Data provider InsideTheBlock recently published a new post stating that Chainlink (LINK) saw an increase of over 220% in active addresses last month. Similarly, demand for the token also increased by 211% during the same period.

Increase in LINK Network Activity!

According to data obtained from Santiment, LINK saw the creation of 3044 new addresses on November 9th. This was the highest daily number since July. The growth in LINK’s network activity last month could be attributed to the overall market surge. Taking advantage of this situation, the price of LINK has increased by 108% in the past 30 days.

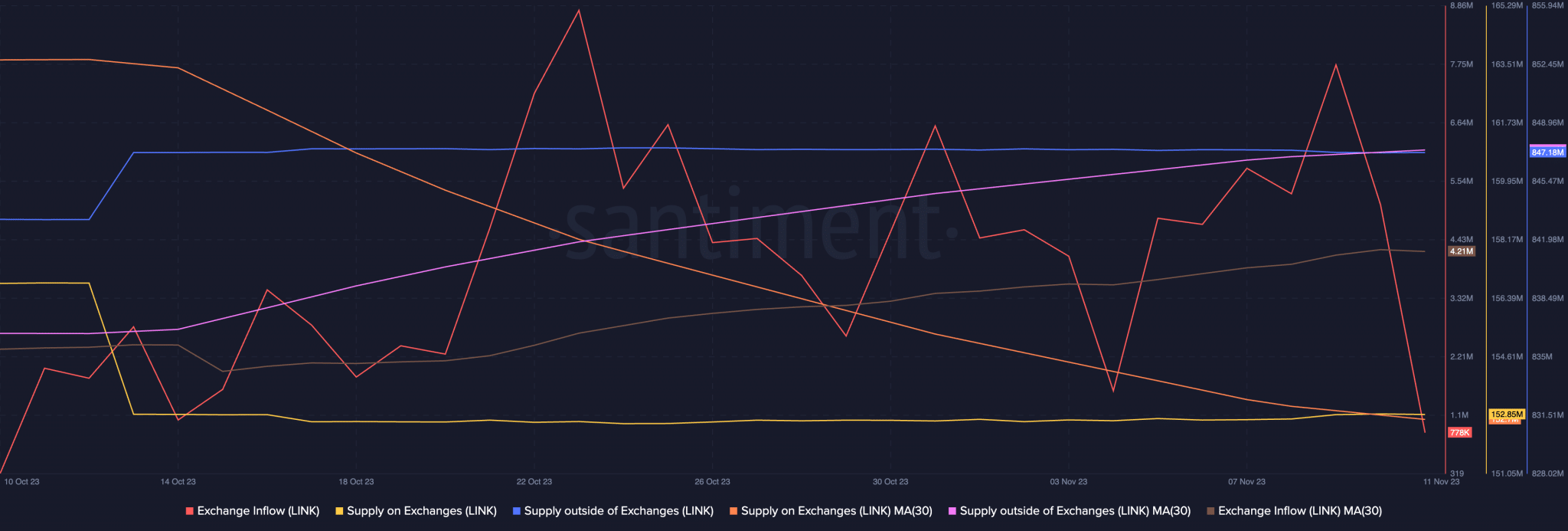

With the trading volume at its highest level in several months, LINK holders have been transferring their tokens to cryptocurrency exchanges for future sales. An evaluation of the altcoin’s exchange activities revealed a steady flow of LINK tokens to exchanges since the rally began.

Current Data on LINK

According to data from Santiment, the inflow observed in the 30-day moving average of LINK increased by 17%. This increased the token’s supply on exchanges by 0.1% and caused a 0.02% decrease in supply outside of exchanges during the same period. Due to the profitability of LINK transactions since the beginning of the surge, token holders have been encouraged to diversify their assets.

Furthermore, data obtained from Santiment showed that the daily profit/loss ratio for LINK transactions was 2.1 (30-day MA) at the time of writing. This suggests that for every LINK transaction that resulted in a loss in the past month, 2.1 transactions ended in profit. Additionally, the current market value ratio (MVRV) of LINK, which is 76.29%, was higher than the average price at which it was last purchased. Therefore, most investors can expect a minimum return of 76.29% from their initial investments.

According to data from 21milyon.com, at the time of writing, the altcoin was traded at its highest price level since April 14th, at $15.04.