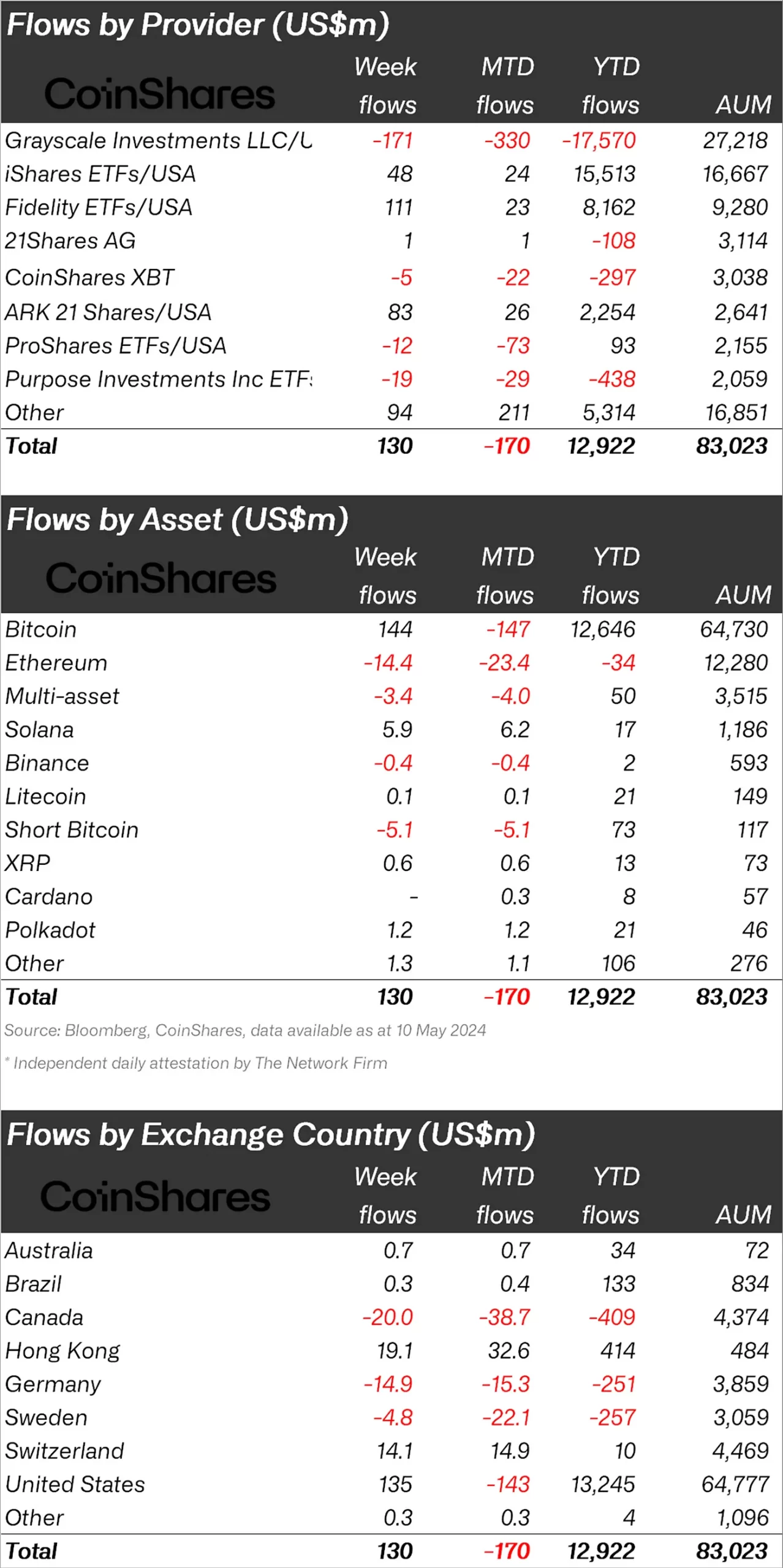

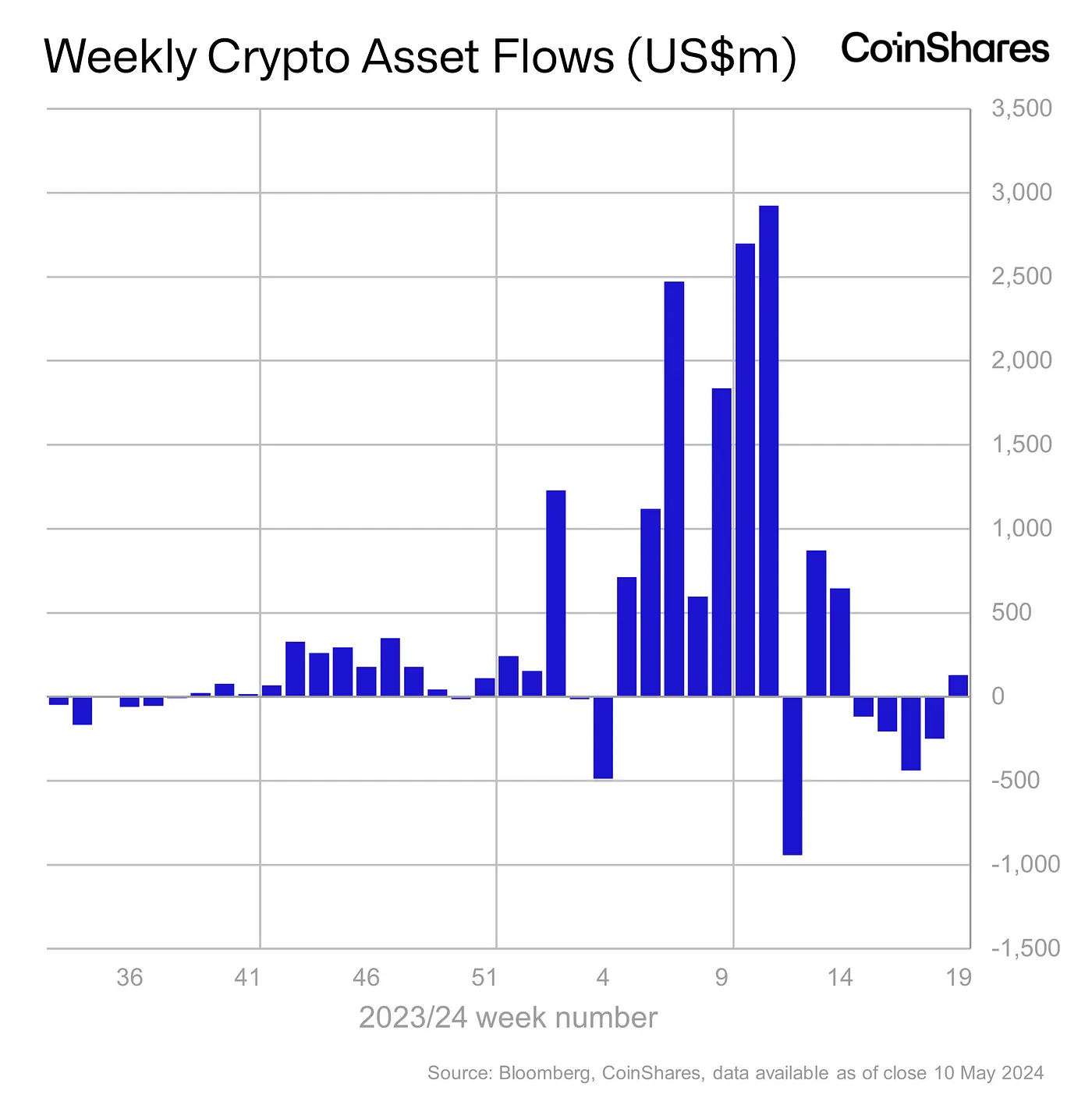

Crypto asset investment products have seen inflows totaling $130 million over five weeks for the first time. Regionally, the majority of these inflows, amounting to $135 million, were seen in the USA, and Grayscale experienced its lowest weekly outflows since January. The low interaction of US regulators with the issuers’ applications for a spot Ethereum ETF has increased speculation that an ETF approval is not imminent; this was reflected in total outflows reaching $14 million last week.

What’s Happening in the Crypto Space?

Crypto asset investment products have seen inflows for the first time in five weeks, totaling $130 million, while ETP volumes continue to decline; while the average inflow in April was $17 billion, it dropped to $8 billion weekly. These volumes highlight that ETP investors are currently participating less in the crypto ecosystem, representing 22% of the total volume on global trusted exchanges compared to 31% last month.

Regionally, the majority of the inflows in the USA totaled $135 million, while Grayscale saw its lowest weekly outflows since January, totaling $171 million. Switzerland saw inflows of $14 million. Following record inflows last week, Hong Kong saw only $19 million in inflows this week; this shows that the majority of the inflows in the first week following Bitcoin ETF launches were core capital. Canada and Germany continued to see outflows of $20 million and $15 million respectively; total outflows since the beginning of the year have now reached $660 million.