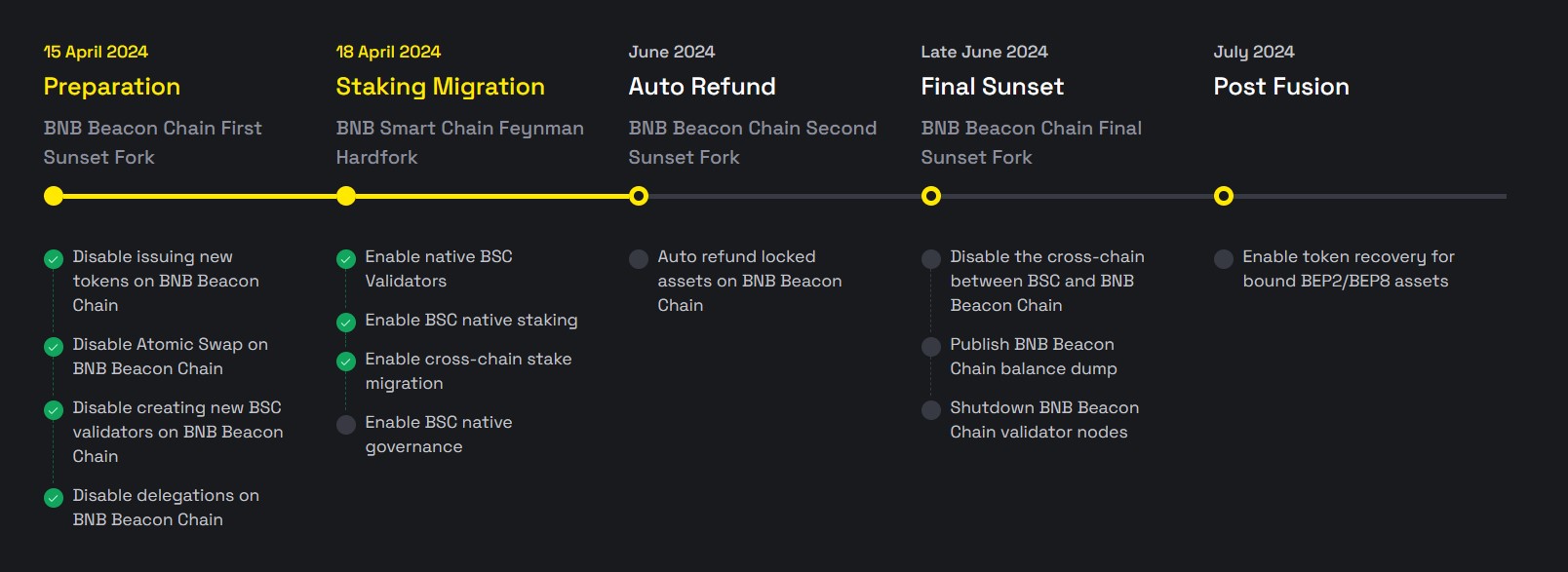

BNB Chain team announced that as part of the transition of BNB Beacon Chain’s functions to the Binance Smart Chain (BSC) network, they will enable native liquid staking services on BSC. BNB Chain, in its announcement, stated that the BNB Beacon Chain will be completely shut down by June 2024. However, the team also reported that they would transfer their services to BSC before the shutdown.

A Noteworthy Step from the BNB Team

BNB Chain said that enabling liquid staking services on BSC will allow ecosystem participants to secure the network while maintaining asset liquidity. While no specific date was given for the launch of the liquid staking service, the BNB Chain team mentioned that this step would occur in April or May.

The BNB Chain core development team described the transition to BSC as an initiative to streamline the organization’s network and stated in the announcement:

“The implementation is compatible with the end of the BNB Chain Fusion process, streamlining the network, enhancing efficiency, reducing security risks, and meeting current technological demands.”

The team added that this step is also part of the company’s growth plans aimed at making the BNB Chain network more attractive to users. BNB Chain explained that this feature would allow users to participate in decentralized financial activities without compromising the utility of their assets, as they will own liquid stake tokens representing the staked crypto assets.

Significant Announcements Regarding the Process

BNB Chain core development team also stated in the announcement that users would be able to transfer their BNB assets to a liquidity pool or directly to a validator, summarizing the issue with the following words:

“Liquidity staking not only rewards BNB stakers but also enhances the security of the BNB Chain network. It offers BNB holders more flexibility and options in staking their assets.”

The team explained that BNB holders would receive liquidity provider tokens, which they can use in many activities within the ecosystem when they stake tokens located in the liquidity pool. According to the development team, liquid staking and maximum extractable value (MEV) optimization for BNB Chain will be implemented together:

“Validators enabling MEV will have the opportunity to increase their staking returns through MEV revenue, which will be included in the Liquidity Staking rewards,” they added.