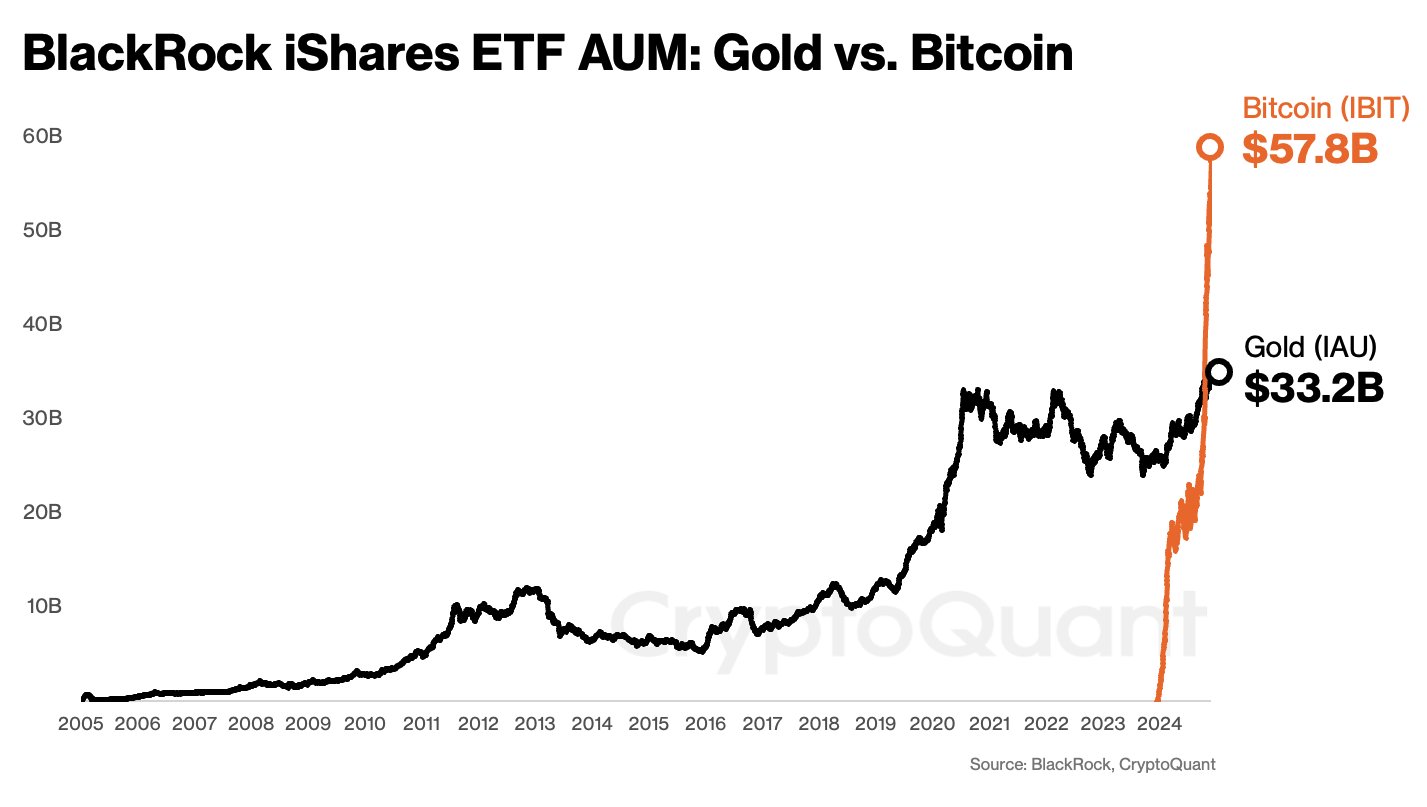

BlackRock, the world’s largest asset management company, has seen its spot Bitcoin  $105,151 ETF, IBIT, reach an impressive asset size of $57.8 billion in just one year. In contrast, the company’s gold ETF, IAU, which has been in the market for 20 years, remains at $33.2 billion. This development highlights the increasing institutional interest in cryptocurrencies.

$105,151 ETF, IBIT, reach an impressive asset size of $57.8 billion in just one year. In contrast, the company’s gold ETF, IAU, which has been in the market for 20 years, remains at $33.2 billion. This development highlights the increasing institutional interest in cryptocurrencies.

Spot Bitcoin ETF Grows at Unprecedented Speed

BlackRock launched its gold ETF in 2005, which has consistently attracted investors seeking a safe haven. However, by 2024, the spot Bitcoin ETF has surpassed this growth within a single year.

According to data from the crypto analysis platform CryptoQuant, the spot Bitcoin ETF is rapidly growing due to the interest of institutional investors and this growth trajectory continues. As the share of cryptocurrencies in portfolios increases, Bitcoin presents a new investment alternative compared to the precious metal gold.

Institutional Investors Quickly Shift to the Digital Realm

Experts attribute this heightened interest in the spot Bitcoin ETF to the growing institutional acceptance of cryptocurrencies. BlackRock’s spot Bitcoin ETF is viewed as a significant milestone in financial markets. While traditional investment vehicles may retain their value, this strong shift towards cryptocurrencies is altering the dynamics in the investment world.

The rapid ascent of the spot Bitcoin ETF signals that Bitcoin and the broader cryptocurrency market could become more substantial investment instruments in the future.

Türkçe

Türkçe Español

Español