The king of cryptocurrencies once again surpassed the $26,800 support today, but the daily close was just below the zone. On October 12, the closing was at $26,759. These levels are crucial for Bitcoin and if today’s closing is below the critical support, losses may increase. So what will happen if history repeats itself?

Cryptocurrency Cycle

Historical patterns have always been exciting for cryptocurrency investors. Moreover, since they often provide accurate results, a few investors have managed to multiply their capital by taking the right positions. Although medium-term risks can be psychologically exhausting, identifying the right alternatives and persistently protecting investments pays off in the long run.

Bitcoin and the crypto market have been priced within recurring patterns so far. Bull seasons followed the halving event, and that has been the case until now. But what about before halving? In the pre-halving periods representing the current phase, the market tended to find a bottom. Most experts’ negative approach until April of next year is also based on this.

With approximately 6 months left until the halving, analysts are warning investors by recalling previous cycles.

Cryptocurrency Analyst Predictions

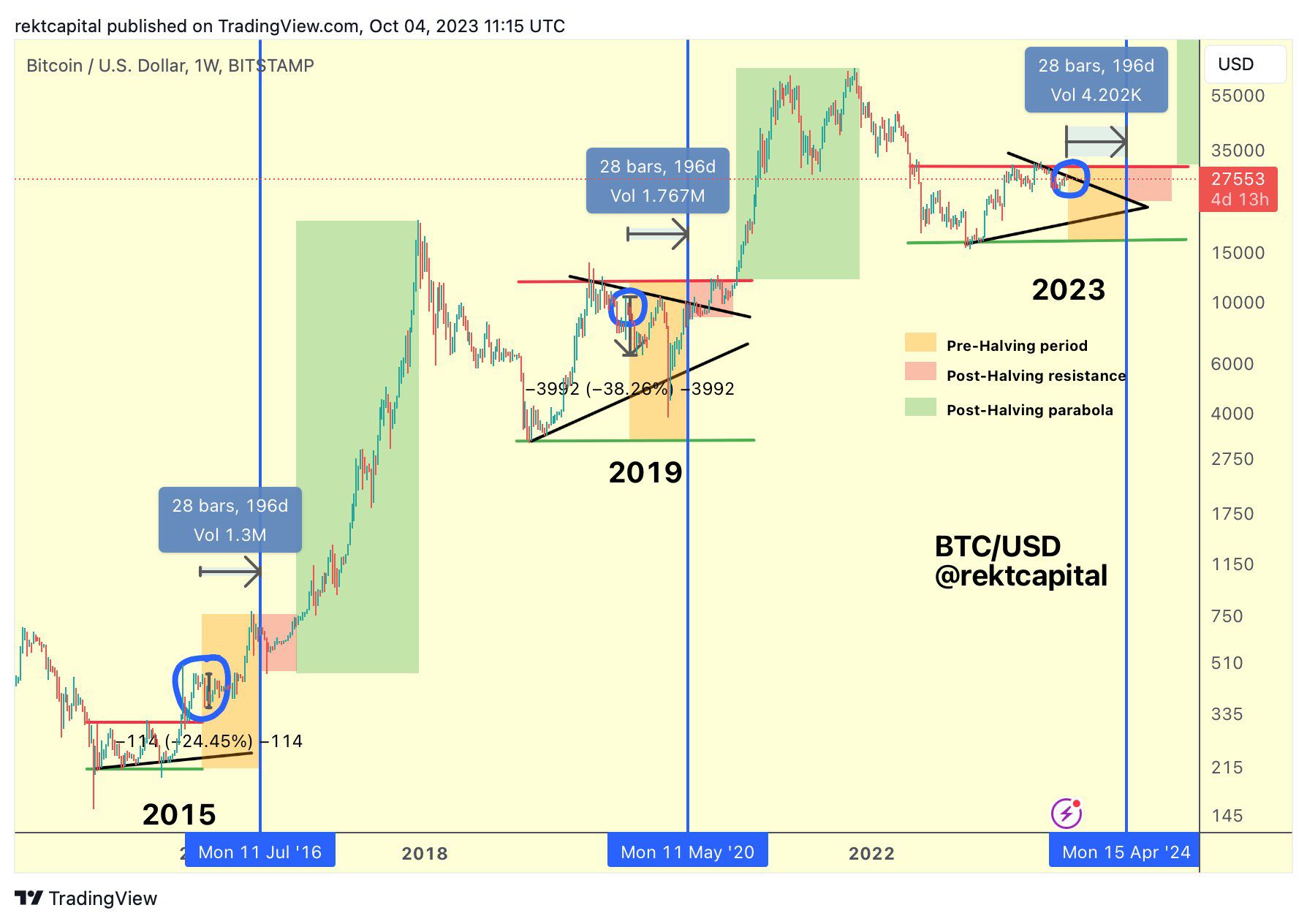

Today, popular crypto analyst Rekt Capital shared a gloomy comment that reminds us of what happened at the same point in previous cycles. With less than 190 days until the Bitcoin block reward halving, it can give us an indication of where prices will go for the rest of this year.

