The crypto market continues to experience volatile hours. Accordingly, the share prices of the Bitcoin-focused public companies MicroStrategy and the cryptocurrency exchange Coinbase showed an increase during the pre-market trading session following the rise of Bitcoin’s price above the $45,000 level and the potential end of the Bitcoin ETF decision process on January 10th.

Crypto Companies’ Stocks on the Rise

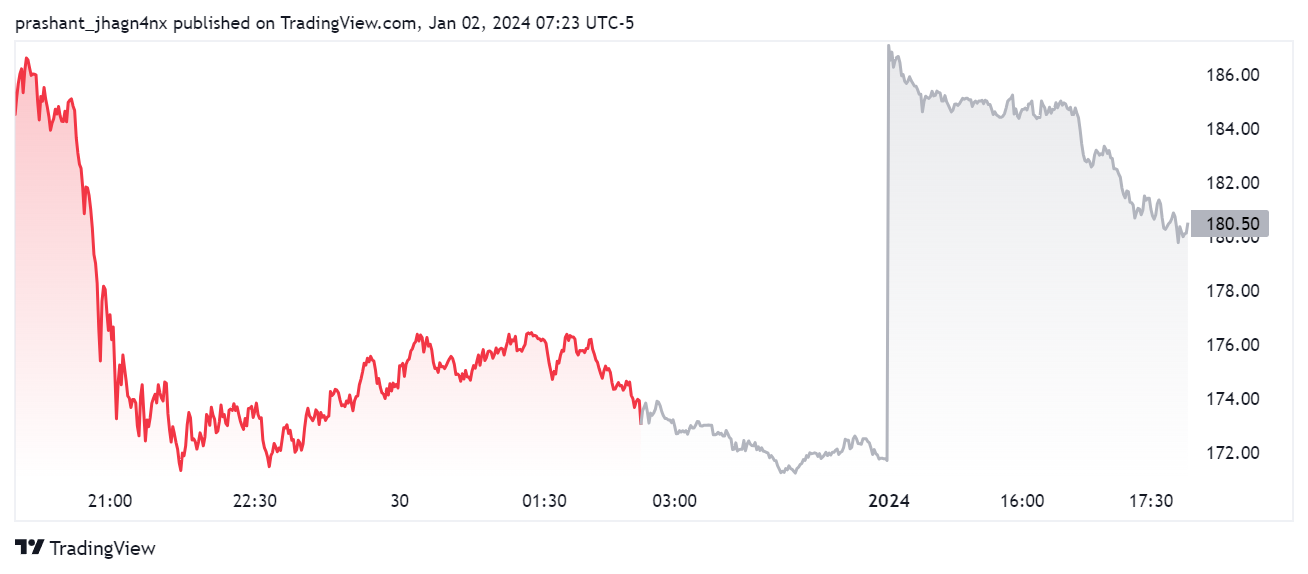

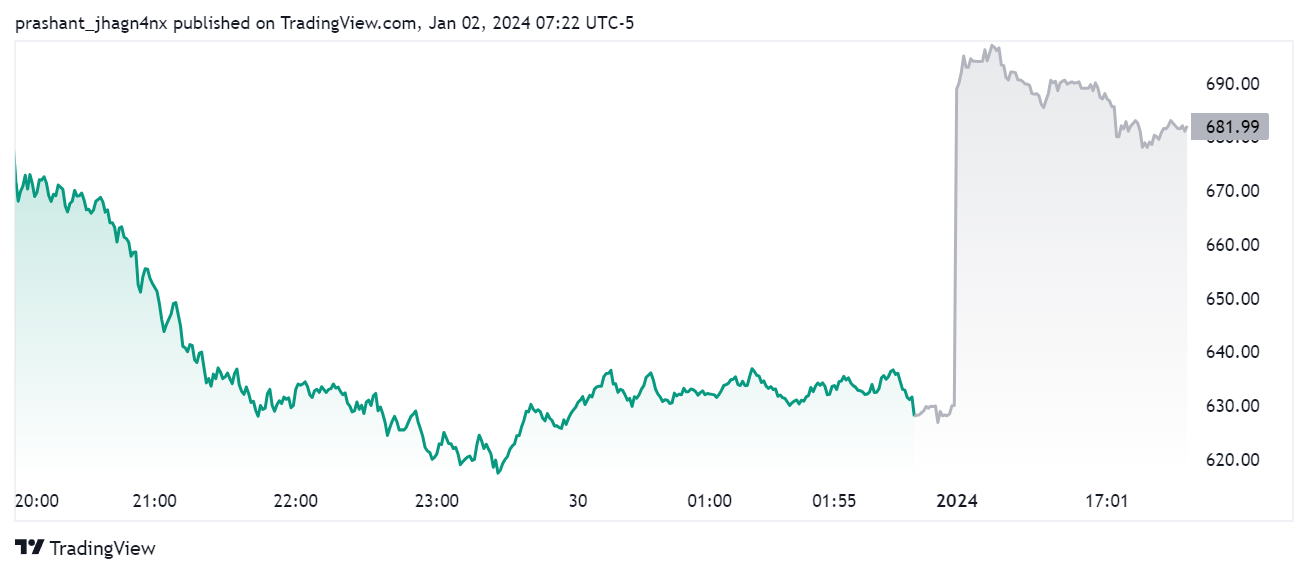

In the pre-market trading session on January 2nd, Coinbase shares rose by 6% while MicroStrategy recorded a 9% increase. Coinbase shares climbed to $184.99 with a 6.4% rise, and MicroStrategy shares achieved a 9.14% increase, reaching $689.11. The pre-market trading session typically occurs in the hours before the market opens at 9:30 AM in New York, allowing investors to buy and sell stocks before the open market.

After a challenging 2022, Coinbase’s share price increased by about 36% last month and approximately 420% over the year. However, the share price of America’s first publicly traded crypto exchange continues to trade about 46% below its all-time high of $343, which was set after its launch in 2021.

Similarly, MicroStrategy shares showed a 25% increase last month and a 372% rise over the past year, currently trading about 8% below its highest level of $750 seen in 2021.

Noteworthy Details in the Market

Other crypto-focused public companies such as PayPal or Block Inc. did not experience a rise in the pre-market trading session despite the upward momentum in the Bitcoin market. However, this situation can certainly change at market openings in the United States.

The recent changes in the share prices of crypto-focused companies form a contrasting view to the end-of-year trajectory of most crypto-focused companies, with many seeing their share prices fall amid broader market corrections. The recent price increase of the two major Bitcoin-focused companies is linked to the potential approval of a spot Bitcoin ETF.

MicroStrategy continues to be the largest institutional investor in Bitcoin, while Coinbase has been selected as a custodian by several institutional giants applying to launch spot Bitcoin ETF services.

Türkçe

Türkçe Español

Español