A Canadian regulator accused the crypto trading platform ezBtc and its founder David Smillie of misusing customer funds. Grayscale’s Ethereum Trust completed its first non-exit day 14 days after its launch. Meanwhile, Argo Blockchain fully repaid a $35 million loan from Galaxy Digital, which prevented its bankruptcy in 2022 during the crypto bear market.

Notable Incident in Canada

The Canadian crypto trading platform ezBtc and its founder David Smillie defrauded customers by misusing approximately 13 million Canadian dollars in crypto investments. A panel formed by the British Columbia Securities Commission (BCSC), a provincial regulator in Canada, found that ezBtc misused customer funds for its own purposes.

The ezBtc platform, which went offline permanently around September 2019 and was dissolved in 2022, claimed to store all user crypto investments in cold storage. During its operation from 2016 to 2019, ezBtc collected over 2,300 Bitcoin and more than 600 Ethereum from crypto investors. According to the BCSC panel, Smillie used about one-third of the users’ funds for personal use:

“We found that a total of 935.46 Bitcoin and 159 Ethereum were transferred by ezBtc to Smillie’s exchange accounts or to CloudBet and FortuneJack. Transfers to the two gambling websites were sometimes made directly from ezBtc and sometimes indirectly from ezBtc to Smillie’s exchange accounts and then to the said websites.”

According to the court file, sanctions will be imposed on September 24 and could range from monetary penalties to market participation bans.

Exciting Development in ETHE

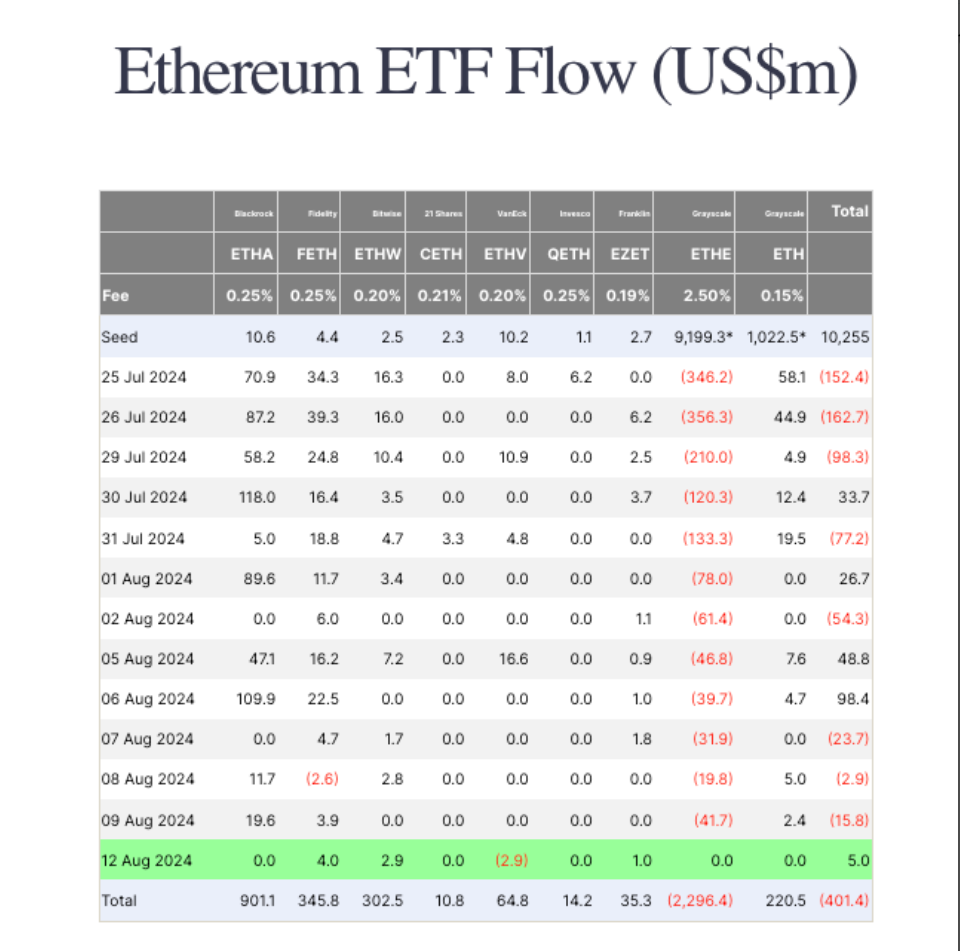

Grayscale Ethereum Trust (ETHE) announced its first non-exit day, ending a streak of daily exits since its launch. On August 12, Ethereum ETF flows turned positive for the fifth time since their July 23 launch, supported by ETHE’s announcement of its first zero-exit day, according to Farside data.

ETHE lost approximately $2.3 billion in Ethereum over the 20 days since its launch. In comparison, it took about four months for Grayscale’s Bitcoin Trust (GBTC) to see its first non-exit day.

