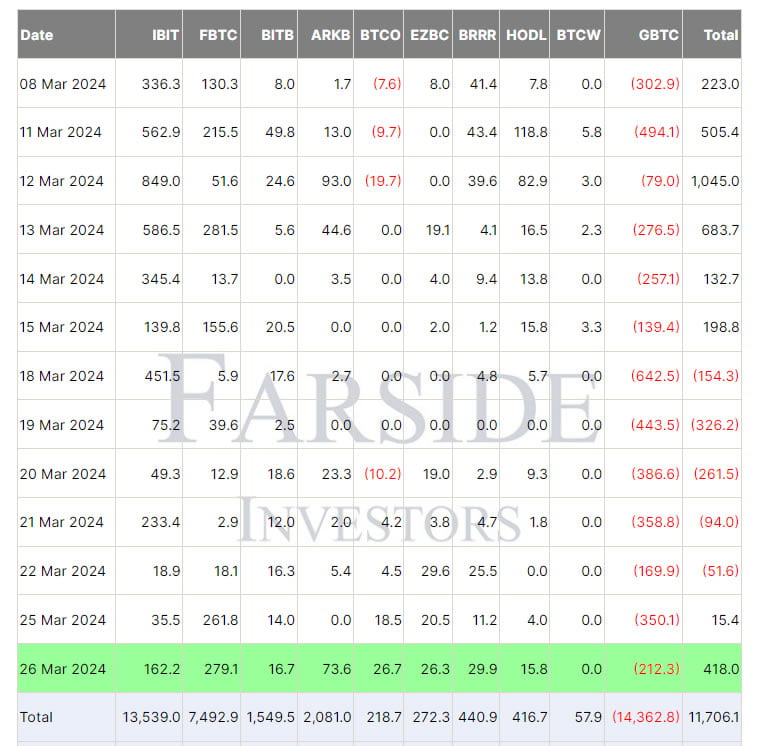

New capital is flowing back into US spot Bitcoin exchange-traded funds (ETFs) after five consecutive days of net outflows. According to Farside Investors data, ten recently approved spot Bitcoin ETF funds, led by strong entries into Blackrock and Fidelity’s funds, saw a combined net inflow of $418 million on March 26th.

What’s Happening in the ETF Space?

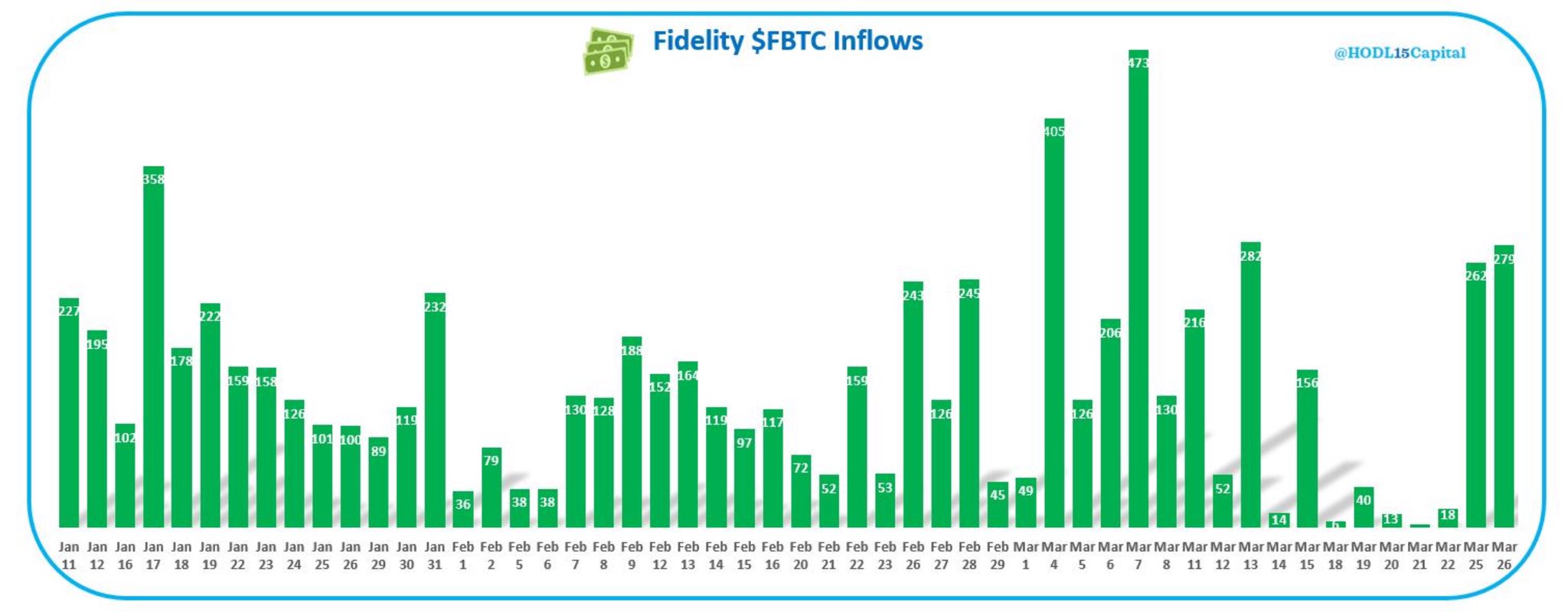

Fidelity’s fund achieved its biggest daily entry since March 13th, reaching $279.1 million on March 26th, with the investment giant purchasing an additional 4,000 Bitcoins. This marked the second consecutive day the fund saw entries exceeding $260 million.

