Since its launch, Blur (BLUR) has gained immense popularity in the NFT space, outperforming even the market leader Opensea in several aspects. While the market performance remains relatively strong, there are few things to write home about the native token.

Blur Surpassing Opensea

When looking at the metrics of both NFT markets, it is evident that Blur has managed to surpass Opensea in many aspects. In particular, Blur witnessed a significant increase in weekly volume, surpassing Opensea by a large margin in February 2023. However, Opensea maintained higher daily volume throughout last month.

A similar trend was observed in the graph highlighting the weekly average transaction prices of both marketplaces, with Blur overshadowing Opensea. However, things changed as Opensea’s graph closely followed Blur’s last month.

Blur’s Growth Potential

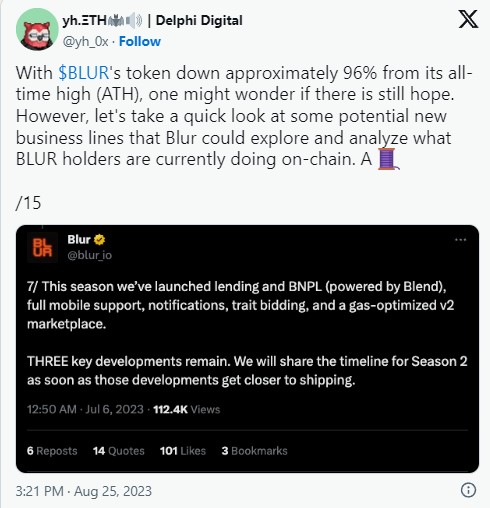

While the marketplace’s performance is impressive, it has experienced a decline in statistics along with the price of the native token in the past few months. However, a NFT researcher at Delphi Digital mentioned several potential new business lines that Blur could explore, benefiting both the marketplace and the token.

According to the tweet, Blur could explore NFT derivatives. NFT derivatives can offer investors flexibility and hedging opportunities similar to token markets. Another possible direction was an NFT trading bot. Blur’s bot could reduce entry barriers by directing users to the marketplace aggregator, increasing overall trading volume by encouraging more frequent trades.

The tweet also mentioned how Blur’s market leadership positioned it as an attractive launchpad for NFT projects. The marketplace can differentiate itself from competitors by generating revenue from creative fees or mints.

Blur Token’s Current Status

Not only did market measurements record a decline, but BLUR’s performance in terms of price was also concerning. The token has experienced a 96% drop from its all-time high (ATH).

Last month, the token saw a drop of over 31% and was trading at $0.2041 with a market cap of $178 million at the time of writing. The current measurements of the token indicate a downward trend. For example, trading volume has decreased, indicating a lack of investor interest in trading the token. The token’s exchange listings increased, indicating selling pressure.

Furthermore, BLUR will unlock over two million tokens in February next year, potentially causing further price decline. Interestingly, the top 100 wallets did not trade the token last month, which could reflect whales’ confidence in BLUR.

Türkçe

Türkçe Español

Español