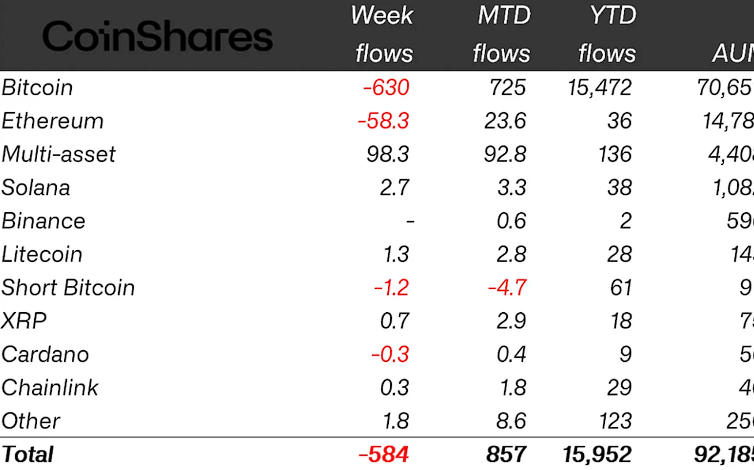

According to data provided by CoinShares, investment products covering Bitcoin saw outflows rise to $630 million last week, with total outflows over the past 14 days reaching approximately $1.1 billion.

Bitcoin Outflows

CoinShares’ “Weekly Digital Asset Fund Flows” report indicated that outflows from all cryptocurrency investment products in the market reached $584 million in the week ending June 21.

The recent FED interest rate decision, which affected the entire world, is believed to have caused significant outflows in ETFs, with ongoing uncertainties regarding interest rate cuts.

CoinShares Head of Research James Butterfill stated:

We believe this is a response to investor pessimism about the Fed’s likelihood of lowering interest rates this year.

The recent outflows in ETFs and price declines are also thought to be caused by the German government’s BTC sale and comments from a Mt. Gox official regarding Bitcoin repayments.

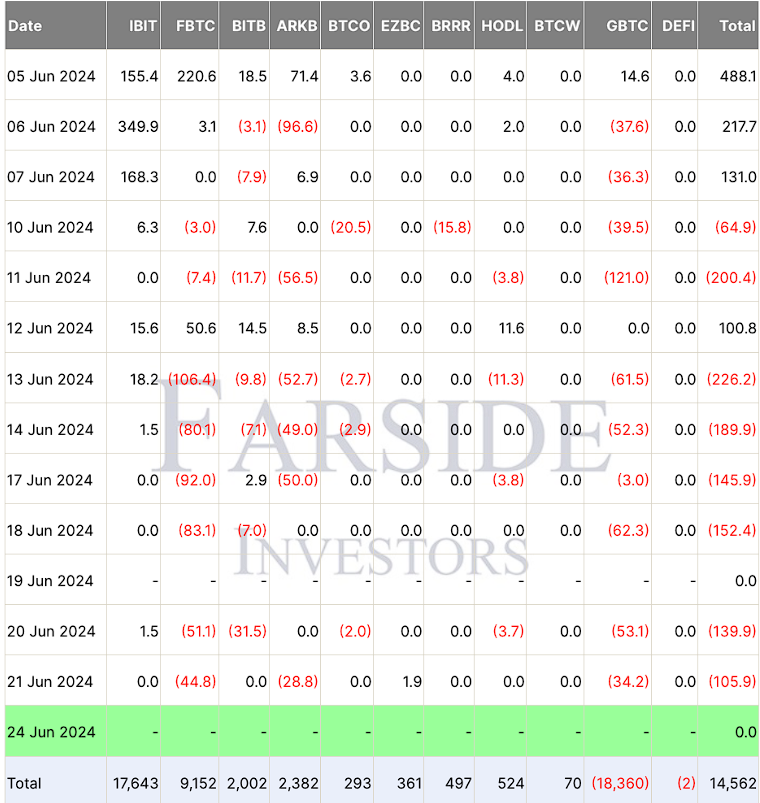

Farside Investors data also holds significant importance in the market. The company’s data shows that institutional companies investing in the market experienced $544.1 million in outflows from spot Bitcoin ETFs between June 17 and June 21.

The largest outflows during this period were from Fidelity’s FBTC. The amount increased significantly over the week, surpassing $271 million.

Bitcoin Price Update

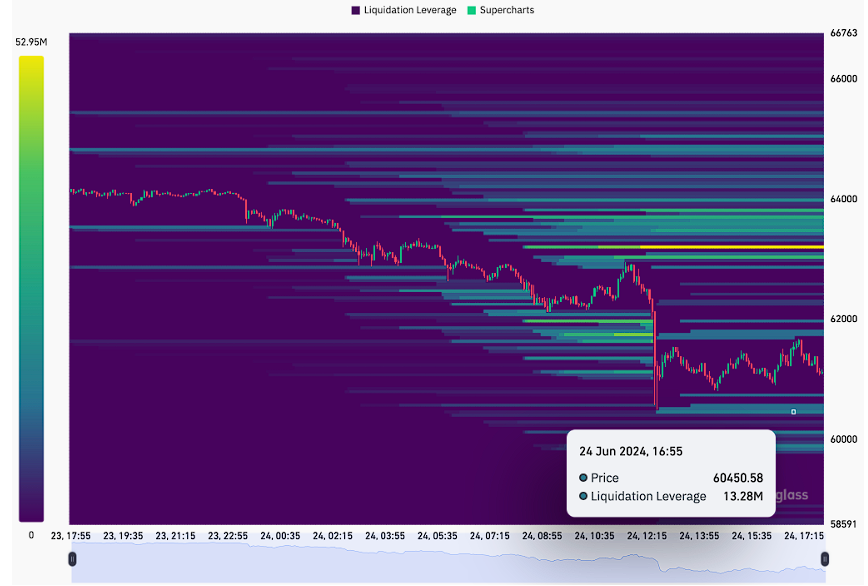

Bitcoin continues its downward trend after falling 6.5% last week. According to the latest data, BTC’s price fell below $60,000 during the day after opening at $63,170 on June 24.

Crypto analyst Jelle made a post on X on June 24, stating:

Bitcoin’s daily RSI value hasn’t been this low in about a year.

Trader Dom’s Crypto made a statement outlining key levels for Bitcoin’s progress:

If it can’t bounce from $61,300 or hold above $60,000, the “200-day SMA could drop to $57,200. After that, it will rise to $60,700, retest at $59,000, and then again to $62,000.

According to Coinglass data, there was $13.28 million in liquidity at the $60,450 level, and a significant liquidation occurred when the level was breached. Investigations revealed that over $155.22 million in BTC long positions were liquidated in the past 24 hours.

Türkçe

Türkçe Español

Español