Chainlink (LINK) investors continue to witness increased activity on the chain, thanks to the significant price surge the altcoin has experienced since September 18, 2023. The price surge was triggered by the revelation that a major bank collaborated with Chainlink to test Cross-Chain Interoperability for its Australian dollar stablecoin, and whales’ interest in the altcoin remains high.

$4 Million Worth of LINK Transferred from Binance

Recently, it was revealed that Chainlink wallet addresses were involved in the transfer of approximately 71.8 million LINK tokens, sparking speculations about the price surge. Furthermore, the news that Chainlink has collaborated with the banking system SWIFT for a tokenization test in the past few months has also provided support for LINK’s price.

On September 24, 2023, a major Ethereum (ETH) whale transferred 28 million LINK tokens worth $4 million, causing a stir in the Chainlink community. Interestingly, despite the transfer resulting in an impressive 7% gain in LINK’s price, the gains were partially lost as Bitcoin dropped to around $26,000. Data shows that the receiving wallet address in the transfer holds 32,723 ETH worth over $31 million.

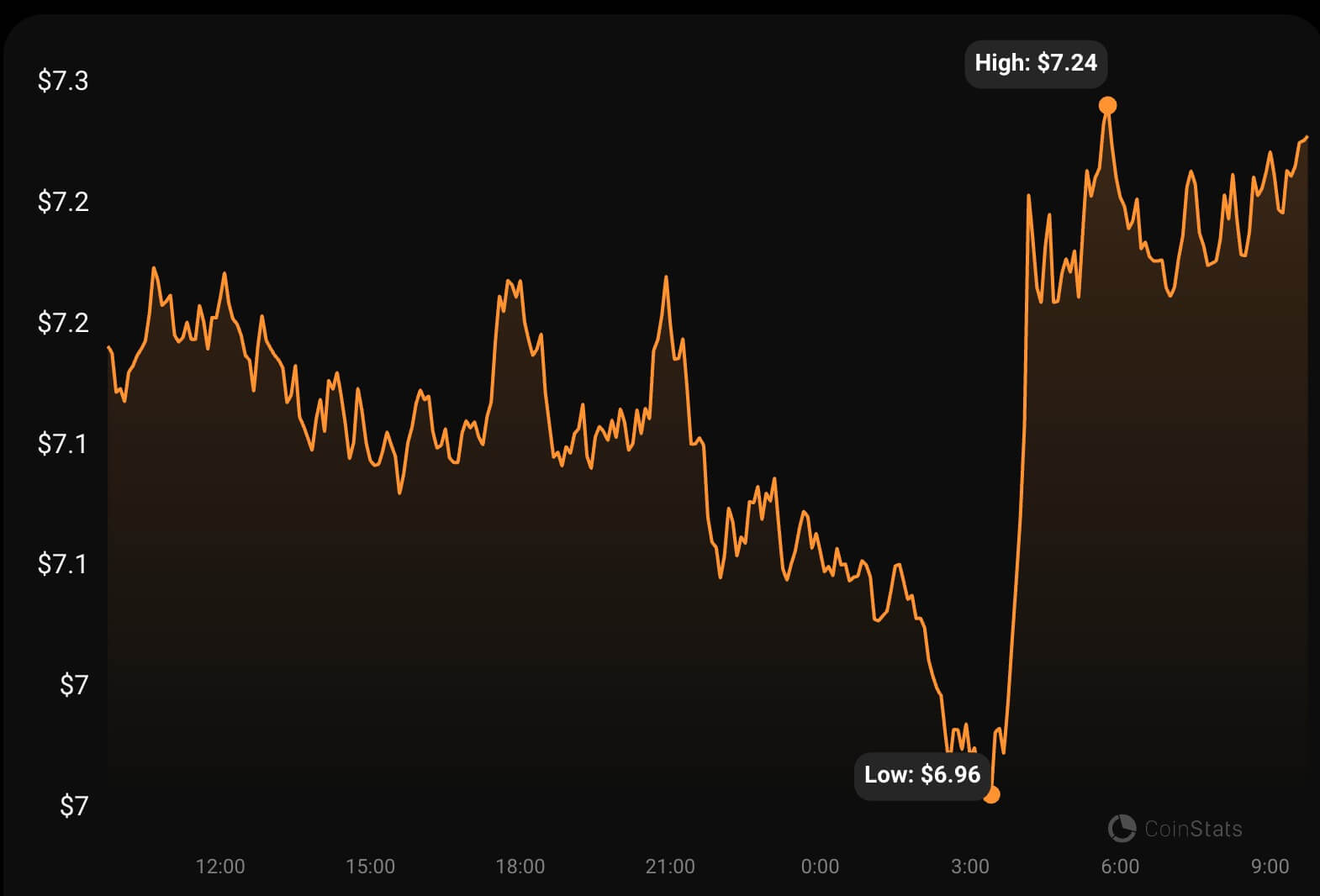

Nevertheless, Chainlink’s native asset LINK continues to demonstrate strength as one of the prominent altcoins, especially during a period when Bitcoin struggles to hold above the $27,000 level and faces the possibility of dropping below $26,000. While the cryptocurrency market focuses on developments surrounding the race for a spot Bitcoin ETF, LINK’s ability to maintain price stability in the coming weeks remains a subject of great curiosity.

Price Prediction for LINK

Analysts expect LINK, which has been on an upward trend since September 18, to continue moving upwards until early October against Tether (USDT) without undergoing a correction.

Additionally, crypto analyst Rootlashbin predicts a correction and a period of consolidation after reaching around $9, before a strong rally in November. Rootlashbin’s prediction suggests that LINK could experience an almost 100% surge from the current range to reach $13 levels by the end of the year.