These days, the cryptocurrency markets are not as noisy as they were in 2021, and that’s the rule of bear markets. Many investors who witnessed altcoins gaining thousands of times in value were spending their days with regrets. We can easily understand why the minority of those who made profits during the bull season is due to the ongoing silence of the bear markets.

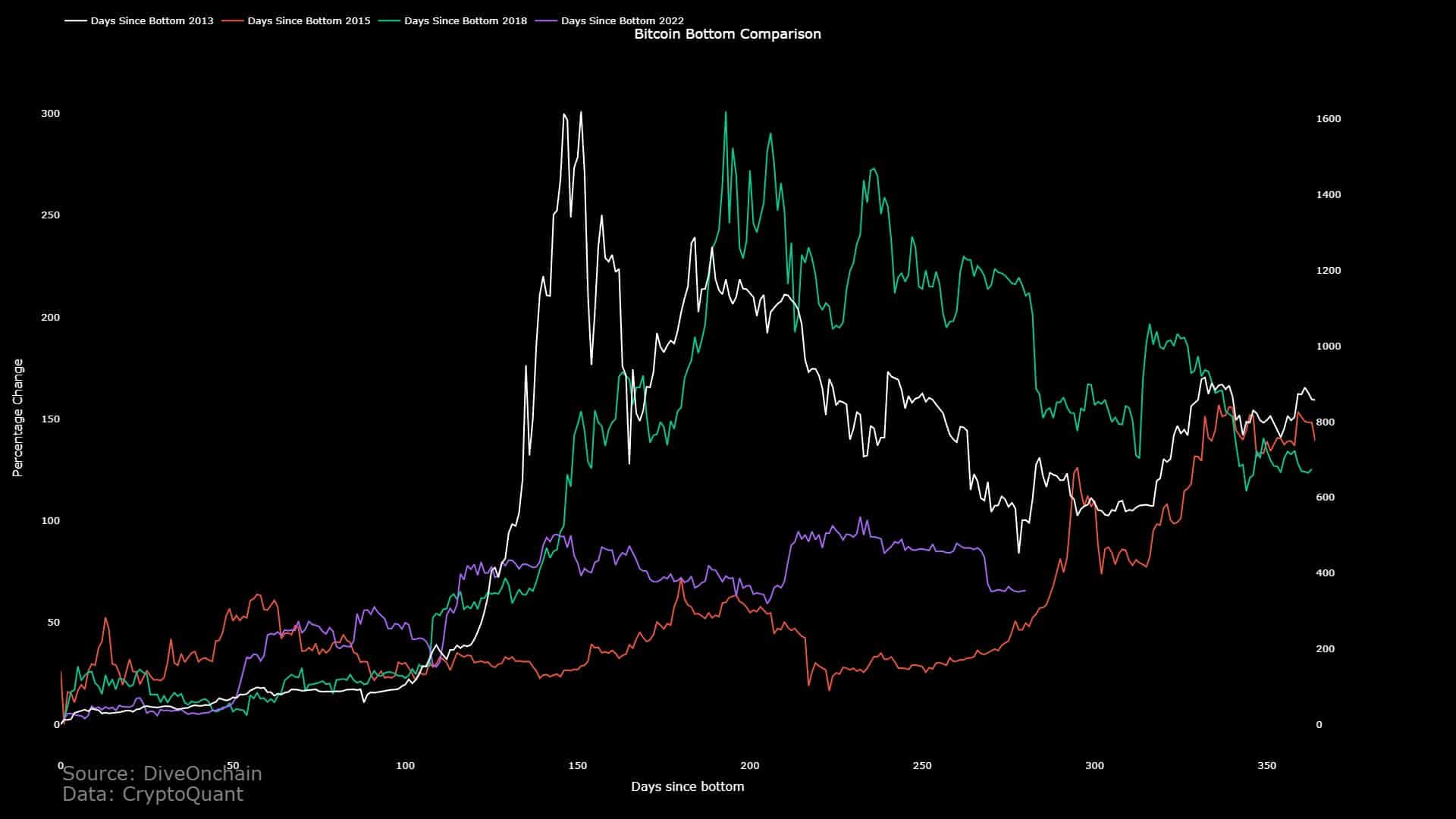

2016 and 2020 Bitcoin Price

August may be coming to an end, but volatility is beginning to rise again. As of the second half of the month, cryptocurrency investors saw a weakening in the sideways movement. Maximalists believe that this optimism will keep the demand for Bitcoin alive and increase it. Moreover, it is not difficult to understand this excitement with 8 months left until the halving.

This event, which takes place every four years, reduces the block rewards of miners by half and reduces the number of new circulating BTC by 50%. Furthermore, ongoing trends showed some similarities with previous halving periods. According to CryptoQuant analyst JA Maartun, the price movement at the time of the release of BTC was very similar to its trajectory in 2016 and 2020.

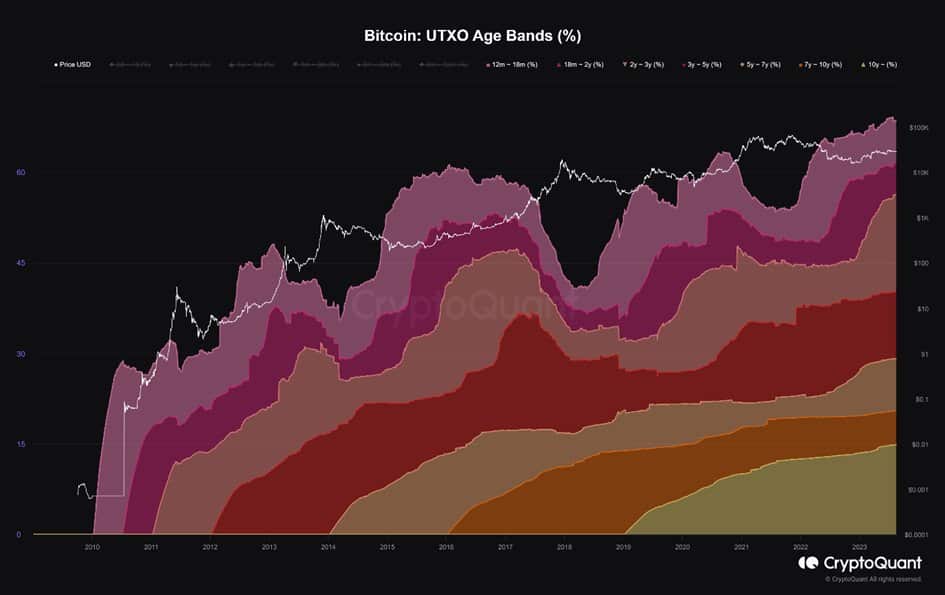

In addition to price movement, the accumulation activities of long-term investors (LTH) were also reminiscent of history repeating itself. Approximately 75% of the supply was held by these diamond hands, similar to the 2016 and 2020 cycles.

The Future of Cryptocurrencies

The performance of Bitcoin price directly affects the value of the rest of the crypto market. If BTC remains strong, altcoin prices rise, and in the opposite scenario, altcoins lose more value than BTC. In this regard, the similarities in 2016 and 2020 advise us to be hopeful for 2024.

Since their total earnings from each block will decrease from 6.25 to 3.125, miners continue to work at full speed these days. Moreover, as the halving approaches and miners increase their accumulation tendency, it is likely that the price will rise with new demand.

After noting the above patterns, a fascinating new finding emerged. Since the last halving in May 2020, Bitcoin’s supply on exchanges has caused a reversal in the trend. Therefore, it will be interesting to see how this trend shapes us after the next halving.