With the strong showing of Bitcoin bulls this month, the price of the largest cryptocurrency has surpassed $38,000 for the first time since May 2022. The rise in Bitcoin futures on CME continues, surpassing the world’s largest crypto exchange, Binance, and indicating strong demand from institutional investors. CME Bitcoin futures are now on an upward trajectory, aiming for a rally above $40,000.

CME Bitcoin Futures Signal Rise Above $40,000

As the expiration of monthly options increases market sensitivity, Bitcoin bulls continue to push up the price of the largest cryptocurrency. Both individual and institutional investors are now more confident in Bitcoin reaching $40,000 and closing the year around $45,000.

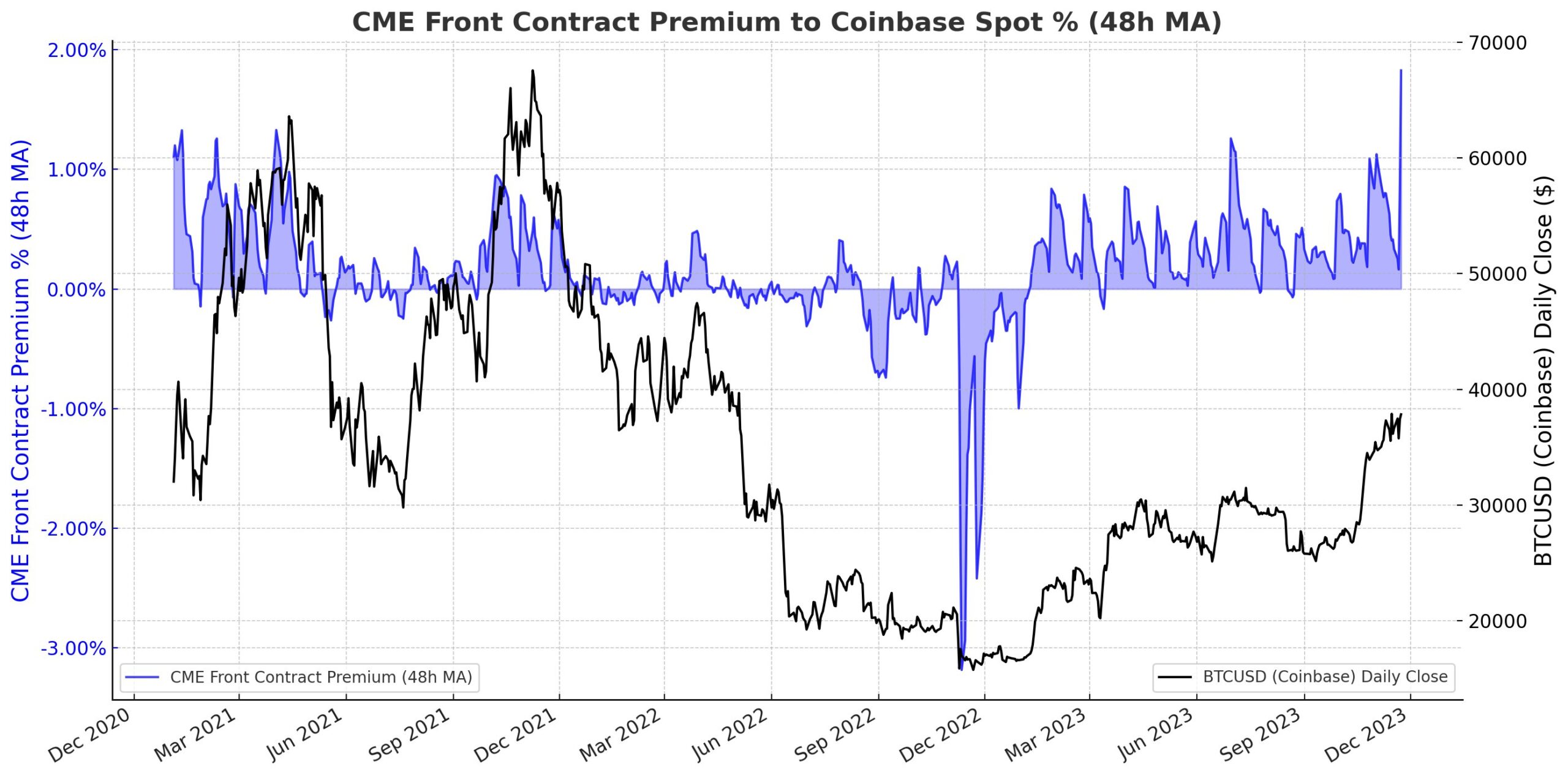

The CME Pre-Contract Premium has reached its all-time high as a percentage compared to the spot market on the giant crypto exchange Coinbase, thanks to the positive market sentiment. CME Bitcoin futures have traded at a high level of $39,300 at some point in the past 24 hours, trading with a positive premium compared to the spot price, almost $1,000 higher. Futures and options traders also continue the upward trend in Bitcoin.

