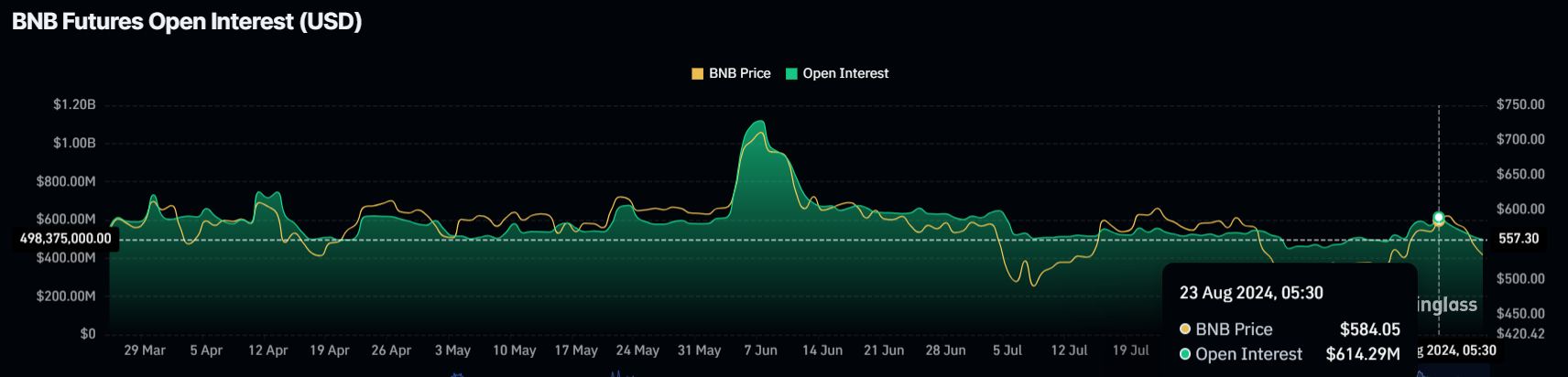

BNB’s price is attempting to turn a critical resistance block into support and failing. Investors withdrawing their funds are weakening the altcoin as the market shows slight bearish signals. BNB’s price is affected by both investor actions and broader market cues. Between August 23 and the date of writing, BNB’s Open Interest in the Futures market saw a significant drop.

What is Happening on the BNB Front?

The OI dropped by 20% from $614 million to $497 million, directly contributing to BNB’s recent price decline. Broader market conditions greatly impact the declining bullish momentum in BNB. The weakening sentiment is evident in various indicators, suggesting potential challenges ahead for the altcoin.

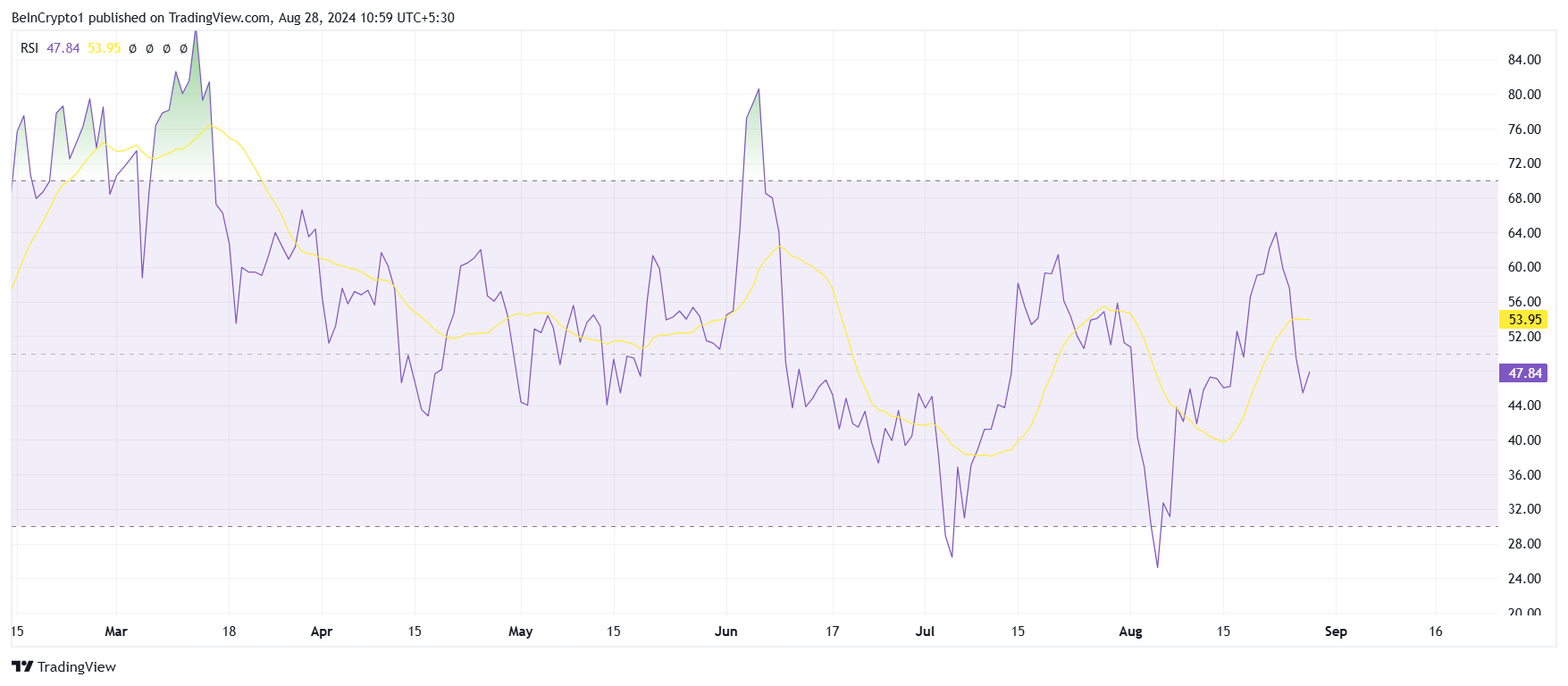

One of these indicators is the Relative Strength Index (RSI) falling into the bearish zone. The movement of the RSI level into this zone indicates a shift in market sentiment and suggests that investors might be more cautious about BNB’s short-term prospects.

While the current position of the RSI indicates a potential struggle, it is important to note that this does not guarantee a prolonged stay in the bearish zone. Market conditions can change, and if broader factors align positively, a recovery could occur. However, for now, BNB’s price may face difficulties in initiating a rebound.

BNB Chart Analysis

At the time of writing, BNB is trading at $540, having dropped 9.8% in the last four days. This decline occurred after BNB entered the five-month resistance block from $575 to $619. Since the beginning of March, BNB has attempted to enter and surpass this resistance zone nine times but succeeded only twice. One of these successes resulted in the altcoin reaching a new all-time high of $721 in early June.

Falling below the $550 support, BNB seems to need stronger bullish signals to resume its upward trend. However, it is uncertain whether BNB can break through the resistance block. A drop below $520 could be detrimental to investors’ gains. BNB’s price might then test the $495 support. But if $550 turns into support and the altcoin rises again, it could re-enter the resistance block and invalidate the bearish thesis.

Türkçe

Türkçe Español

Español