According to research by the cryptocurrency exchange Bitget, there is a notable increase in interest in cryptocurrencies and cryptocurrency registrations in the Middle East markets. The report indicates that there are about 500,000 active cryptocurrency investors in the region daily. This growing trend demonstrates the rising importance of cryptocurrencies as a developing business sector in the Middle East.

Cryptocurrencies Rise with Friendly Regulations

According to the report, the first and most significant factor contributing to the development and growth of the Middle East’s cryptocurrency world has been the adoption of crypto-friendly regulations, especially in the United Arab Emirates (UAE). While some Middle Eastern countries had previously banned cryptocurrencies outright, many are now transitioning to more compliant regulatory frameworks, facilitating cryptocurrency-related transactions.

Especially in recent years, Middle Eastern users have demonstrated their use of Blockchain networks, offering opportunities to play games, explore the metaverse, and participate in decentralized projects. This change reflects the evolving interests and preferences of Blockchain users in the region, highlighting a growing interest in various cryptocurrency applications beyond traditional trade and investment.

According to the report, individual investors in the Middle East are particularly willing to invest in speculative assets like memecoins, while institutional users tend to focus on core cryptocurrencies like Bitcoin (BTC). This difference in investment preferences shows the diversity of cryptocurrency strategies and goals pursued by individual and institutional investors in the region.

High Interest Yet Low Transaction Volume

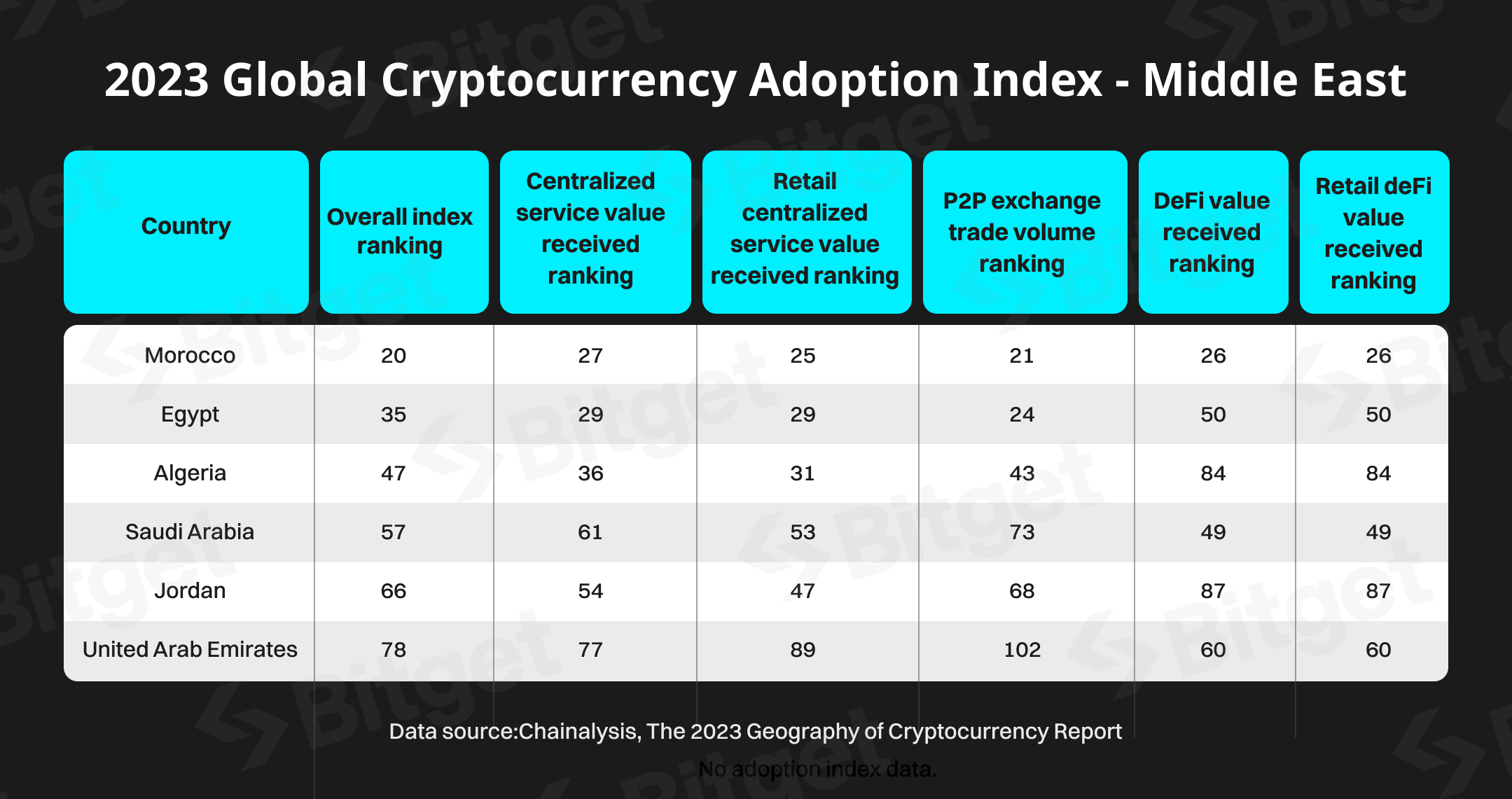

Despite the increasing importance of the cryptocurrency arena in the Middle East, the overall volume produced by the region remains statistically low compared to other global regions. In 2023, the cumulative cryptocurrency volume of the Middle East and North Africa accounted for about 7.2% of the global volume. However, the region’s liberal regulatory environment and rapid development pace are making it a significant player in the global cryptocurrency world, indicating that this trend will continue to grow.

On the other hand, the Middle East, particularly in light of regulatory pressures and resource constraints in other regions, is emerging as a potential target for cryptocurrency mining operations. Major North American mining companies like Core Scientific, Riot Blockchain, Marathon Digital, and Argo Blockchain have expressed interest in expanding their operations to the Middle East. This shift follows the pressure on cryptocurrency mining in China and the subsequent relocation efforts of mining companies seeking regions with less regulatory pressure and abundant power resources.