Twitter’s former CEO Jack Dorsey’s Bitcoin-focused fintech company, Block, released its third quarter earnings report to the public on November 2nd. According to the report, the company had a profitable quarter, surpassing analysts’ expectations. The firm announced that it generated $5.62 billion in revenue in the third quarter of 2023, thanks to strong revenue growth in Cash App and Square.

Shareholder Letter from Jack Dorsey

Block made a profit of $44 million from its Bitcoin holdings, especially due to the recent price increase. In a shareholder letter, Dorsey shared the company’s focus and future plans regarding Square, along with the key financial data for the third quarter.

Dorsey also announced that the company allowed the repurchase of $1 billion worth of shares to offset the value loss caused by share-based sales, providing a secure environment for investors.

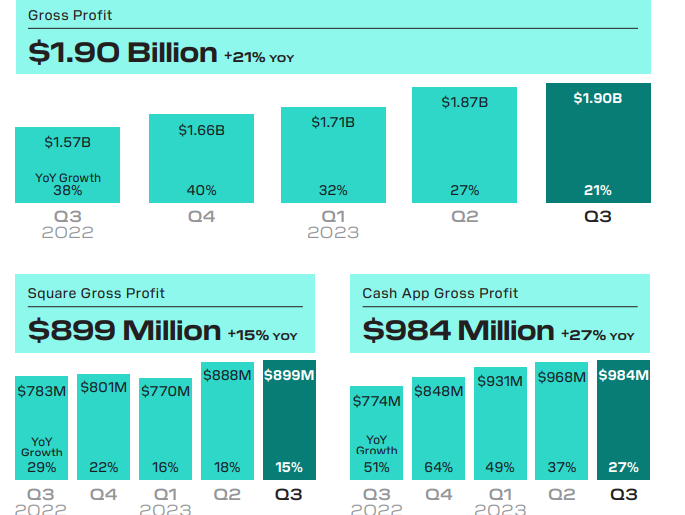

Block achieved a gross profit of $1.9 billion in the third quarter of 2023, a 21% increase compared to the third quarter of 2022. Additionally, the mobile payment tool, Cash App, saw a 27% increase in gross profit, reaching $984 million, and Square had a 15% increase, making $899 million in gross profit during the same period.

Notable Details for Block

The revenue generated from Block’s Bitcoin holdings accounted for approximately 43% of the company’s total revenue of $5.6 billion. Strong consumer demand and positive spending contributed to the growth of fintech companies in the third quarter.

Block’s gross profit from Bitcoin increased by 22% compared to the previous year, reaching $45 million. The company sold $2.42 billion worth of Bitcoin to customers through Cash App. However, Bitcoin revenue accounted for only 2% of the total Bitcoin gross profit.

The company explained that the increase in Bitcoin revenue was due to the rise in the average market price of Bitcoin and the increase in the amount of Bitcoin sold to customers. Block stated that there has been no depreciation in the value of its Bitcoin holdings since the second quarter of 2023. As of September 30, 2023, Block’s Bitcoin investment was valued at $102 million. The fair value determined based on observable market prices was $216 million, $114 million higher than the book value.