Crypto exchange Coinbase has reportedly launched a crypto lending service for institutional investors in the US, aiming to capitalize on the market’s major failures. This initiative comes as the crypto lending sector tries to revive after past crises, and Coinbase is fighting against SEC allegations.

Coinbase Prime Introduced

According to a report by Bloomberg on September 5, Coinbase quietly launched Coinbase Prime, a corporate-level crypto lending platform for US investors. Coinbase Prime will serve as a full-service brokerage platform, allowing institutions to trade and store their assets. The company stated:

“With this service, institutions can choose to lend their digital assets to Coinbase under standardized conditions in a product compliant with the D Regulation.”

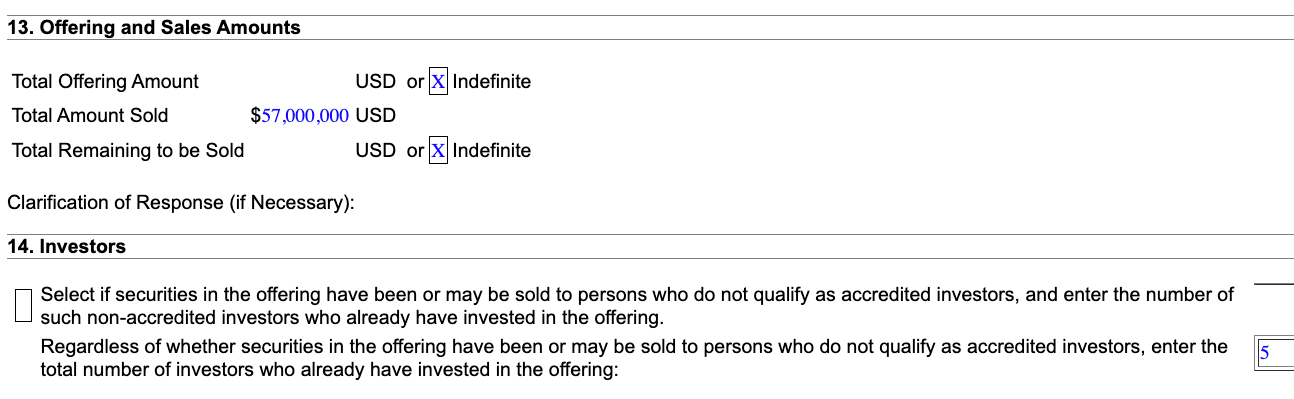

According to an application filed with the US Securities and Exchange Commission (SEC), Coinbase customers have invested $57 million in the lending program since the first sale on August 28. The offering attracted the interest of five investors as of September 1.

SEC vs. Coinbase Case Updates

Coinbase’s new crypto lending product follows the suspension of new lending on Coinbase Borrow in May 2023. The program was designed to allow users to borrow up to $1 million through Bitcoin collateral. The new institutional program is operated through Coinbase Credit, the same organization that manages Coinbase Borrow.

The news comes months after the US SEC accused Coinbase of offering and selling unregistered securities in connection with crypto staking services that allow users to earn returns by staking their crypto assets on the platform. The exchange strongly denied the claims that staking services are securities. Coinbase eventually had to pause the staking program in the states of California, New Jersey, South Carolina, and Wisconsin while the operations continued.

The crypto lending industry was shaken by a major crisis last year, with major companies like BlockFi, Celsius, and Genesis Global going bankrupt due to liquidity shortages caused by the bear market in 2022. Some crypto enthusiasts have said that the crypto lending sector needs to learn from these collapses and address issues related to short-term assets and liabilities.