The cryptocurrency market continues to decline. In the last 24 hours, positions worth $250 million were liquidated, with $70 million of these being Bitcoin long positions that evaporated. Traders point to macro and technical reasons, suggesting a weak trend could emerge, as the BTC price fell below the $40,000 support level.

Peter Brandt and His Bitcoin Commentary

On the other hand, after a price rally in December, triggered by large purchases from individual and institutional investors, analysts see a correction in Bitcoin’s price as likely. The recent filling of the CME Bitcoin gap at $39,700 and Bitcoin’s drop to a 24-hour low of $38,723 has been noted.

In response to investor Cheds’ Bitcoin price prediction, Peter Brandt suggests that investors who have exited might re-enter long positions below $40,000, indicating that the decline was paved by weak long positions.

Contrary to the weak buying by bulls below $40,000 during the recent downward trend, Peter Brandt made the following statement:

I would like to see what happens when the parabola is retested (if).

As the main support levels break and the CME Bitcoin gap is filled in this manner, it could be likely for investors to make purchases from the bottom with long-term goals.

Furthermore, according to Peter Brandt, if the parabolic price trend continues, it is highly probable that it will be retested at the end of February or the beginning of March.

Analysts’ Views on the Future of Bitcoin

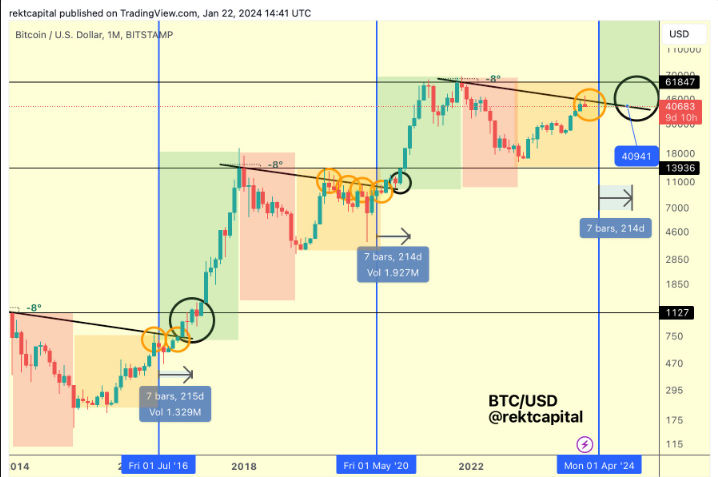

According to research by the frequently mentioned analyst Ali Martinez, whales have sold more than 70,000 BTC worth over $3 billion in the last two weeks. Analyst Rekt Capital has shown on historical chart patterns that corrections before Bitcoin’s halving process have occurred in the past as well.

Commenting on a 4-hour chart, the analyst pointed out price levels seen during periods marked by Bitcoin’s halvings and identified a potential level before the next halving.

In the last 24 hours, the BTC price has experienced a drop of over 4%, with the price finding buyers at $38,900 at the time of writing. The lowest and highest levels in 24 hours were $38,713 and $41,242, respectively. Additionally, the trading volume has increased by 78% in the last 24 hours, indicating sharp movements.

Türkçe

Türkçe Español

Español