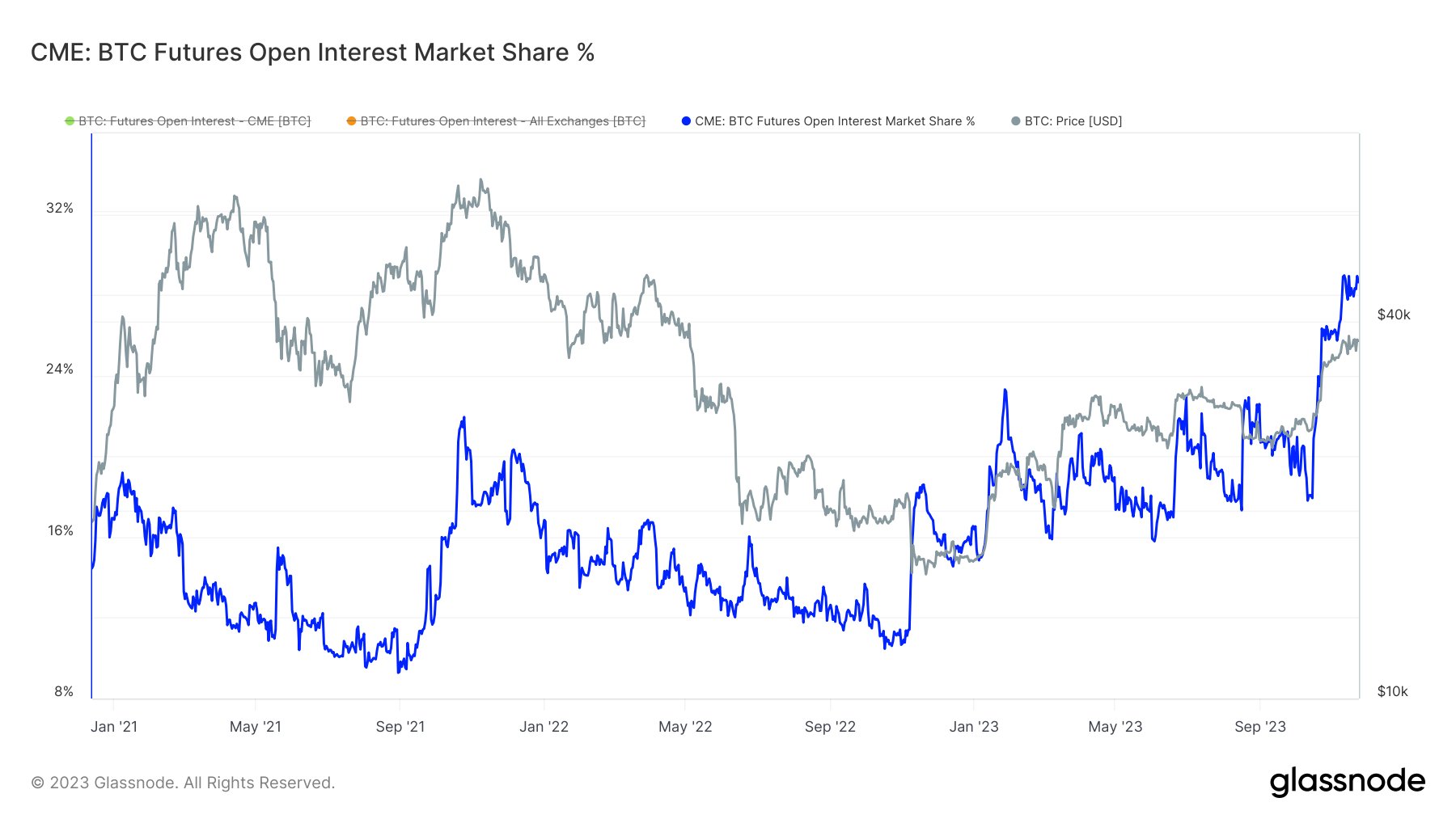

The improved market sentiment and bullishness from institutional investors, such as ProShares’ BITO, investing in Bitcoin futures listed on CME, contribute to the premium. Furthermore, the CME Bitcoin Futures Open Interest Market Share Percentage has increased to about 30%, following Binance’s former CEO Changpeng Zhao’s acceptance of federal criminal charges and settlement with US authorities, agreeing to pay $4.3 billion.

Currently, all data shows that institutional investors are anticipating and continuing to invest in Bitcoin. The significant increase in inflows to crypto funds in the past few weeks reflects this, with the overall crypto market rising under Bitcoin’s leadership.

Bitcoin’s Price Gains Strength

Bitcoin’s price has increased by 2% in the past 24 hours and is currently trading at $37,818. The lowest and highest prices in the past 24 hours were $37,369 and $38,415, respectively. Additionally, the trading volume has increased by 70% in the past 24 hours, indicating an increase in investor interest. One significant contributor to this increase is the largest 100 Tether (USDT) wallet address, which has collectively added $1.67 billion in the past six months. This confirms the upcoming rally supported by positive sentiments and higher trading volumes.

A recent study by Matrixport reveals that Bitcoin is expected to close the year at $45,000 and reach $125,000 by December 2024 with a rally following the halving of block rewards.

Türkçe

Türkçe Español

Español