Investors were quite hopeful for the year 2023, and the market did not disappoint them. Altcoins achieved massive gains. However, there were significant ups and downs in the six-month period. More importantly, we witnessed many critical events in the first two quarters of the new year. If you’re ready, let’s take a look at CoinMarketCap’s report on the remaining part of the year.

General Evaluation

By the end of the second quarter, the cumulative market value reached $1.17 trillion, showing a 48% growth compared to the same period last year. Interestingly, the first and second quarters of 2023 ended with almost the same market value. This turned the months of April, May, and June into a losing period.

In the first three months of the year, we witnessed groundbreaking developments that excited the markets. We saw Arbitrum, ZK-oriented layer 2 networks, Blur’s token issuance, and many other events. The second quarter stood out with a short-lived meme coin season. PEPE and others, which rose and fell within a couple of weeks, are now facing low volatility and losing interest.

BRC-20 standard was one of the exciting events of the last quarter, but it lost its enthusiasm within a few weeks, just like PEPE. The CMC Fear and Greed Index started the year at 30 points and closed the second quarter at 50. This highlights the improvement in investor sentiment.

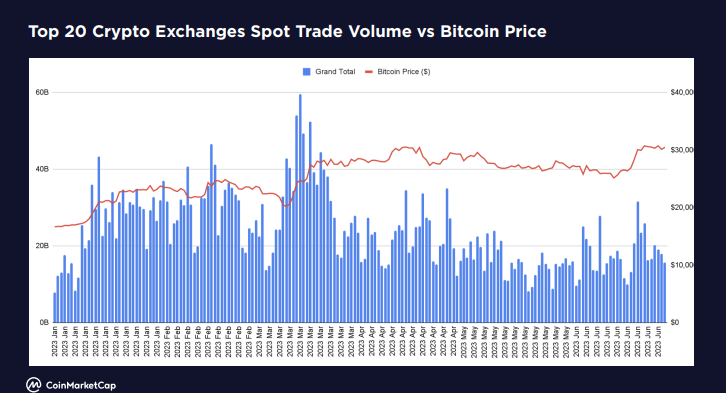

The spot trading volume of the top 20 cryptocurrency exchanges reached its peak in March. Since then, we have seen a 36% decline in volume on a cumulative scale. The volume became almost stagnant at $523 billion by the end of last month.

