Renowned billionaire and prominent figure in crypto, Mike Novogratz, is thrilled with recent developments, but why? Bitcoin price started above $26,300 on Saturday, June 17th. The price rose over a thousand dollars in the last 24 hours, and there’s a single reason behind it. It is the explicit desire of the world’s largest asset manager to venture into cryptocurrencies.

Cryptocurrencies Could Soar

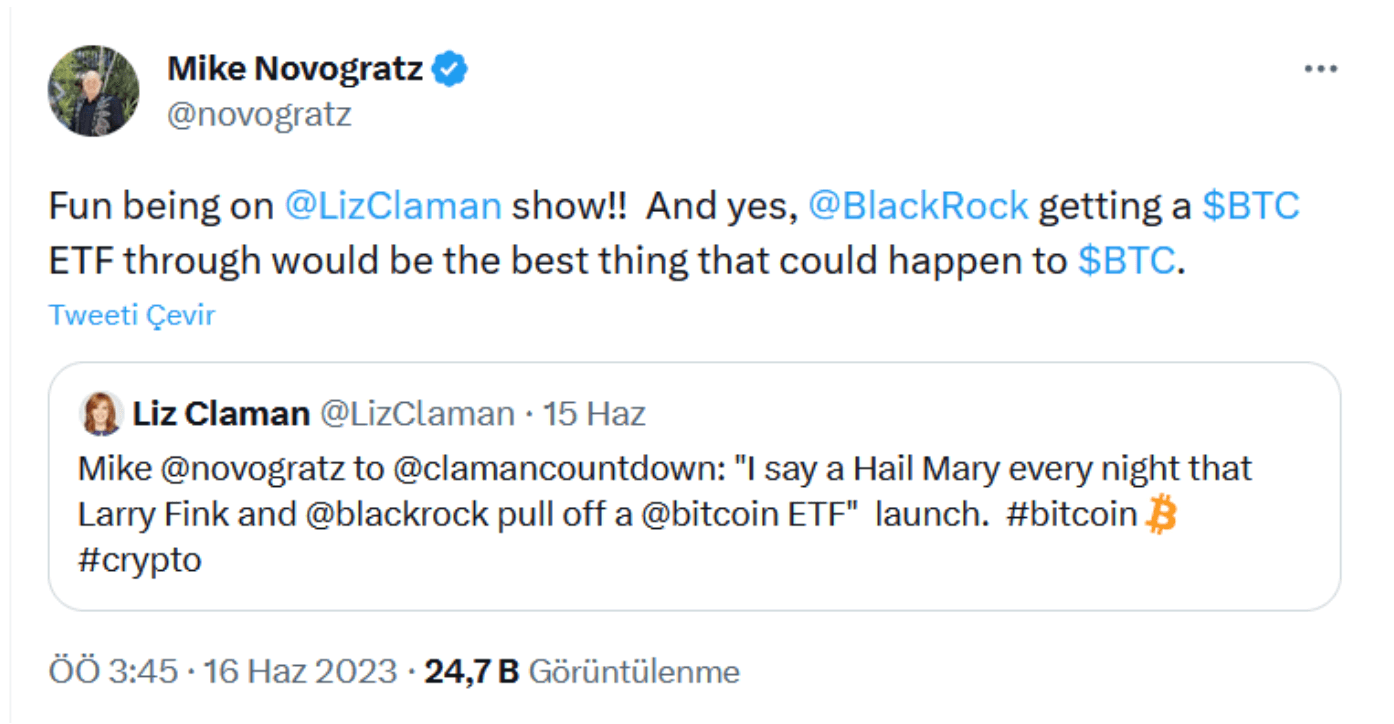

Billionaire Mike Novogratz says BlackRock’s application for a Bitcoin (BTC) exchange-traded fund (ETF) could be the best thing to happen to the crypto king. In a new interview with The Claman Countdown, the Galaxy Digital CEO hopes for BlackRock’s success because it could attract more investors to the sector.

All spot Bitcoin ETF applications submitted to the U.S. Securities and Exchange Commission so far have been rejected. SEC must respond to BlackRock within 240 days. The application that followed two lawsuits filed against major exchanges seems like a move to boost investor confidence.

2024 Bitcoin Bull Run

With BlackRock‘s move, the story of the next bull run is starting to take shape. Next year is turning into a landscape where cryptocurrencies could make massive gains from various angles. We’ve spoken enough about negativity in the past few months; let’s talk about hopeful things. What will happen next year?

- The Federal Reserve is expected to start cutting interest rates in the first quarter of 2024, according to today’s expectations.

- Bitcoin halving will take place in April.

- Hong Kong’s crypto step will start bearing fruits.

- The Ripple case will conclude.

- Legal legislation is expected to be enacted in the US, at least for Stablecoins.

- According to four-year cycles, 2024 is viewed as a rally year.

- A decision on BlackRock’s application will have been made.

Mike Novogratz stated,

If BlackRock CEO Larry Fink can pull this off, it would be a remarkably significant event for this space because it really facilitates institutional participation. They are the world’s largest asset manager…

There’s no reason for us not to have a Bitcoin ETF; we have a futures ETF. The judge already scolded the SEC for this madness in the Grayscale case, so we’ll see.

Elaborating on his stance, Novogratz said the success of BlackRock’s BTC ETF proposal would be the best thing to happen to the king cryptocurrency.

Implementing BlackRock’s BTC ETF would be the best thing that could happen to BTC.

BlackRock initially submitted a request to the SEC for the iShares Bitcoin Trust on June 15. Other companies trying to create BTC ETFs include Grayscale, VanEck, and Cathie Wood’s ARK Invest.