Cardano (ADA) is experiencing a surge from its June lows and a bounce at a key support, the 21-day moving average, at $0.28. What’s causing this increase in the cryptocurrency?

ADA’s Ascending Indications!

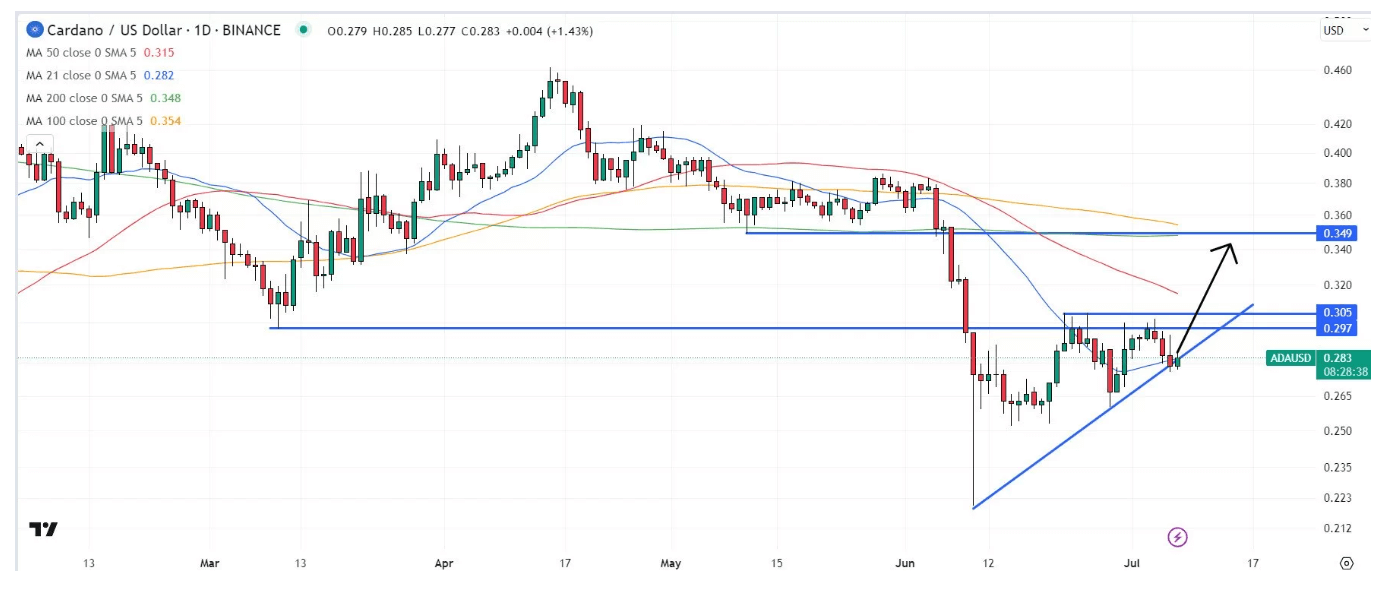

The bounce, coming with a sigh of relief following less alarming U.S. employment numbers than the crypto markets feared, is keeping hopes alive for an ascending triangle pattern in ADA. This pattern tends to form before a bullish momentum.

Even as the broader crypto market pulls back, ADA remains approximately 7% below its psychologically significant previous weekly high levels around the $0.30 region. So, is it time to buy the dip?

Because Cardano is still in the process of forming a short-term technical structure, bulls remain optimistic, and short-term price predictions are consequently bullish. If ADA can break above the resistance in the $0.30 region, it may open the door to a swift recovery towards the 200DMA and the resistance in the $0.35 area.

ADA Rally!

If ADA can sustain this rally, it could recover almost all of the ground lost after the U.S. Securities and Exchange Commission labelled it as a security last month. It’s not just technical data indicating a potential ADA rally.

Despite SEC FUD (Fear, Uncertainty, and Doubt), the blockchain’s Decentralized Finance (DeFi) ecosystem continues to strengthen. According to DeFi Llama, the total value locked (TVL) in Cardano smart contracts (via Cardano Decentralized Applications) has climbed back over $200 million, nearly returning to its highest levels of the year.

Furthermore, TVL in ADA continues to reach all-time highs. While U.S. regulatory uncertainty continues to loom over ADA, now could be a good time to buy the dip.