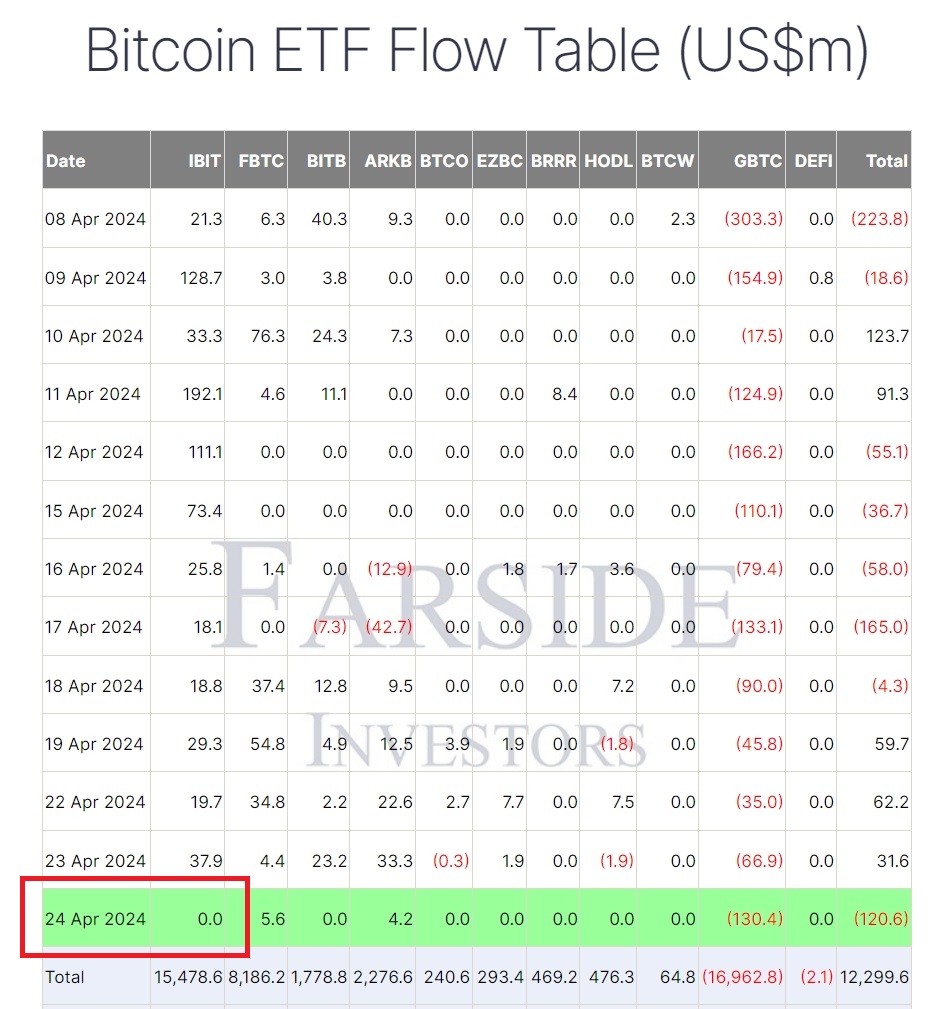

BlackRock iShares Bitcoin Trust (IBIT) recorded no new entries for the first time since its launch in January, ending a streak of daily multi-million dollar investments. Since its launch on January 11, IBIT had consistently attracted millions of dollars daily, amassing approximately $15.5 billion in just 71 days, but this series of fund inflows ended on April 24 when BlackRock recorded no new entries.

What’s Happening in the Bitcoin ETF Sector?

Other participants in the Bitcoin ETF market also witnessed a challenging period. Among the 11 Bitcoin ETFs registered in the US, Fidelity Wise Origin Bitcoin Fund (FBTC) and ARK 21Shares Bitcoin ETF (ARKB) stood out, recording inflows of $5.6 million and $4.2 million, respectively. Meanwhile, selling pressure continued in the Grayscale Bitcoin Trust ETF (GBTC), which saw an outflow of $130.4 million on April 24, resulting in a net outflow of $120.6 million from spot Bitcoin ETF funds that day.

While this was a first for fund entries in IBIT, it is not an unusual situation among other ETF participants. For instance, Fidelity’s FBTC fund also recorded no entries on three days over the last two weeks.

To date, Bitcoin ETFs trading in the US have managed to accumulate a net $12.3 billion in Bitcoin. However, outflows from GBTC balanced some of the inflows from the other 10 Bitcoin ETFs, with fund outflows from GBTC exceeding $17 billion since January 11.

ETF Landscape and Ethereum

Some participants in the Bitcoin ETF market are also continuing to apply for Ethereum ETF funds in the US, but the Securities and Exchange Commission (SEC) recently postponed approval decisions for many of them. The SEC announced on April 23:

“The Commission believes that it is appropriate to designate a longer period to issue an order approving or disapproving the proposed rule change, as modified by Amendment No. 1, so that it has sufficient time to consider the proposed rule change.”

The SEC extended the decision on whether to allow Grayscale’s ETH Trust to convert to a spot Ethereum ETF on NYSE Arca by 60 days, pushing the deadline to June 23.