Popular crypto currency analyst Jamie Coutts has suggested that in the current market cycle, gold will perform much lower compared to cryptocurrencies. The expert discussed historical economic data in his statements, comparing Bitcoin and gold. Moreover, the analyst indicated in his statements that Bitcoin will leave precious metals behind in terms of rise in the coming years.

Bitcoin and Gold Comparison

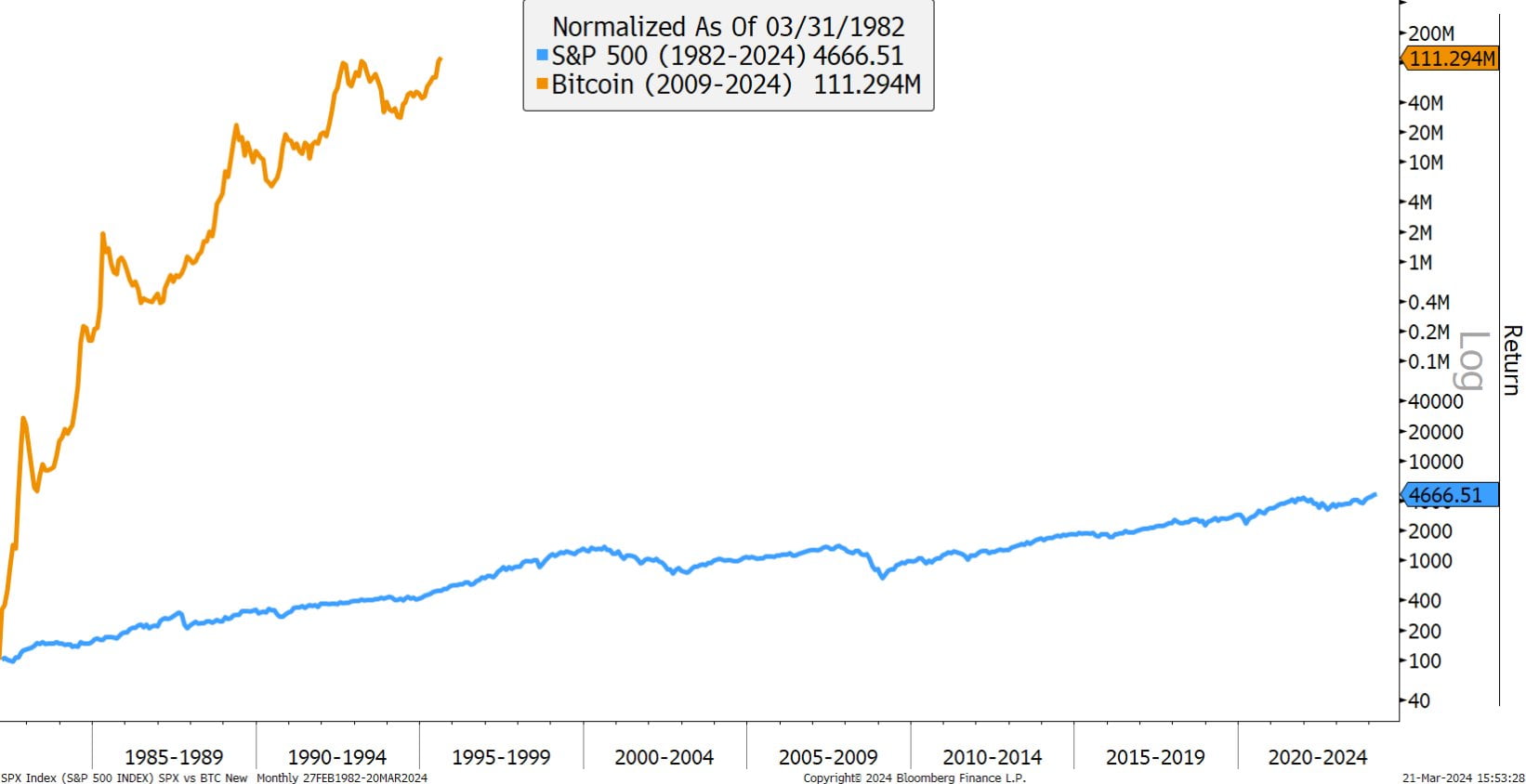

Senior analyst Jamie Coutts, while expecting gold to rise, anticipated that the cryptocurrency would significantly overshadow the precious metal as markets give rise to a new asset class. The analyst stated in his remarks:

Crypto currency exchanges list products (ETP) with Assets Under Management (AUM) of about 100 billion dollars (80% Bitcoin). For gold ETPs, AUM is approximately 190 billion dollars. I believe in gold’s rise, but it won’t match the expected 2-3 fold increase of crypto currency in this cycle. This is the birth of a new asset class.

Historical Analogy for Cryptocurrencies

Jamie Coutts compares the leading cryptocurrency, Bitcoin (BTC), and cryptocurrencies to the stock market boom in the early 1980s. According to the analyst, Generation Y could outperform inflation with crypto units just as they did with stock investments over the last 40 years. The analyst concluded his remarks on the subject as follows:

What 1982 was for the Boomer generation, 2009 is for Generation Y. The great secular bull market in stocks began with Boomers fully entering the workforce. The great secular bull market in Bitcoin (and blockchain assets in general) started when governments and the Boomers they represent decided to punish all subsequent generations for their own sins during a period marked by the GFC (Great Financial Crisis). No one was punished for the GFC, bonuses were honored, and industry’s takeover of regulations (where banks, big food, big pharma, and big tech became too big to fail) worsened. The government decided that the way forward was through debt and devaluation rather than restraint and integrity. Bitcoin is an antidote specifically created for an age of adulteration and debt. A new form of solid money synthesized with technology, finally a fair and transparent financial network. Moreover, as it has throughout history, as it is doing today through inflation, it is an asset that can be entrusted to oneself, away from banks and governments that will seize it when needed.

Türkçe

Türkçe Español

Español