Ethereum‘s price has been locked in a narrow trading range between $1,800 and $1,900 since July 21. Despite recent positive developments such as the launch of PayPal’s Ethereum-based stablecoin and increasing demand for Ethereum-based exchange-traded funds (ETFs), this significant lack of volatility has created uncertainty and skepticism among investors.

PayPal’s entry into the crypto world could be a major step towards mainstream adoption for Ethereum. However, this move also raises concerns about centralization and potential loss of control over personal assets.

Growing Concerns in Ethereum

The U.S. Securities and Exchange Commission has witnessed an increase in applications for Ethereum ETFs, reflecting the trend of major asset management firms looking to establish Bitcoin (BTC) ETFs.

The Ethereum network is facing issues due to high gas fees, which are the cost of transactions, including those involving smart contracts. Over the past two months, the average transaction fee has been over $4, limiting the demand for decentralized applications (DApps).

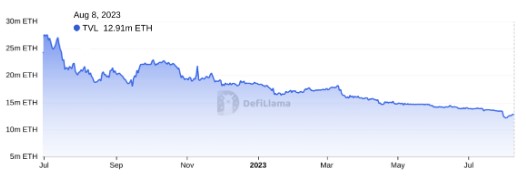

There has been a noticeable decline in the total value locked (TVL) in deposits on the Ethereum network. According to DefiLlama, this decline indicates the lowest TVL level observed in the past three years.

Although there have been some changes in this trend over the past week, the current scenario reflects a significant decrease in Ethereum deposits, particularly around 12.9 million, compared to the previously recorded 14.75 million three months ago.

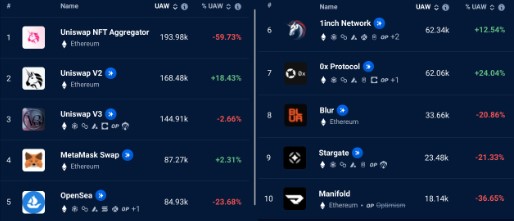

To determine if the decline in Ethereum’s TVL is related to a decrease in user base, investors should monitor the usage of DApps. It may be important to note that certain DApps, such as gaming platforms and marketplaces, do not require significant deposits.

The number of active addresses using DApps has decreased, which can be concerning. In the past 30 days, major DApps on Ethereum had 25% fewer active users. This may reflect investors’ dissatisfaction with the cost of transactions on the network.

Examining Ethereum derivatives can help determine if the $1,800 level is a truly reliable support level depending on how ETH investors position themselves.

Balancing Bulls and Bears

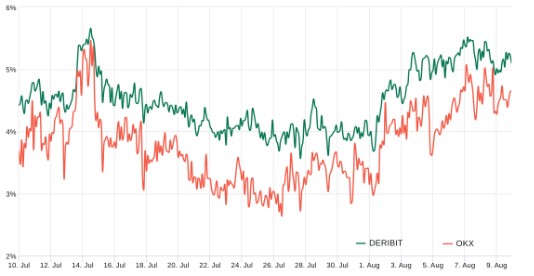

Ethereum quarterly futures are popular among whales and arbitrage traders. However, these stable monthly contracts typically trade at a slight premium compared to spot markets, indicating that sellers demand more money to delay settlement. As a result, healthy ETH futures contracts should trade with an annual premium of 5% to 10%, which is not exclusive to crypto markets.

Based on the futures premium, also known as the fundamental indicator, professional traders in the Ethereum market have not shown a bullish stance since July 16. The current 5% level hovers around the neutral-bear threshold, indicating a balance in demand between leveraged long and short positions.

The introduction of Coinbase’s Base network on August 9 could contribute to Ethereum’s struggle to surpass $1,900. Several development teams in the ecosystem have announced their proposals for the Base network, which currently includes a version of decentralized exchange Uniswap.

While expectations for Ethereum’s rise are fueled by the potential approval of an ETF and the significant user base facilitated by PayPal’s stablecoin, the network faces competition from existing smart contract platforms and well-resourced competitors. Such a scenario creates uncertainty surrounding the durability of the $1,800 support level.