Additionally, BlackRock’s fund attracted $162.2 million in inflows. However, these daily inflows remained low compared to earlier this month when daily averages exceeded $300 million. Ark 21Shares Bitcoin ETF recorded its best day since March 12th with a $73.6 million inflow, while funds from Invesco Galaxy, Franklin Templeton, and Valkyrie all saw inflows of over $26 million.

Meanwhile, Grayscale’s Bitcoin Trust (GBTC) continued to bleed out, recording a daily outflow of $212 million, yet this was not enough to outweigh the net inflows of its competitors. Since converting from a trust to an ETF fund on January 11th, Grayscale has lost approximately 277,393 Bitcoins valued at around $19.5 billion at current prices.

Noteworthy Data on the ETF Front

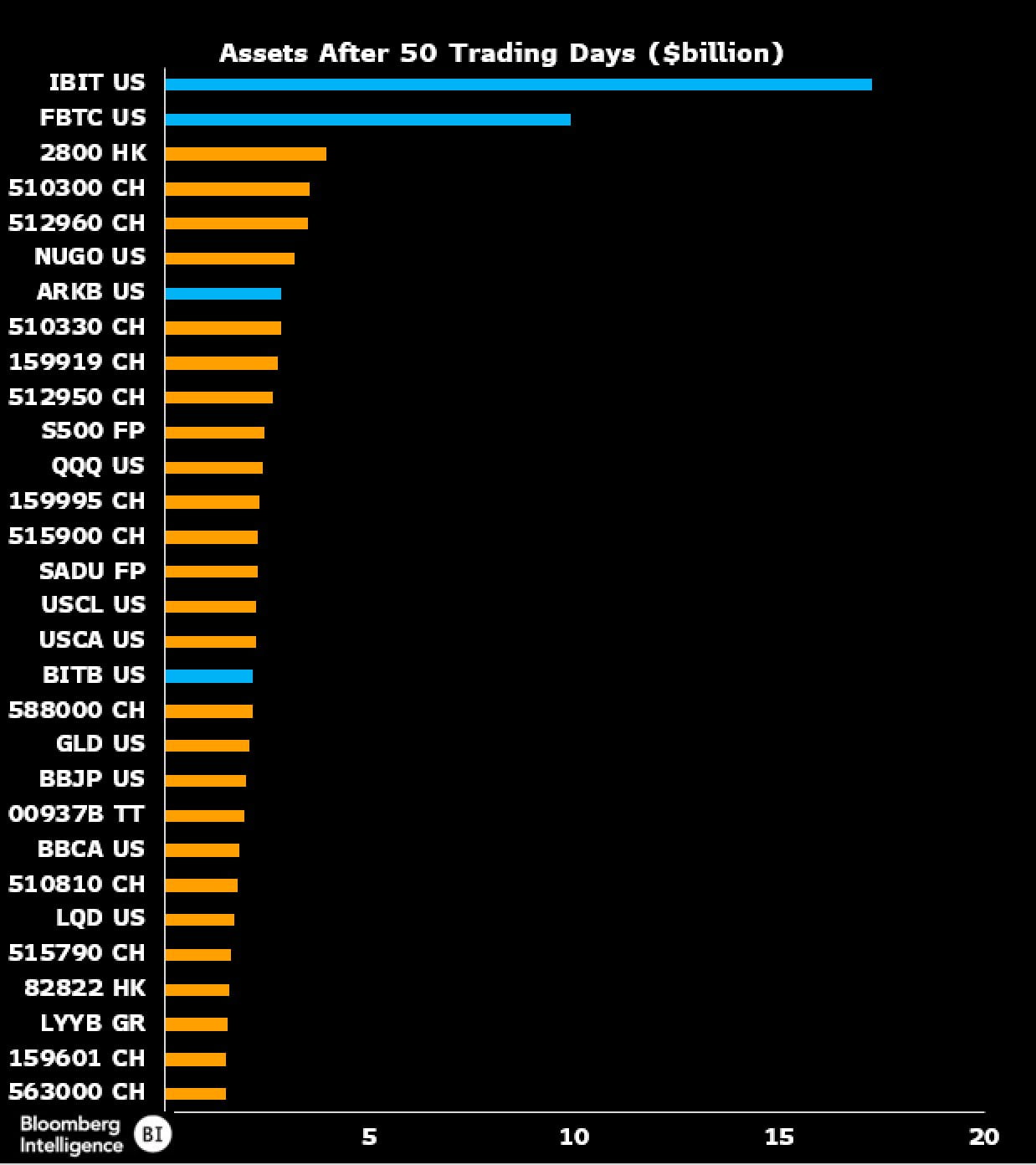

Bloomberg senior ETF analyst Eric Balchunas highlighted the presence of Bitcoin ETF funds in a chart of the top 30 asset funds during their first 50 days of trading in a note sent to X on March 26th. He pointed out that four Bitcoin ETF funds, including BlackRock’s IBIT and Fidelity’s FBTC, are in a league of their own on the global funds list.

Balchunas mentioned that even the Bitwise Bitcoin ETF fund (BITB), currently the 18th largest fund by assets under management, is bigger than the world’s largest SPDR Gold Shares (GLD) fund. Crypto asset management firm Hashdex announced on March 26th that it had converted its futures fund into a spot product now trading under the DEFI code, thereby becoming the eleventh spot Bitcoin ETF issuer in the US.

Türkçe

Türkçe Español

Español