back their stablecoins in stocks, fluctuations could render some of these stablecoins worthless. After facing criticism for an extended period, Tether has transitioned from risky assets to solely relying on bonds.

The demand for tokenized U.S. bonds from giants like BlackRock could be significant, driven solely by stablecoin yields. In fact, the tokenized Treasury market has tripled in the past year, reaching $2.2 billion.

Ethena received applications from 25 different issuers to meet its fund needs, selecting BlackRock and others from this pool. BUILD and many other RWA tokens have been issued on the Ethereum  $3,414 network, and we have observed various tokenized assets expanding to networks like Solana

$3,414 network, and we have observed various tokenized assets expanding to networks like Solana  $173 and Avalanche. Long-term, the demand and activity in this space are expected to provide substantial returns, liquidity, and TVL support to reliable smart contract platforms.

$173 and Avalanche. Long-term, the demand and activity in this space are expected to provide substantial returns, liquidity, and TVL support to reliable smart contract platforms.

Meanwhile, Bitcoin  $119,377 continues to hover around $60,500, seemingly oblivious to all the positive news. Today marks another red day for altcoins, with losses exceeding 3%.

$119,377 continues to hover around $60,500, seemingly oblivious to all the positive news. Today marks another red day for altcoins, with losses exceeding 3%.

Türkçe

Türkçe Español

Español