Let’s take the example of the year 2015. 6 months before halving, which is where we are today, the BTC price had declined by 25%. In 2019, during the same period, the price dropped by 35%.

If history repeats itself in cryptocurrencies, we may see the BTC price drop to $20,000 in the near future. But can a prediction of $20,000 be overly pessimistic when BTC made a bottom lower than it should have been due to the extreme stress environment last year? It can be, because BTC witnessed many industry giants collapsing on investors for the first time while going through the Fed tightening (with such rapid interest rate hikes).

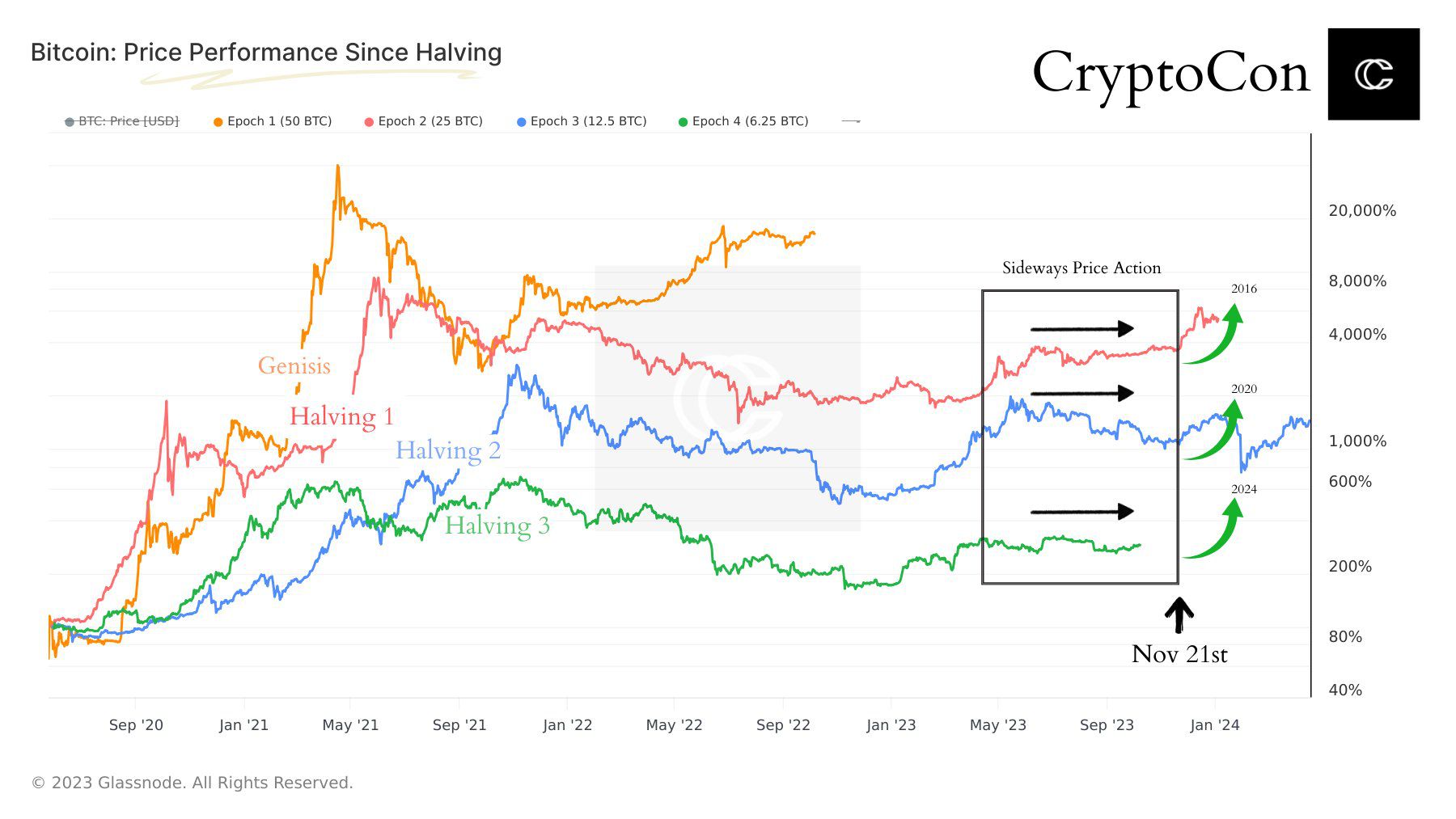

Analyst CryptoCon says that a major movement will occur by November 21. If we are to see a new bottom, it may happen by that date.

The third analyst, Mags, reminded us how far below the ATH point the price is 6 months before halving. In 2015, during this phase of the cycle, BTC was below the all-time high level by 65%. In 2019, it was below by 60%. So what about today? Today, BTC is 60% below, which means instead of the second bottom of $20,000 we mentioned earlier, it could be around $25,000. Because the violation of the previous ATH level was a situation seen for the first time, and today BTC may not drop to those levels.