Scaling solutions for Ethereum are becoming more popular over time, with popular networks also getting involved. The intentions of projects like CELO and others to transform Ethereum into L2 help keep popular projects in the spotlight. So, when compared, which one is better: Polygon or Optimism?

OP and MATIC Coin

The L2 solutions space is fiercely competitive with Arbitrum (ARB), Polygon (MATIC), and Optimism (OP) vying for market share. MATIC seems more exciting in terms of price performance here. Unlike the others, its token price history and partnerships have helped it stand out even more.

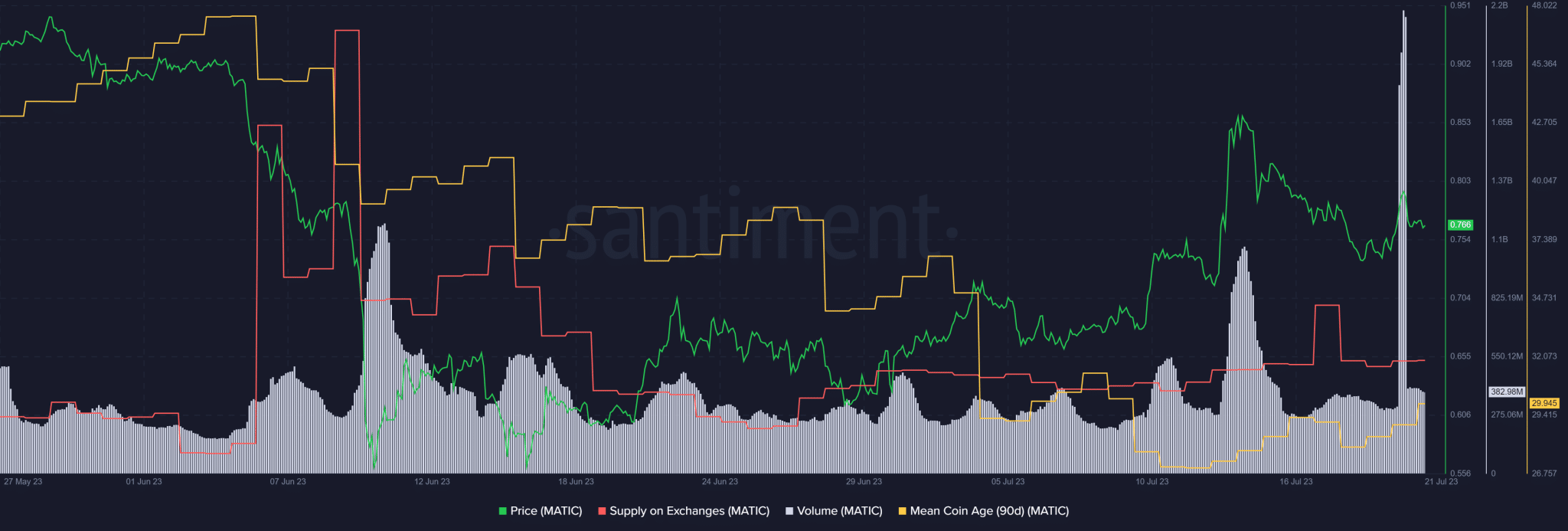

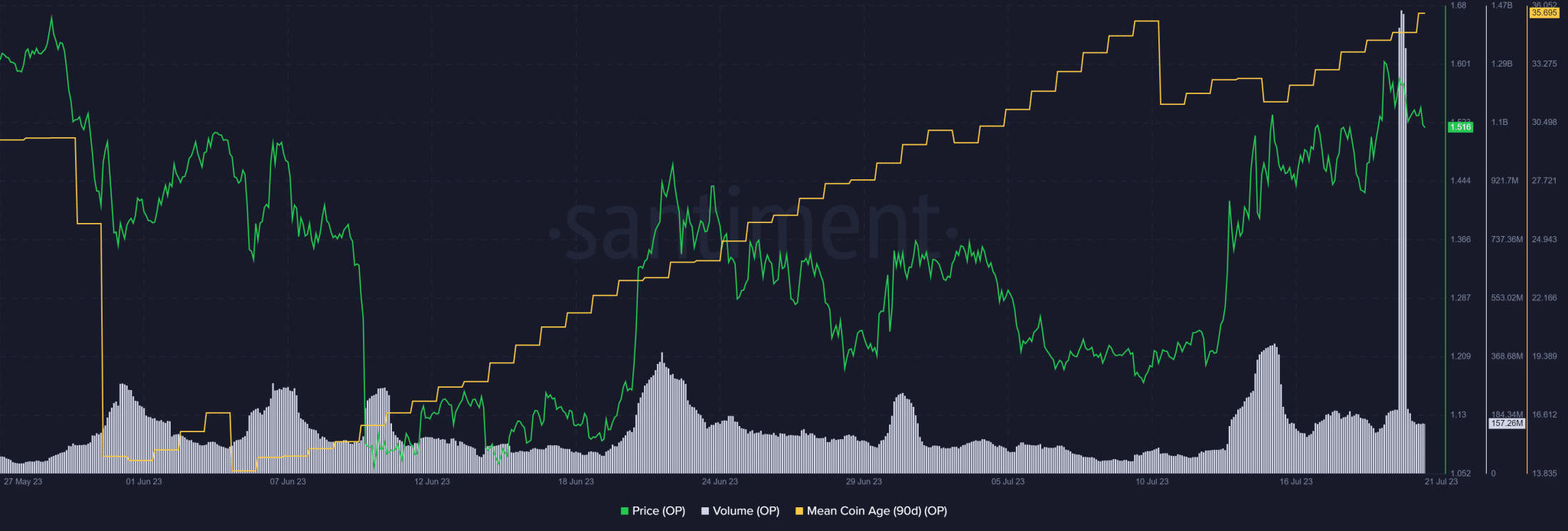

From a perspective point of view, the downward pressure in the second quarter led both altcoins to breach important psychological levels. While MATIC dropped below one dollar, OP lost the $2 level. However, each token responded differently to the recovery at the beginning of the third quarter. In early June, the US SEC filed lawsuits against Binance and Coinbase for violating federal securities laws and listing several tokens as “securities”.

MATIC and OP experienced significant declines during the same period. In particular, MATIC, which was classified as a security by the US SEC, dropped below $0.9. During the same period, OP dropped from $1.5 to $0.9 and stabilized around $1. This decline led to a value loss of approximately 41%.

Therefore, MATIC experienced more value loss than OP during the downward pressure and regulatory scrutiny at the end of the second quarter. However, BTC performed better than both altcoins during the same period.

Polygon and Optimism

The rise of BTC reversed all the losses at the beginning of June, resulting in OP token gaining over 40%. However, MATIC only gained about 20% in value and continues to feel the pressure from the SEC. So, what do on-chain data say? Based on Santiment’s 90-day Average Coin Age metric, we can conclude that OP has more potential for growth than MATIC at the time of writing.

Although there has been fluctuation in volume for both tokens, OP has seen more buying pressure, while MATIC has continued to face selling pressure. Regulatory uncertainty surrounding MATIC may provide more advantages for OP in price charts.

Based on the above indicators, considering the accumulation witnessed since the beginning of June and the regulatory uncertainty surrounding MATIC, we can say that OP Token may bring better returns in the coming months compared to Polygon.

Of course, this scenario is valid in an environment where there is no significant movement with Polygon 2.0. MATIC Coin still does not seem to have fully priced in this development.

Türkçe

Türkçe Español

Español