Britannia Financial, a banking partner of Tether, may face a legal process for allegedly not declaring income related to Tether. According to a report published by the Financial Times on November 21, Arbitral International, a company based in the British Virgin Islands, has filed a lawsuit against Britannia due to a $1 billion transfer from Tether, as indicated by court documents filed in London’s High Court of Justice in 2023.

Notable Bank Partnerships of Tether

The lawsuit is related to Britannia’s acquisition of an intermediary company based in the Bahamas known as Arbitral Securities. Britannia announced the acquisition process in October 2021, defining the brokerage firm as a subsidiary of Britannia Securities.

According to the newly published report, Britannia and Arbitral reached an agreement regarding an additional payment based on the income-generating asset value owned by Arbitral Securities one year after the sale. The agreement was stated to include customers tied to Arbitral or related parties. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Referring to court files, the report revealed that Tether opened an account at a subsidiary of Britannia Financial in November 2021. The news came a few months after Bloomberg described Tether as a private bank based in the Bahamas on the Britannia Bank and Trust platform for conducting dollar transfers. Paolo Ardoino, Tether’s Chief Technology Officer and new CEO, had previously stated that the stablecoin company had strong relationships with more than seven banks.

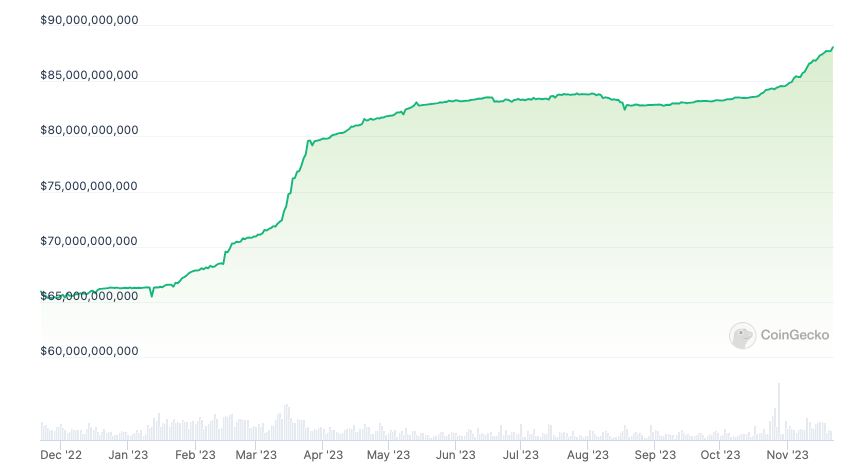

USDT Aims for a Value of 90 Billion Dollars

According to data from CoinGecko, Tether’s stablecoin is steadily gaining momentum in the cryptocurrency market and heading towards a market value of 90 billion dollars. On November 20, USDT reached a new peak of 88 billion dollars with a 33% increase since the beginning of 2023.

According to Tether, USDT added over 20 billion dollars to its market value in 2023 due to two main factors, including ongoing market excitement, including the possible approval of a spot Bitcoin exchange-traded fund. The company states that Tether’s record-breaking growth continues to attract attention, particularly in developing markets like Brazil, due to increasing demand.

Türkçe

Türkçe Español

Español