Coinbase, the largest digital asset exchange in the United States, has been granted permission to offer crypto futures trading to its retail customers. This approval is seen as a major regulatory victory amid a heated battle with the country’s securities regulator. On August 16, the National Futures Association (NFA), designated by the US commodity regulator as a registered futures association, granted Coinbase permission to operate a futures trading platform.

A Loud Signal

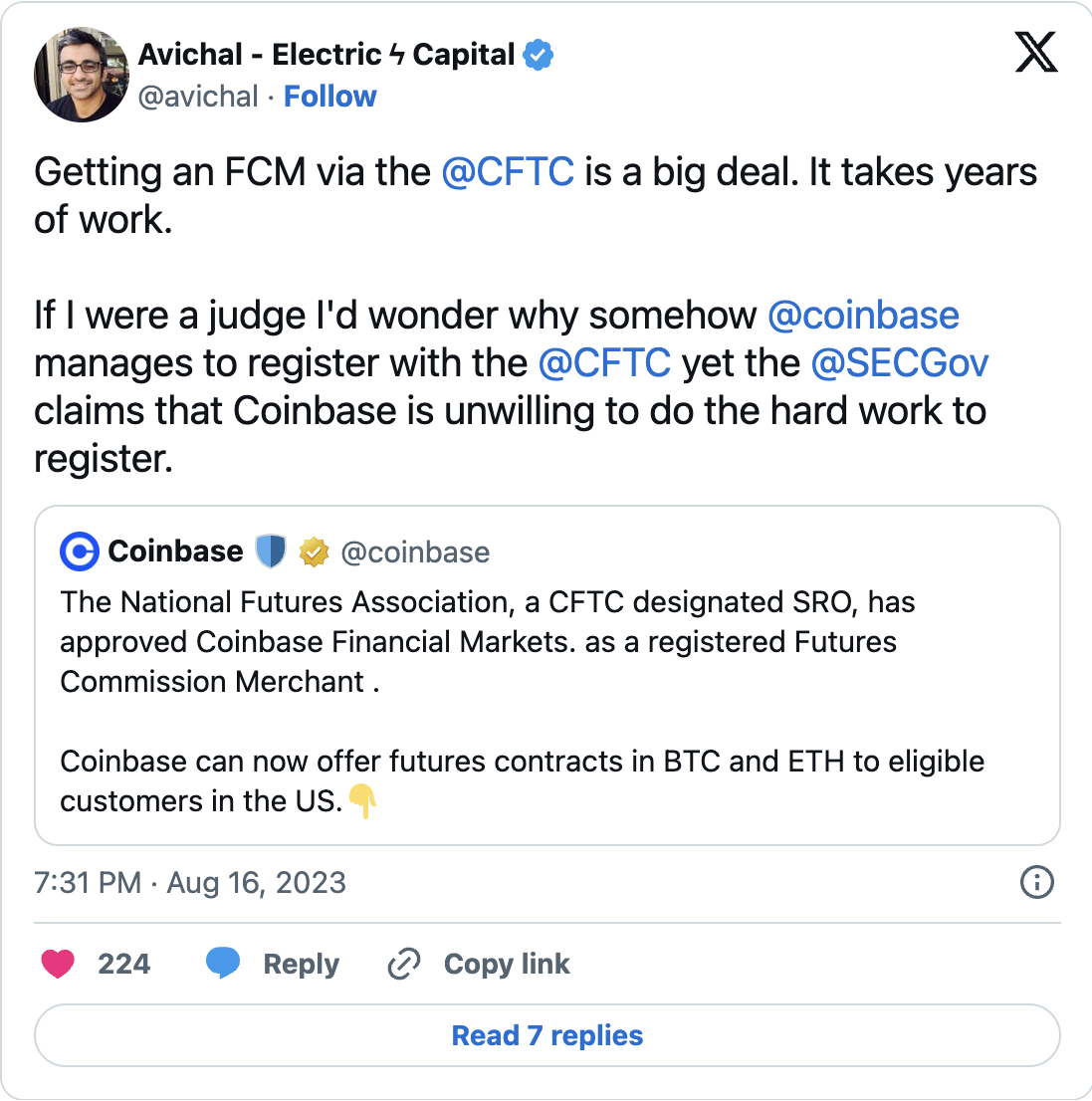

Given that the US Securities and Exchange Commission has accused the exchange of evading registration, some crypto industry commentators see this approval as a significant regulatory victory for Coinbase and the crypto industry as a whole. Avichal Garg, the founder of investment management firm Electric Capital, tweeted on August 17, “If I were a judge, I would wonder how Coinbase managed to register with the CFTC.”

Brian Quintenz, former CFTC Commissioner and current policy head at crypto investment firm a16z, stated, “When a regulator is open to constructive dialogue about new technology, both customers and innovation can benefit.” Meanwhile, Coinbase CEO Brian Armstrong said the approval was a significant moment for crypto assets in the United States. This move also positions Coinbase in a position typically held by traditional financial firms.

Currently, two institutional exchanges, the Chicago Mercantile Exchange and the Chicago Board Options Exchange, offer Bitcoin and Ethereum futures trading in the United States. Coinbase, referring to this move as a “critical milestone,” added that it is the first US-based crypto company to offer not only futures trading products but also direct spot crypto trading traditionally managed by traditional financial firms.

Leveraging a Massive Market

While CoinGecko reported in May that the global crypto derivatives market is valued slightly below $3 trillion, Coinbase highlighted that it represents about three-quarters of all trading volume in the global crypto derivatives market. Dan Dolev, an analyst at Mizuho Securities, wrote in a note dated August 16, as reported by Barron’s, “Since the global crypto derivatives market could be three to four times larger than spot, this approval expands Coinbase’s total addressable market.”

Jeff Sekinger from Orca Capital said Coinbase “will become a crucial access point for traders” and added that their new products “will meet this demand and provide advanced opportunities and flexibility for investors.”

Meltem Demirors, Chief Strategy Officer at CoinShares, said that particularly during US trading hours, “exciting times are ahead in the US crypto markets.”

The company first announced plans to offer BTC and ETH futures contracts in mid-2022. The new approval will allow Coinbase to offer crypto futures trading not only to institutional customers but also directly to eligible US retail customers. However, the exchange did not specify when it will be available for use.

Coinbase shares (COIN) did not react to the news and dropped 1.56% during the day, reaching $77.7 in after-hours trading. However, Coinbase shares have risen by 130% so far this year.

Türkçe

Türkçe Español

Español