Top 10 Popular Crypto Sectors

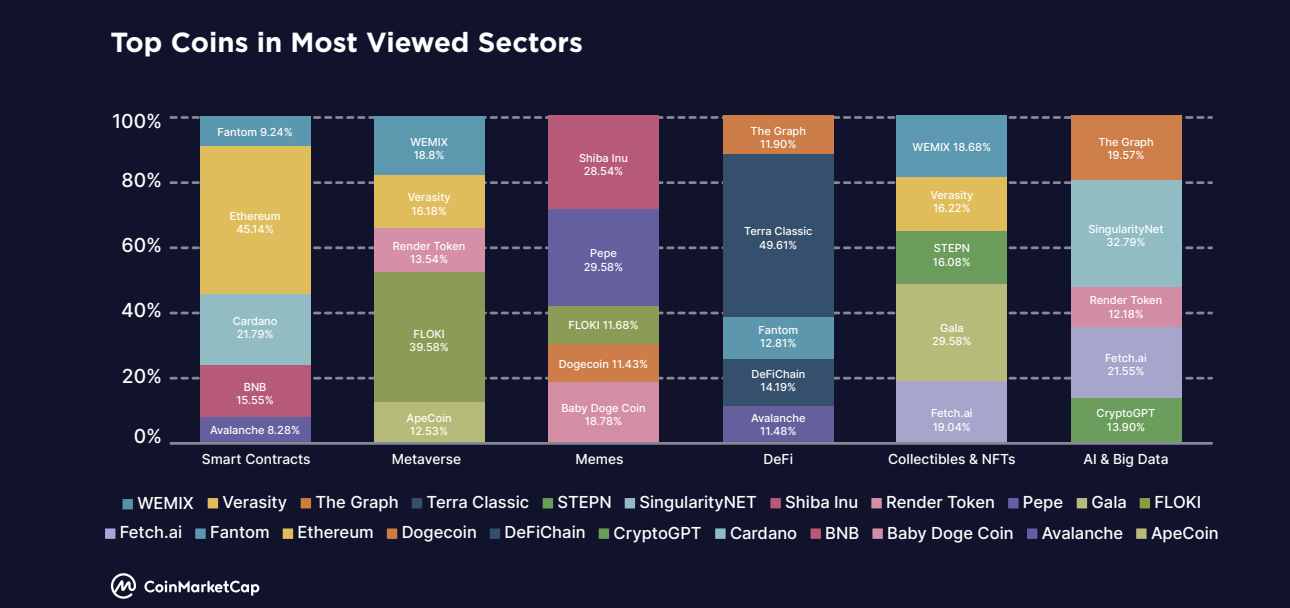

When examining the data for the first two quarters, it is impossible to overlook altcoin categories. Amidst the challenging market, some sectors significantly outperformed others and showed much more substantial growth. VR/AR and AI/Big Data tokens were at the top of the list. Virtual reality-focused tokens grew by 704% from the beginning of the year until the end of the second quarter. The category of artificial intelligence altcoins gained 323% in value. This was, of course, fueled by last year’s fourth quarter launch of ChatGPT.

In the table above, you can see the growth of all categories throughout 2023. The third notable area was meme coins, with 260 new tokens listed this year.

Events Influencing Bitcoin Price

We experienced a lot in the first 6 months. Especially in June, there was a significant amount of fear and panic, rivaling that of March. Those who sold their cryptocurrencies, fearing the collapse of the US and the stock market, quickly forgot everything in a short time. Then, during the week that was expected to be the calmest of the year, we saw the SEC filing lawsuits against 2 major exchanges.

The following were the events that influenced and stood out in terms of price:

- Bitcoin Ordinals

- Silicon Valley Bank bankruptcy

- Balaji predicted that BTC would reach $1 million within 90 days.

- MicroStrategy terminated its credit agreement with Silvergate. This was significant because there was a spread of FUD in the market, with claims that Saylor would liquidate at a certain price, targeting $12,000. With the closure of this credit, Saylor’s price concerns, and more importantly, the FUD excuse in the market disappeared.

- The US inflation data exceeded expectations.

- Excitement around BRC-20 coins erupted.

- Tether announced its BTC purchase.

- Hong Kong crypto regulations came into effect on June 1st.

- SEC filed lawsuits against 2 major exchanges. Many altcoins received securities stamps.

- BlackRock applied for a Spot Bitcoin ETF, and others followed suit.

- EDX Markets officially launched as a joint product of trillion-dollar giants.

Among all these events, the bankruptcy of SVB and the BlackRock application had the most significant impact on the price. The former pushed the price to a local bottom, while the latter renewed the annual high.

Most Popular Sectors and Cryptocurrencies

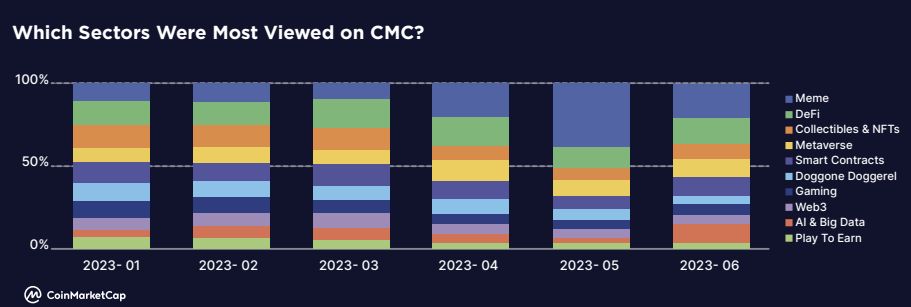

The table below clearly shows which categories were more popular in the first 6 months of the year. If you pay attention to the changes from month to month, you can understand how the mentioned events influenced investor sentiment. The table was prepared based on CMC viewing data.

