The rise of the cryptocurrency market, led by Bitcoin (BTC), has caused great excitement as many altcoins have seen at least a 2x increase. Following the recent market surge, crypto analyst The Flow Horse has issued a warning for several altcoins, urging investors to be cautious.

Warning of Sharp Decline for Avalanche and THORChain

The Flow Horse, also known as Cantering Clark, an anonymous crypto analyst, warned his followers on his personal X (formerly known as Twitter) account, specifically about two altcoin projects. The analyst stated that Avalanche (AVAX), considered as a competitor to Ethereum (ETH), and THORChain (RUNE), a decentralized liquidity protocol among chains, pose a danger.

In his warning about both altcoins, the analyst said, “I have started shorting this morning. So far, I have only opened short positions in AVAX and RUNE. If you ask why I expect a decline in these two strong projects, it is because the rallies have become exaggerated, and I anticipate that everything will fall more than expected. I believe a drop of at least 30% can be expected.”

The Flow Horse also mentioned that the altcoin king, Ethereum, could briefly drop below $1,900, but with significant demand, it could rise again within this price range. He stated:

“ETH is undoubtedly a better hedge instrument than BTC. My gut tells me there will be more comprehensive liquidations and trend tests before the restart. The argument of tracking Ethereum’s strength has historically been useful, so it will be beneficial to look for it during any BTC consolidation. I want to buy any bounce below $1,900, but it seems like everyone wants to do the same.”

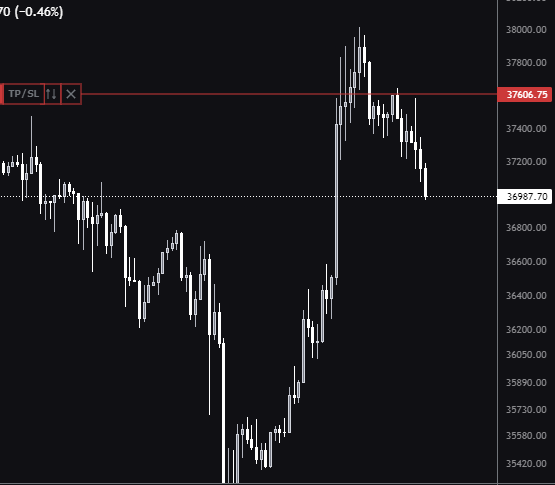

Attention to the 37,000 Dollar Resistance in Bitcoin

Furthermore, the analyst pointed out that the largest cryptocurrency, Bitcoin, is struggling to surpass a resistance level (around $37,000) and is likely to move downward as a result. He stated:

Looking at the amount of unfilled orders, it seems that there is at least resistance on the downside for BTC. My opinion is that this recent rally is due to a void left by liquidations and that everyone expecting a decline has been passively adding to the market for a long time. I will continue to hold this short position I mentioned last night.

However, the analyst emphasized that as long as the price of the crypto king remains above the $30,000 level, the long-term uptrend in BTC will continue. He said, “Nearly 2,000 points have been profitable enough for me. I will not switch to the side that generally expects a decline when it is above $30,000.”

Türkçe

Türkçe Español

Español