Bitcoin Mining Company Repaid Its Debt

Bitcoin miner Argo Blockchain successfully repaid a $35 million loan borrowed from Galaxy Digital in 2022 to avoid bankruptcy during the crypto bear market. The loan was part of a broader deal involving the sale of Argo’s Helios Bitcoin mining facility in Texas to Galaxy Digital for $65 million and refinancing its debt.

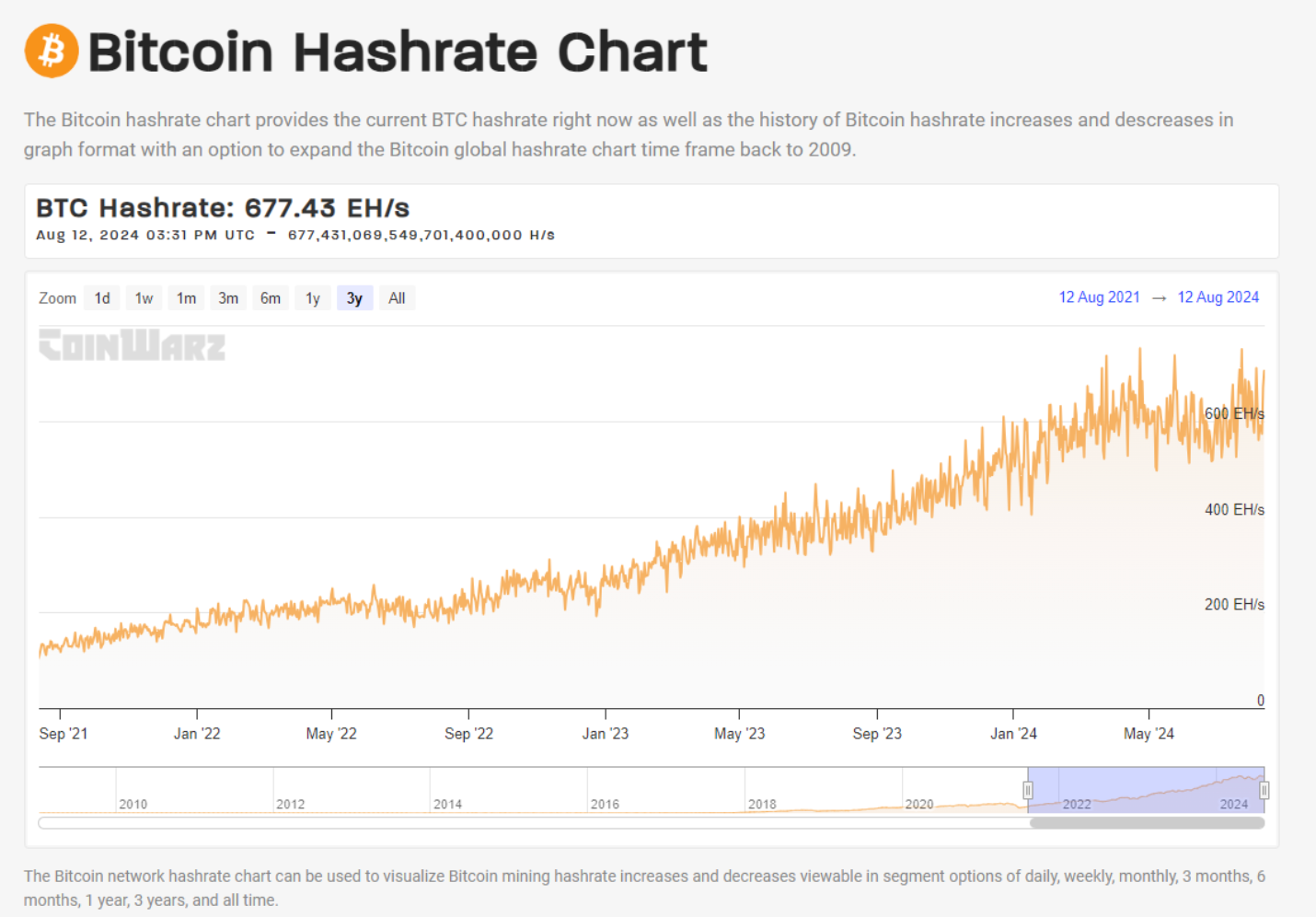

The loan was secured by 23,619 Bitmain S19J Pro mining machines currently operating at Helios and Argo’s data centers in Canada. As part of the deal, Argo agreed to lease back space at Helios to continue operating its Bitcoin mining equipment. At the end of 2023, Argo had a hashrate of 2.7 exahashes per second (EH/s). According to CoinWarz data, the total hashrate of the Bitcoin network is currently 677.43 EH/s. In July, Argo announced it was mining an average of 1.5 Bitcoin per day or 48 Bitcoin per month.