The well-known blockchain platform and altcoin project, Cardano (ADA), renowned for its innovative approach towards decentralized finance (DeFi), has been in the limelight due to its recent significant strides. With each move, the platform attracts more investor interest, evident in the dramatic increase in the total value locked (TVL) in its network.

Cardano’s ADA-Denominated TVL Surpasses 400 Million ADA

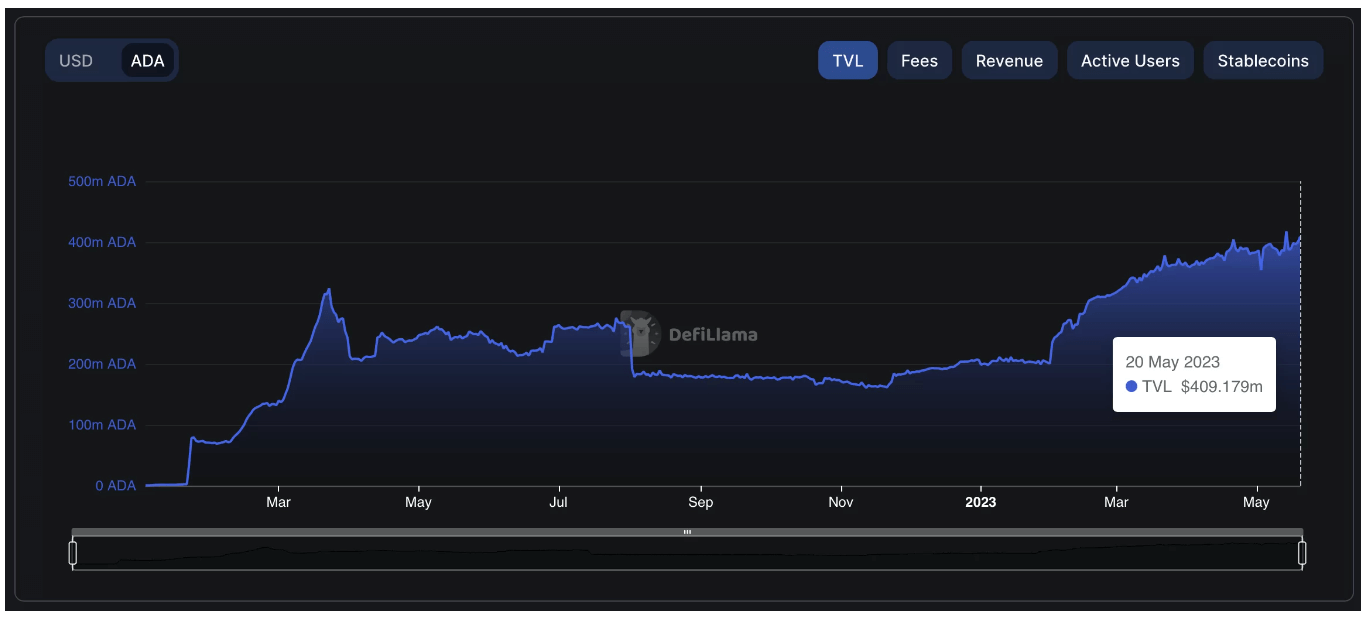

Cardano’s DeFi ecosystem, denominated in ADA, once again exceeded a TVL of 400 million ADA. As of May 20th, data from the data platform DeFiLlama revealed that Cardano’s TVL reached 409.1 million ADA, equating to $150.82 million in US dollar value.

Previously, Cardano’s ADA-denominated TVL crossed the 400 million ADA mark on May 14th but quickly retracted.

What is Total Value Locked (TVL)?

In brief, the total value locked (TVL) signifies the amount/value of the cryptocurrency locked in smart contracts within the DeFi ecosystem. TVL serves as a measure of the overall activity and liquidity within the system and is a crucial indicator for many investors. The surpassing of 400 million ADA in Cardano‘s TVL illustrates increased investor confidence and high interest in the platform’s DeFi services.

Cardano’s unique approach to scalability and sustainability is leading the factors contributing to its success in the DeFi field. Cardano utilizes the Proof of Stake (PoS) consensus system, which allows faster transactions compared to traditional Proof of Work (PoW) systems and significantly reduces energy consumption.

Furthermore, Cardano’s emphasis on security continues to attract both developers and users. The platform’s rigorous approach to code accuracy and auditing provides a higher level of trust and reliability for DeFi applications built on its network.