What if such a table were prepared specifically for altcoins? It exists too. You can examine which altcoin received more attention month by month in the table below.

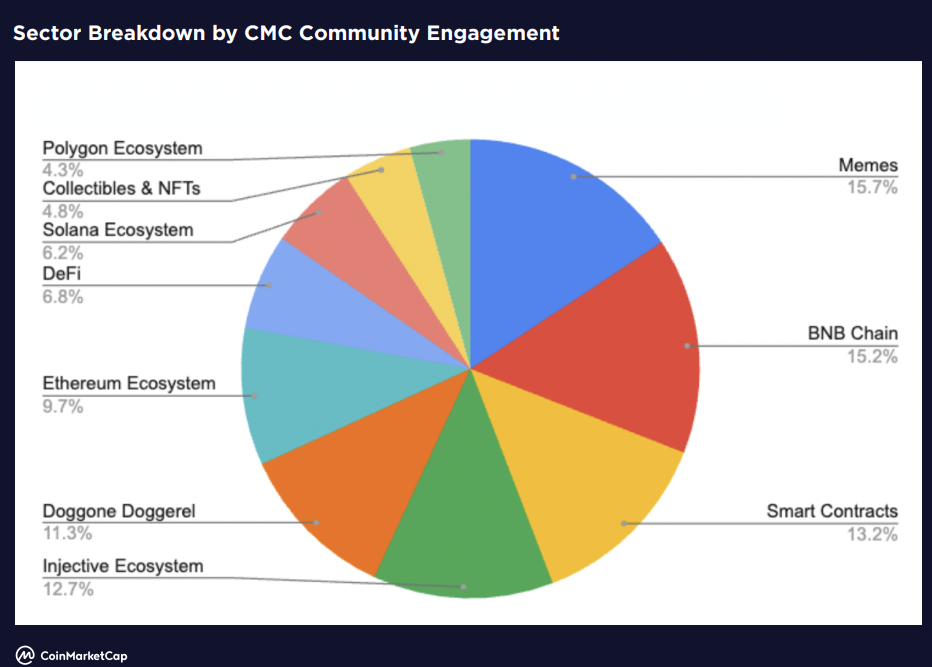

The CMC Community section was recently activated and has received significant interest from investors. The participation density there also tells us where the current demand is. The table below reveals the size and interest of categories and communities.

