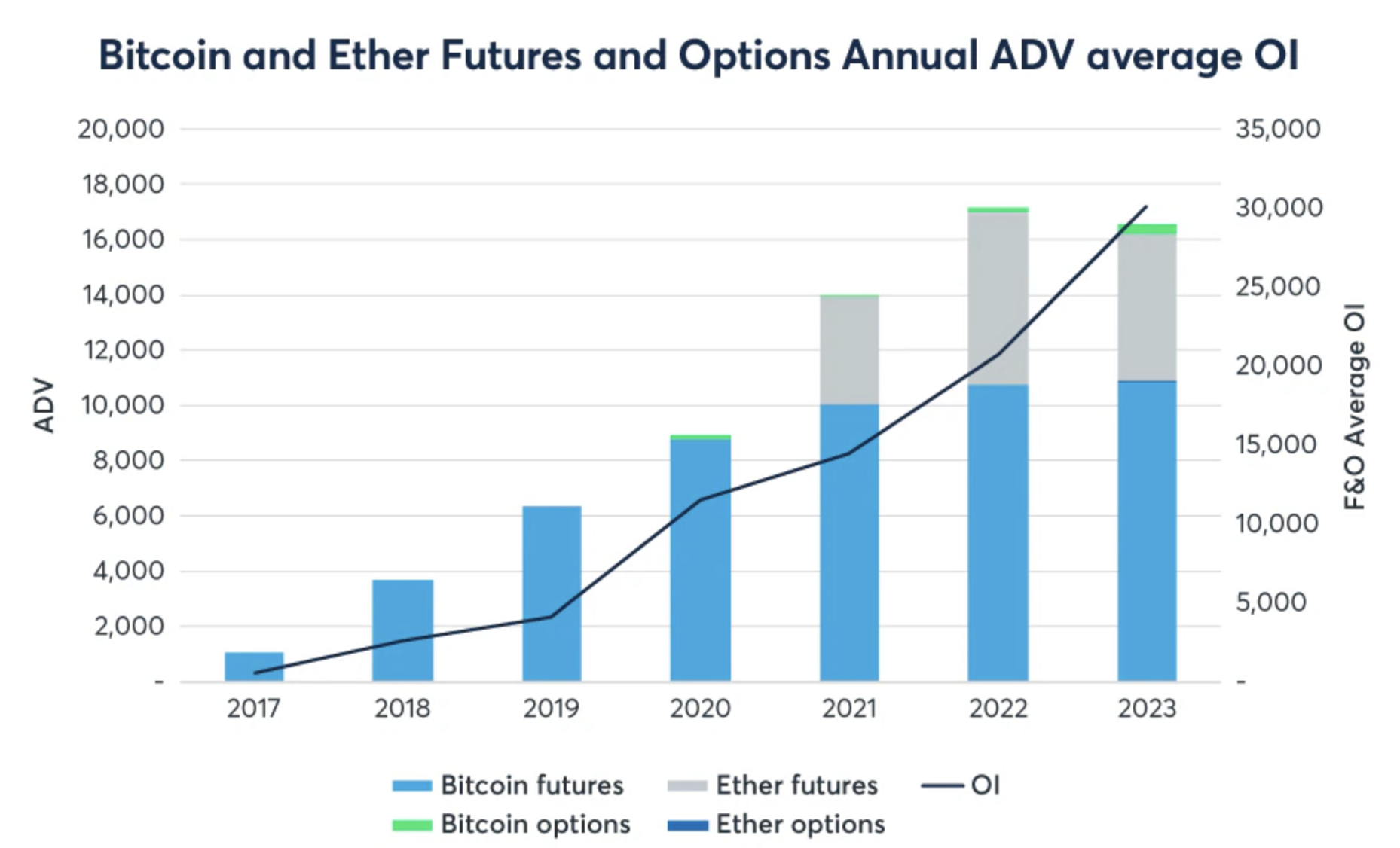

The Chicago Mercantile Exchange (CME) reported that regulated Bitcoin (BTC) and Ethereum (ETH) futures saw a record level of participation from large investors in the second quarter. The increased demand for hedging instruments has led to record trading volumes and open positions in BTC and ETH futures and options.

Institutional Interest in Bitcoin Futures Increases

The average number of participants with large open interest in the futures contract, which allows trading with a minimum of 25 BTC, was 107 during the quarter, while the average number of participants with large open interest in ETH was 62. CME attributed the strong participation of institutional investors in Bitcoin futures to the growing institutional interest. Investors turned to regulated venues and products to hedge against increasing volatility and manage risk and exposure.

Data from CME’s regulated and cash-settled futures show that it continues to be a preferred option for institutional investors who want to invest in cryptocurrencies without directly owning them.

The record participation of large investors was driven by the continued rally of the top cryptocurrencies in the first quarter of the year. Bitcoin increased its value by 7% in the second quarter, resulting in an 84% increase in the first half of the year. Ethereum, on the other hand, saw a 61% increase in value during the same period.

Significant Surge in BTC and ETH Futures and Options

The increase in demand for hedging instruments contributed to a rise in trading volumes and open positions in BTC and ETH futures and options, reaching all-time highs in the first half of the year.

The open interest in standard Bitcoin futures contracts reached a record level in the first half of the year, averaging 14,800 contracts, representing a 15% increase compared to 2022. Additionally, the open interest in Bitcoin options recorded an impressive 175% increase from the previous year, with an average of 9,400 contracts.

Türkçe

Türkçe Español

Español