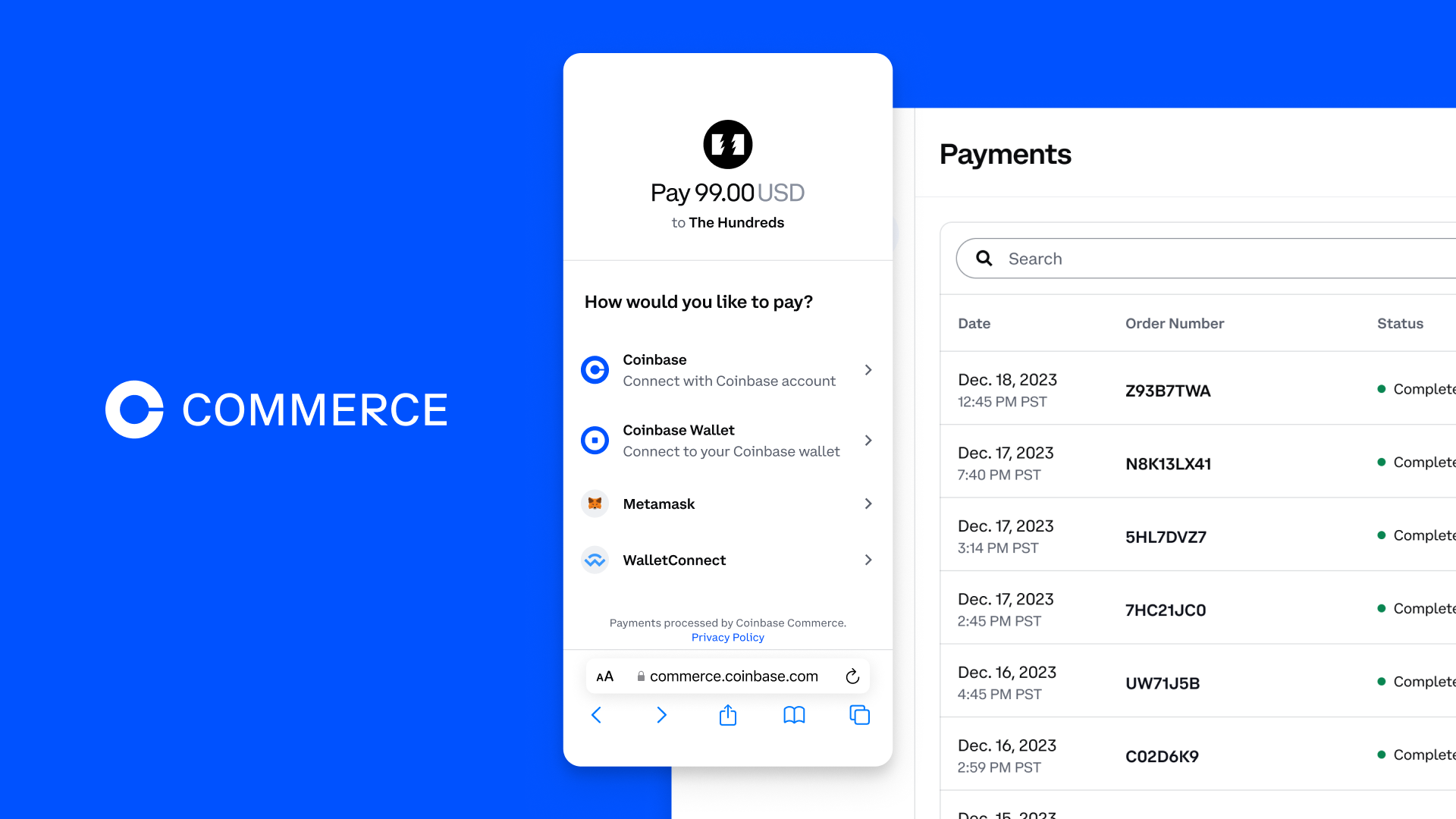

Designed to facilitate the acceptance of crypto payments by investors, Coinbase Commerce has announced plans to integrate Solana (SOL) and Lightning Network in the long term. As the crypto ecosystem continues to evolve, Coinbase Commerce is redeveloping its strategy to further empower its users and established investors.

Coinbase Commerce Redefines Its Strategy

According to the company’s Product Lead Lauren Dowling, the team is evaluating their products. The company has made some changes to meet its fundamental goals of serving everyone. Lauren mentioned that as part of their efforts, Coinbase Commerce has removed support for Bitcoin payments and UTXO for certain reasons.

She pointed out that the inability to enable smart contracts on Bitcoin, especially for the growing user base of Coinbase Commerce, made automating crypto payments challenging. The Product Lead also noted that the absence of a native stablecoin on Bitcoin further complicated the company’s entire mission related to BTC.

Exploring New Avenues Initiative

Lauren confirmed that despite removing Bitcoin support, users can continue to transact with other assets such as Base, Polygon, and Ethereum, or protocols compliant with the ERC-20 standard.

Lauren stated that the plans to integrate Solana and the Lightning Network are part of the company’s initiative to continuously explore new ways to enhance customer experiences. The integration will also position the company to properly assess support for other payment methods to facilitate participation in the Blockchain world.

Coinbase Establishes Dominance in the Industry

Coinbase may be trailing Binance in terms of daily trading volume. However, it is definitely leveraging its influence in the United States market, particularly through the Coinbase Custody initiative.

Beyond Coinbase Commerce, the exchange’s custody service emerges as a dominant service adopted by the majority of spot Bitcoin ETF issuers in the country. From BlackRock to Grayscale Investments, the adoption of Coinbase Custody positions the trading platform as one of the key players in the success of Spot Bitcoin ETF products to date.

With its positioning and strategic products, Coinbase recorded a better-than-expected revenue increase in the fourth quarter of 2023. The company’s Q4 profit amounted to $273.4 million. In the same period of the previous year, Coinbase had reported a loss of $557 million. Following the earnings announcement, the company’s shares rose 15% to $180.31 on Friday.

Türkçe

Türkçe Español

Español