The cryptocurrency exchanges in the European Economic Area must take significant steps to continue their operations. The MiCA regulation, which governs cryptocurrency markets, has placed many responsibilities on exchanges. The European Union has implemented the most comprehensive cryptocurrency regulation on a global scale. As a result, investors in the European region will lose access to certain stablecoins.

Coinbase Delist

Coinbase, the largest cryptocurrency exchange in the U.S. by volume, will delist unlicensed stablecoins in the region to comply with the EU’s MiCA regulation. Stablecoins that do not meet MiCA requirements by December 30, 2024, will be restricted in the European Economic Area.

“Given our commitment to compliance, we aim to restrict stablecoins that do not meet MiCA requirements for users in the European Economic Area by December 30, 2024.”

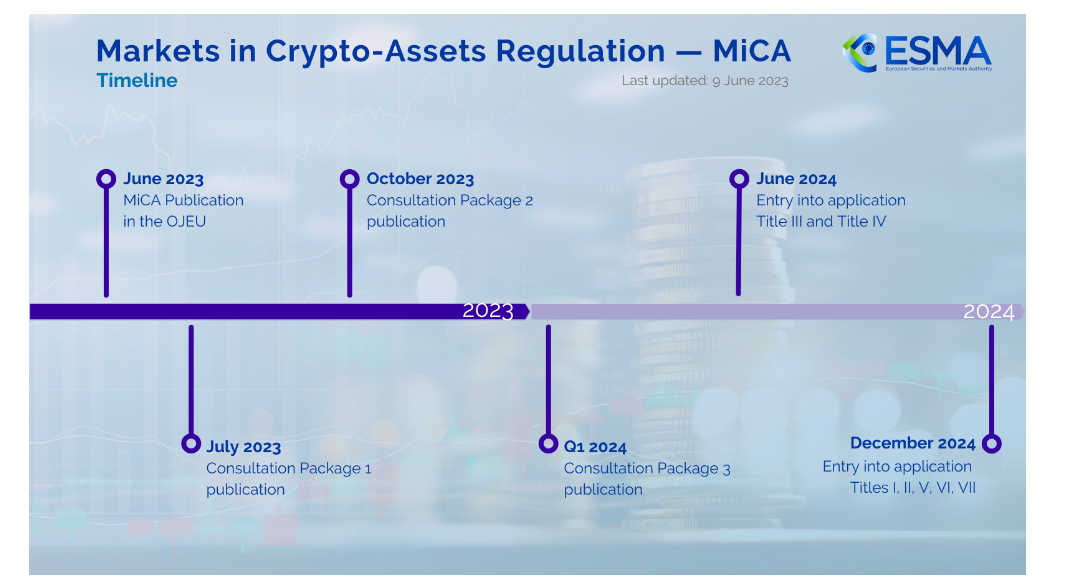

Stablecoins are required to obtain an authorization license from at least one EU country, but many will face restrictions if they fail to do so by the rules that took effect on June 30. Tether has not yet succeeded in obtaining an e-money license in any of the 27 member states.

Future of Stablecoins

Popular stablecoins like USDC and PYUSD have acquired their licenses so far. However, the largest stablecoin by market capitalization, USDT, has yet to succeed in this regard, which could lead to a contraction in its market share. While Circle’s USDC and EURC stablecoins have acquired their licenses, USDC will remain the largest option among the few alternatives in the region.

As global regulations surrounding cryptocurrencies become more widespread, new restrictions are likely to emerge. Some governments are considering KYC proposals for DeFi protocols, while examples like the EU are now imposing licensing requirements. Cryptocurrency companies will need to grow their compliance and legal teams to quickly adapt to the rules set by governments.

Otherwise, many cryptocurrency firms could weaken under regulatory pressure. The privilege of operating in gray areas will be curtailed in this new era for cryptocurrencies. Companies that have operated freely for years due to regulatory gaps will now face serious penalties, especially in the U.S.

Türkçe

Türkçe Español

Español