Global Cryptocurrency Investors

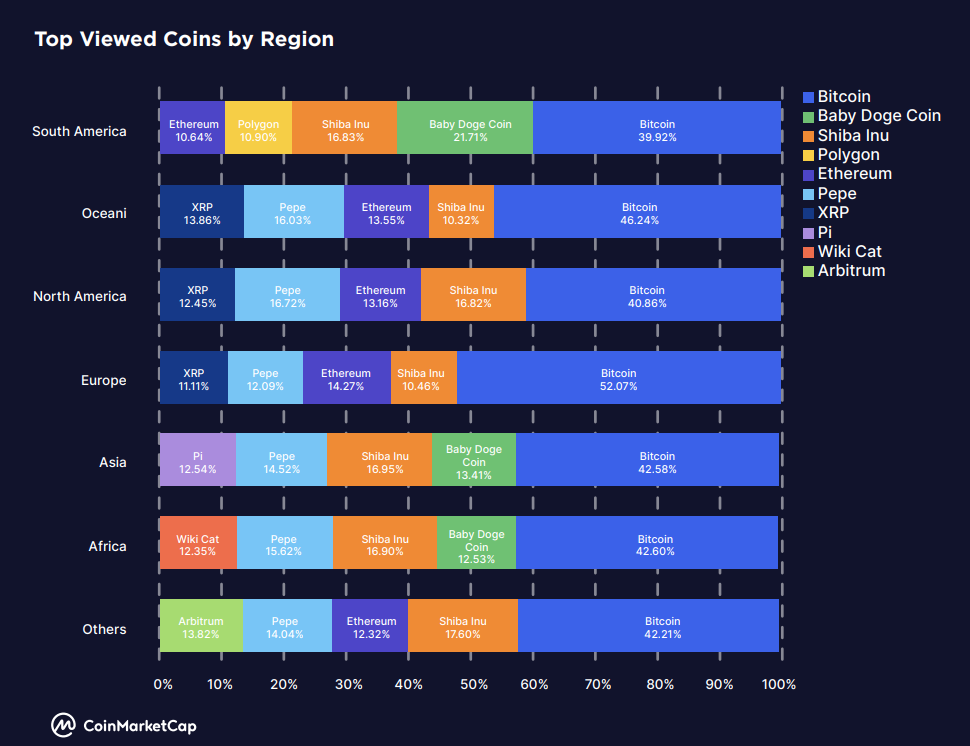

Bitcoin (BTC) continued to be the most viewed cryptocurrency in all regions. This is quite normal during bear markets. Periods where altcoins take the lead are usually bull seasons. Moreover, optimism about the upcoming halving and the approval of a spot Bitcoin ETF increases global demand and interest in Bitcoin.

Shiba Inu (SHIB) and Baby Doge Coin (BabyDoge) continue to be popular meme coins in all regions.

PEPE Coin gained significant popularity in many regions. Ethereum (ETH) maintained its position among the popular cryptocurrencies in most regions, except for Asia and Africa. Ethereum scaling solutions like Polygon (MATIC) and Arbitrum (ARB) received more attention in South America.

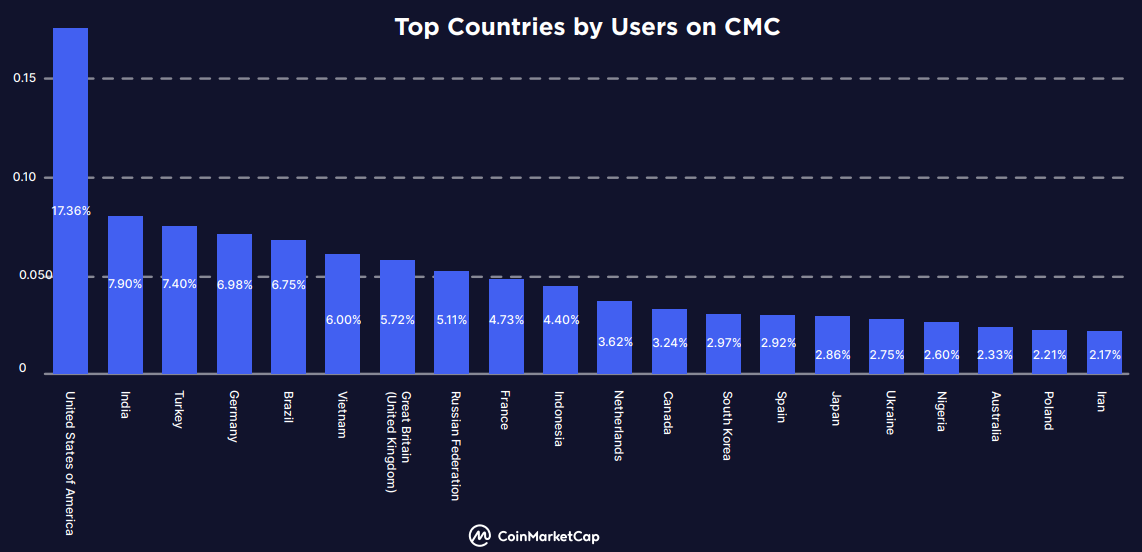

Turkey Ranks Third

When we look at country-specific interest, Turkey ranks third. The US ranks first, and India ranks second. The complete ranking is as follows. Especially due to the ongoing inflation and exchange rate increases in the third quarter, the demand for cryptocurrencies in our country is expected to continue to rise.

Türkçe

Türkçe Español

Español