The latest report, which demonstrates the institutional demand for the cryptocurrency markets and is published every week, has been shared. The report includes important details. There are positive signs both for a popular altcoin competitor and for cryptocurrencies in general. So, how is the interest of institutional investors in crypto? Here are the details.

Corporate Investors and Cryptocurrencies

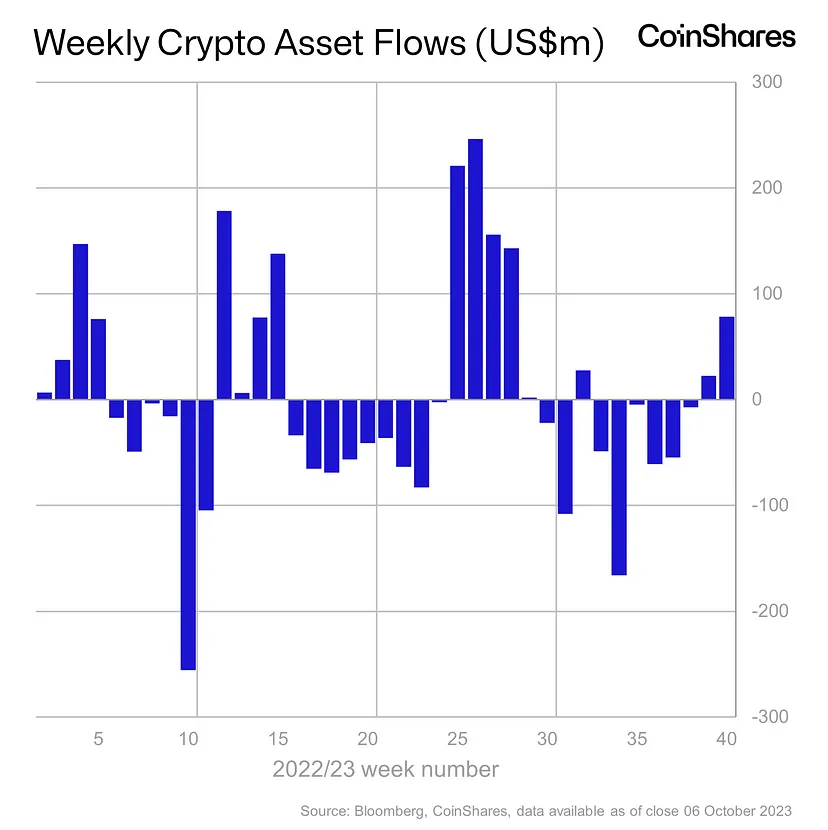

Since July, there has been the largest influx into cryptocurrency investment funds. Last week marked the second consecutive positive entry to crypto investment products. Investors, who have been experiencing net outflows for a long time, seem satisfied despite the BTC price drop. The $78 million net inflow now indicates that institutions are starting to return to the game.

The trading volume of ETPs also increased by 37% to $1.13 billion. There was also a double-digit increase in BTC trading volume on popular exchanges.

While 90% of the inflows came from Europe, only $9 million of inflows were seen in the US and Canada. Last week, $43 million of the inflows went to Bitcoin. During the same period, there was a $1.2 million inflow to the short BTC product, indicating that those anticipating a decline are not giving up.

The Future of Solana (SOL)

Last week, the launch of 6 ETH futures ETFs in the US played an important role in measuring the appetite of institutions. ETH, which is the largest altcoin in terms of market value, did not receive the expected interest. Many institutional investment channels, including EDX Markets, take ETH Coin seriously, but the weakness in risk appetite was worrisome.

On the other hand, the ETFs launched last week received slightly less than $10 million in interest, overshadowed by the futures-based Bitcoin ETFs, which saw $1 billion in the first week.

The indifference towards ETH futures ETFs not only shows how weak the risk appetite is but also gives us an idea of what to expect when the approval for spot BTC ETF comes. Under current conditions, even if the BTC ETF is approved, we may see a similar indifference as we are far from the conditions in November 2021.

For the past few weeks, the most notable altcoin has been Solana (SOL). Solana has seen its largest influx with $24 million since March 2022. Last week, this altcoin managed to attract significant attention from institutions.