BlackRock iShares Bitcoin Trust (IBIT) has redefined crypto investment standards with a record-breaking daily inflow of $788 million on March 5th. This milestone overshadowed the previous record of $612.1 million set on February 28th. These impressive figures underscore the growing confidence among institutions and individual investors as Bitcoin climbs to new heights.

What’s Happening in the ETF Space?

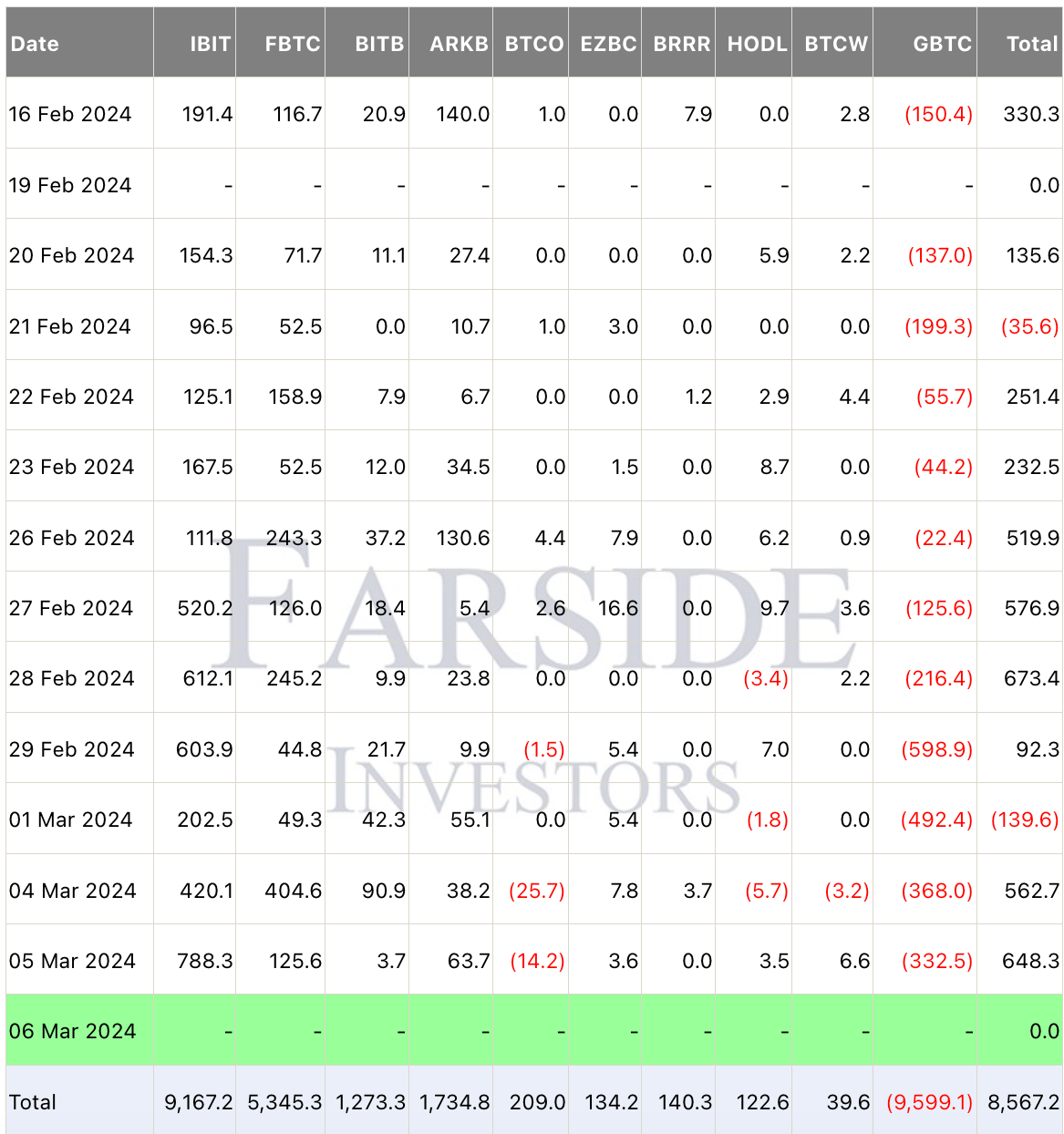

On March 5th, Bitcoin reached an all-time high of $69,200 amidst a noticeable increase in spot Bitcoin ETF investments in the United States. According to Farside Investors, the total inflow reached $648.3 million on the day Bitcoin hit its ATH, clearly indicating increased interest from individuals and institutions in Bitcoin.

During this active period, the performance of U.S. spot Bitcoin ETF funds varied. While Grayscale Bitcoin Trust (GBTC) and Invesco Galaxy Bitcoin ETF experienced net outflows, IBIT led with net inflows. Contributions from Fidelity Wise Origin Bitcoin Fund (FBTC), Bitwise Bitcoin ETF (BITB), and others also supported this momentum, leading to a total net inflow of $8.5 billion in the ecosystem.

Price Volatility in the Crypto Market

GBTC fund continued to see outflows; however, IBIT and FBTC did not record a single day of outflows, standing out with a total inflow of $14.46 billion. Alongside these developments, the market faced significant volatility. After surpassing $69,000, Bitcoin’s value experienced a sharp decline, falling by approximately 15% to around $59,000.

This sudden correction triggered a significant shake-up, resulting in $1.13 billion in investor liquidations due to price volatility. Such events highlight the unpredictable nature of the crypto market, affecting many crypto assets. Analysts at Farside Investors commented on the situation:

“This should dispel the notion that Bitcoin will always rise if ETF buyers purchase $500 million per day. When a correction occurs, selling pressure can quickly exceed buying demand, but the price recovered swiftly, indicating that most of the selling pressure was due to forced sales from liquidations.”

Türkçe

Türkçe Español

Español