Following the U.S. SEC’s recent decision to postpone all seven Bitcoin ETF applications last Thursday, Bitcoin and the broader crypto market came under strong selling pressure. However, Cardano (ADA) is showing signs of improvement in on-chain activity.

Cardano’s (ADA) Future

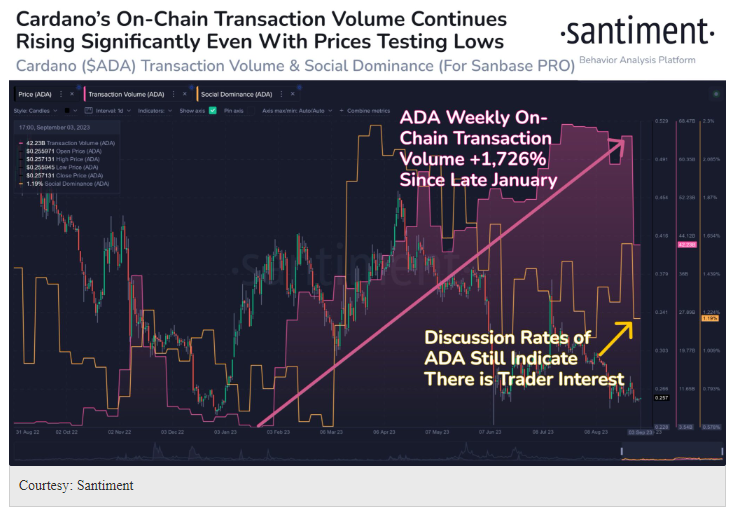

Despite challenging market conditions, Cardano has reported an increase in on-chain transaction volumes compared to the local peak in April. Weekly on-chain transaction volumes for ADA have increased by 1,700% since the end of January. Additionally, the current discussion rates around ADA indicate sustained trader interest.

According to Santiment, utility plays a crucial role in any potential recovery, and when combined with ADA’s significant social dominance, it continues to show promise. Furthermore, Cardano’s DeFi ecosystem is also showing signs of strengthening this year. The smart contract ecosystem has over 35,000 daily active addresses and over $15 million locked in DeFi protocols.

Data from Defillama shows that the Cardano network currently has a total locked value (TVL) of approximately $160.36 million, indicating a significant increase since January 2023.

Cardano (ADA) Price Prediction

Throughout 2023, Cardano’s ADA price continues to trade in the range of $0.25 to $0.40. Currently, ADA is trading near the lower end of the range at around $0.25. The price of Cardano has undergone its third test of a critical support zone this year. Unlike the previous year’s crypto bear market, Cardano has experienced reduced losses, indicating the possibility of a sustained recovery that could potentially push the cryptocurrency back to its all-time high (ATH) of approximately $3.

However, if Cardano’s upward momentum struggles to maintain the $0.25 support zone, crypto experts predict that the price could potentially drop further and reach approximately $0.18 in the coming weeks.

Despite short-term price challenges, Cardano’s smart contract ecosystem is growing with strong Total Locked Value (TVL) and on-chain activities. The network’s utility and continued trader interest paint a promising outlook, including a potential retest of its previous all-time high.