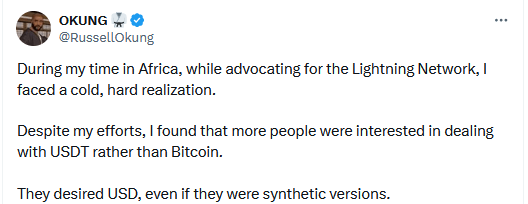

Leading figures in the cryptocurrency world have made noteworthy observations about recent developments in Africa. Professional athlete Russell Okung observed during his time in Africa that dollar-backed stablecoins are preferred as an alternative to Bitcoin. Okung tried to raise awareness by introducing the Lightning Network there and noted a decrease in interest in Bitcoin during this process. In particular, he observed that people generally prefer the dollar, and this preference remains constant, even if sometimes in synthetic forms.

People in Financial Distress Cannot Tolerate Bitcoin Volatility

In addition to Okung’s observations, other users have confirmed similar trends in Africa and noted that similar situations have been encountered in other countries like Lebanon and Argentina. Some have pointed out that people in financial distress cannot tolerate the fluctuations of cryptocurrencies. Therefore, turning to the dollar continues to be a safer option compared to local currencies.

Similarly, Austin Campbell, Founder and Managing Partner at Zero Knowledge Consulting, stated that he observed similar trends during his tenure as Chief Risk Officer at Paxos Trust Company. Campbell emphasized that stablecoins remain the preferred choice for many people, especially as long as USDC maintains its value. However, he also mentioned that this dynamic could change if the value of USDC were to decline.

Stablecoins More Suitable for Daily Transactions

Campbell also mentioned that stablecoins are more suitable for daily transactions and that cryptocurrencies like Bitcoin could be used more as a store of value. To support his view, he compared it to gold, noting that people typically do not use gold for daily shopping but rather keep it as a store of value and convert it to fiat currency when needed.

Campbell emphasized that no currency is perfect as both a liquid asset and a reliable store of value, and he believes that the preference for USDC represents a significant change in many countries’ local currency systems.

We actually encounter a similar situation in our country, which has a high concentration of cryptocurrency investors. As the author of these lines, I see that many cryptocurrency investors think this way: “Since cryptocurrencies are valued in dollars, it’s like I’m holding my money in dollars.” It’s also important to remember that many people in the market hold assets in dollar-backed stablecoins.